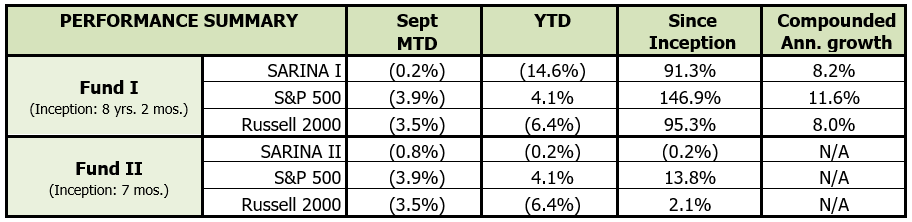

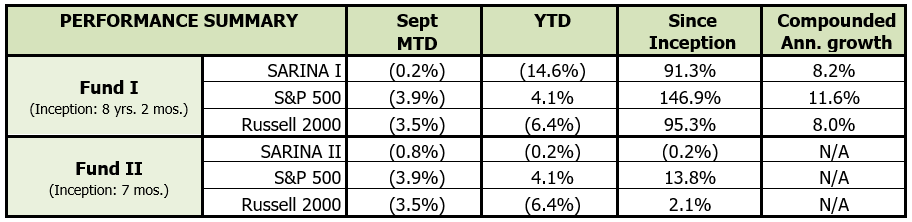

September turned out to be an early Halloween warning as many investors were spooked by wild swings in the markets. SARINA Capital fund I and II were down 0.2% and 0.8%, respectively, while S&P 500 and Russell 2000 were down 3.9% and 3.5%, respectively. The month of October has started with optimism, but investors should prepare for a roller coaster ride over the next few months as the election and election results are sure to cause large swings in markets. Furthermore, COVID-19 has started to wreak havoc again in Europe and we are starting to see similar spikes in some U.S. states also. As we approach the winter months, the cases are expected to spike again given that the economic activity is largely back on a full scale.

Mixed Economic Data

Speaking of the economy, the final jobs report data before the election was released last week which showed unemployment rate at 7.9% versus expectations of 8.2%. However, non-farm payroll rose by 661,000 compared to expectations of 800,000. This could perhaps signal a slowing down of jobs recovery despite the economy being almost fully open. Another concerning figure is the labor force participation rate which dropped 0.3 percentage points to 61.4% – this represents a 700,000 drop in the number of people who are either actively job hunting or are currently employed. The dust has yet to settle on this recession and in our view things could get worse before the economy returns to pre-pandemic level.

Airline Industry Deep Dive

In our previous newsletters we have discussed our cautious stance related to investing in the current markets and we would like to share another reason for our cautious view by doing a deep dive into the airlines industry. First let’s look at some data to better understand the dramatic impact of the pandemic to the industry.

