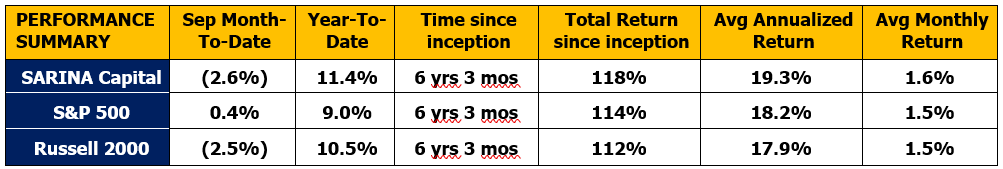

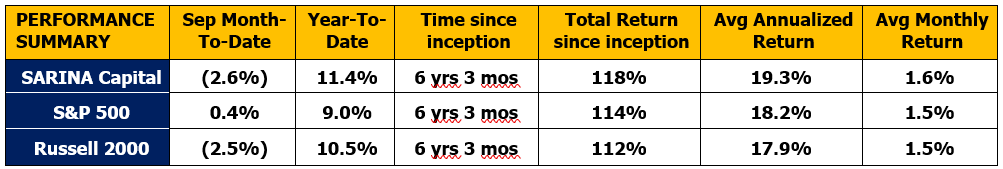

SARINA Capital fund was down 2.6% for the month of September 2018 compared to gains of 0.4% for S&P 500 and a loss of 2.5% for the Russell 2000 index. The last month of the third quarter was unfortunately not kind to us as we saw declines in some of our top holdings.

Trade war concerns are keeping the markets in check and those fears are also impacting our one of our top holdings, Newell Brands, Inc. (Ticker: NWL), more than the broader markets given Newell’s global reach. Though trade war is a bit of a worry in the short-term for NWL, but for a company that is paying out a 4.5% dividend and that produces household names such as Sharpie, Calphalon, Sunbeam, Contigo, Yankee Candle, Marmot, etc., we feel very confident about the long-term viability of this company. Furthermore, the company has been divesting its non-core divisions which is bringing in proceeds, which will ensure dividend payments can continue. The merger with Jarden Corporation, announced in December 2015, did not deliver the expected synergies and hence the reason for divesting its non-core brands and focusing on optimizing operations. Over the long-term, NWL’s strong brand recognition and global reach should prevail but the road to get there could be bumpy!

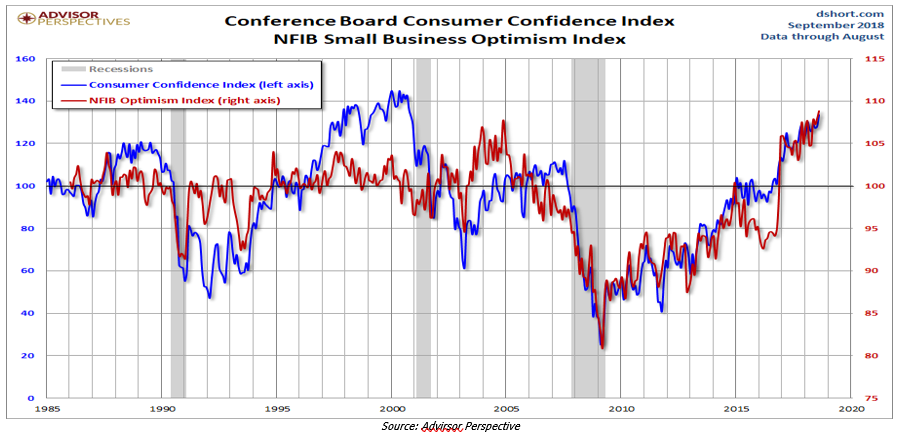

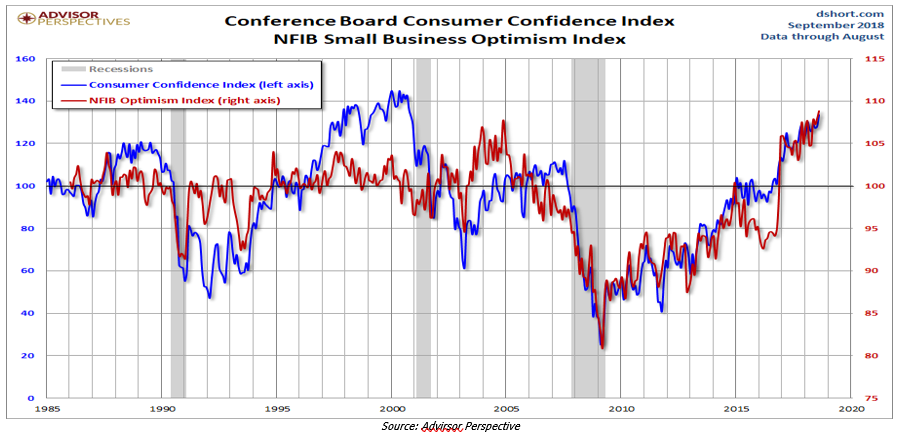

Consumer Confidence Remains High

Consumer confidence in the U.S. continues to remain strong as evidenced by The Conference Board’s Consumer Confidence Index. As of September 2018, the Consumer Confidence Index was at 138.4, up from a very strong showing of 134.7 in August. The index is hovering around an 18-year and is getting close to an all-time high of 144.7 which was seen back in 2000. The chart below provides a historical view of two indices – Consumer Confidence Index and NFIB Small Business Optimism Index.

As consumer confidence has peaked in the past, it has typically been followed by a recession (marked by the grey bars on the above chart). The current surge in consumer confidence is driven by strong economic growth which is a result of low unemployment, higher wages, and lower taxes. As we have discussed in the past, economic growth is measured by Gross Domestic Product (GDP) which is calculated as follows: C + I + E + G (C=Consumer spending or consumption, I=Investments made by businesses, E=Excess of exports over imports, and G=Government spending). Of these 4 components, consumer spending represents approximately two thirds of the overall GDP in the United States and given the strong economic numbers that are boosting consumer spending, it is no surprise that GDP has been strong the past few quarters. The strong consumer spending is also boosting consumer confidence.

In an economic recovery, consumer confidence is typically lags the broader market recovery as the wounds of a recession are slow to heal amongst consumers. We do not know how high consumer confidence will rise or when it will peak, but it is important to note that we are nearing the all-time high and if history were to repeat itself, the possibility of a near term recession is not too farfetched.

Now Hiring!

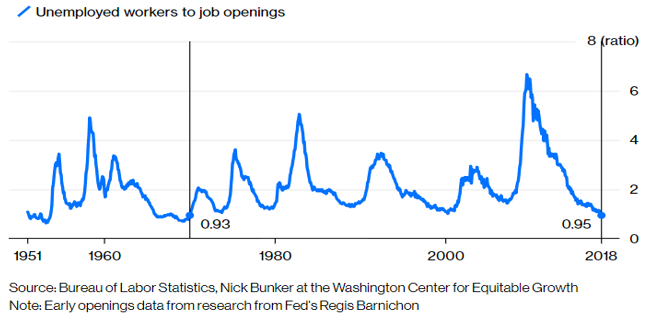