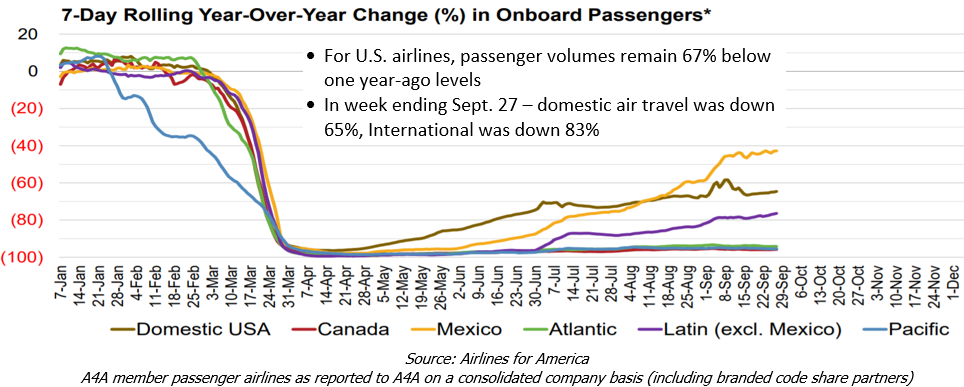

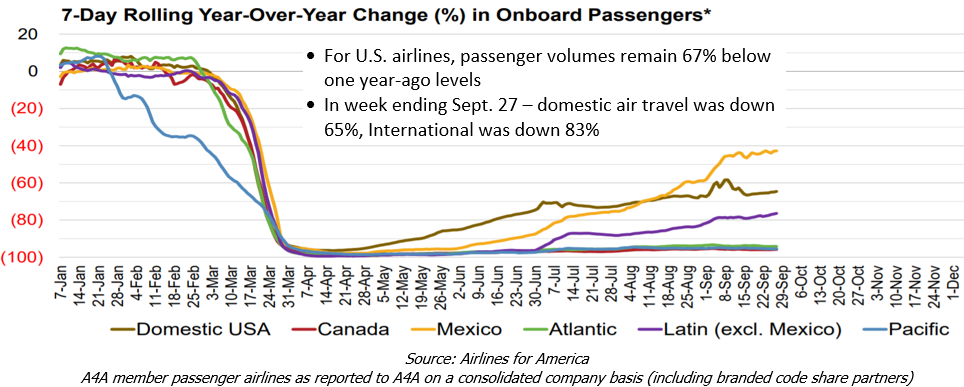

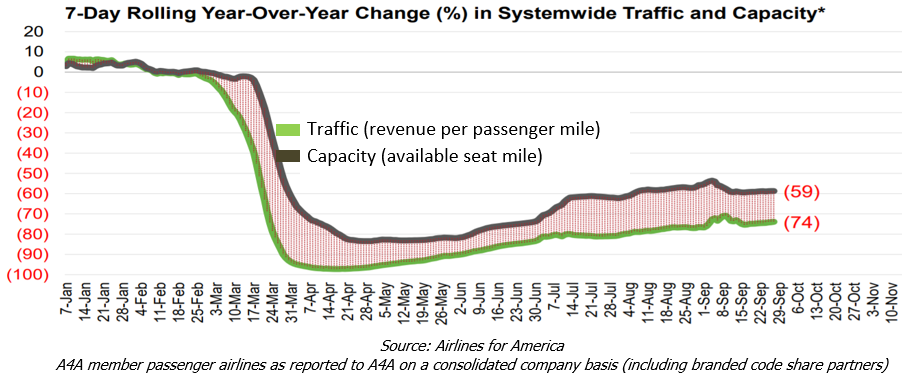

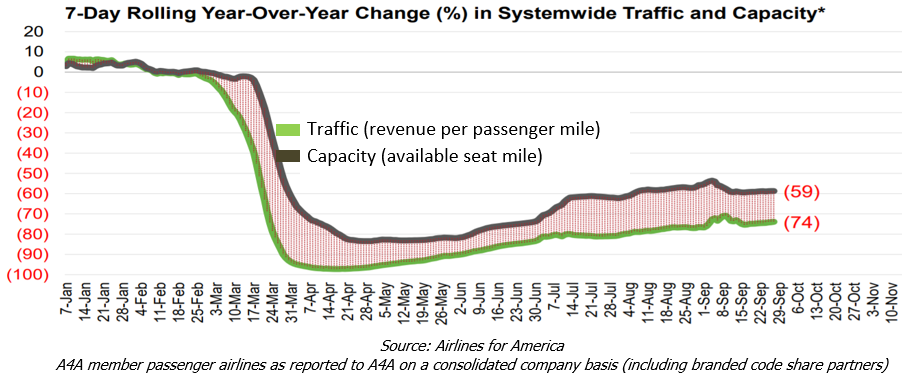

Airline passenger traffic was essentially reduced to zero back in March/April and the recovery process has been slow (to say the least). For the week-ending September 27th, passenger volume on U.S. airlines was down 67% year-over-year. Moreover, international travel was down 83% while domestic travel was down 65%. The return of airline travel back to pre-COVID level will be closely hinged to the return of business travel and expectation for business travel to return in the foreseeable future are very low. Companies are keeping their work force remote for at least for the remainder of this year and most likely through mid-2021, which means no need for office space and definitely no need for air travel.

Airlines have responded to the travel demand destruction by dramatically reducing capacity. However, even though capacity has been reduced, airlines are still struggling to fill the seats as shown in the chart below. The current capacity is down 59% year-over-year but traffic is down 74%! Looking at pre-COVID data, airline capacity was in line with the traffic; however, the current gap between traffic and capacity may also be driven by social distancing measures. The airlines must bear the cost of extra capacity and they must do so despite offering extremely low fares to attract customers back on their planes!

The airline industry has been a major beneficiary of the stimulus package and the industry continues to look for more aide to help sustain the blows it has endured so far. In March, airlines were allocated $25 billion in relief package under the March legislative package, but that clearly is not enough for airline companies to remain afloat. Internally, many airlines have taken steps to reduce costs including: offering early retirement packages, CEOs forgoing their salaries for the year, reducing managers pay by as much as 25%, and many other steps to withstand the impact of COVID-19 on this industry. Despite these steps, the industry needs more aid and is pressuring Washington by threatening massive job cuts. American Airlines announced that it plans to furlough 19,000 employees citing no signs of abatement in the pandemic-induced reluctance to travel. The airline also said that it plans to have 40,000 less employees compared to pre-pandemic level when including buyouts, retirements, and leaves of absence – this would mean a 30% headcount reduction for American Airlines!

When factoring the impact of international airlines to both the U.S. and local country economies, this recession for the airline (and travel and tourism) industry appears to be what the Great Recession was for the banking industry. Emirates airlines has slashed tens of thousands of jobs as international travel, especially leisure-related, has essentially halted. The airlines also received a $2 billion equity injection, the first government has had to provide capital since inception.

So far, we’ve only discussed the impact of air travel on the airline industry, but we must also consider related industries – rental cars, hotels, airports, taxis/ride sharing services, etc. Many hotel owners we have spoken to, especially the high-end chains, are worried about survival. For hotels to cover their operational costs, occupancy needs to be approximately 35-40% and in order to cover both operational costs and debt, occupancy needs to be around 55-60%. Though the current average hotel occupancy is around 48% across the U.S., the revenue per available room (RevPAR) is only 52% compared to year ago level! The combination of lower occupancy rates and a significant drop in RevPAR does not bode well for the survivability of the hotel industry. On the rental car front, Hertz already filed for bankruptcy protection and others rental car companies are struggling to survive and have extended furloughs for many of its employees.

There are many such stories in the airline industry and the related industries, and it is clear that only the strong will survive and even then survival will require massive aid packages. We just hope that these aid packages are similar to TARP funds given to the banks, 100% of which were returned back to the government…after all, it is the public’s money that will be used to bailout a private enterprise!

Happy investing!

Disclosure Statements:

- This letter is confidential and may not be redistributed without the express written consent of SARINA Capital, LP.

- The information presented does not involve the rendering of personalized investment, financial, legal or tax advice, but is limited to the dissemination of general information on products and services. Before implementing any of the options presented, a professional adviser should be consulted about the legal, tax and financial suitability of this type of investment. This presentation should not be viewed as an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein.

- Past performance is no guarantee of future results. No person should invest who is not, either alone or with their advisers, capable of evaluating the merits and risks of prospective investments. No representation is made that SARINA Capital, LP will or is likely to achieve its investment objectives or that any investor will or is likely to achieve results comparable to those shown or will make any profit at all or will be able to avoid incurring substantial losses.

- Specific companies or securities mentioned in this document are meant to demonstrate SARINA Capital’s investment style and the types of industries and instruments in which we invest and are not selected based on past performance. The analyses and conclusions of SARINA Capital contained in this document include certain statements, assumptions, estimates and projections that reflect various assumptions by SARINA Capital concerning anticipated results that are inherently subject to significant economic, competitive, and other uncertainties and contingencies and have been included solely for illustrative purposes. No representations express or implied, are made as to the accuracy or completeness of such statements, assumptions, estimates or projections or with respect to any other materials herein. SARINA Capital may buy, sell, cover or otherwise change the nature, form or amount of its investments, including any investments identified in this letter, without further notice and in SARINA Capital’s sole discretion and for any reason. SARINA Capital hereby disclaims any duty to update any information in this letter.

- Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of preparation and are subject to change.

- Certain information has been provided by third-party sources and, although believed to be reliable, it has not been independently verified and its accuracy or completeness cannot be guaranteed.

- © 2020 SARINA Associates, LLC, all rights reserved.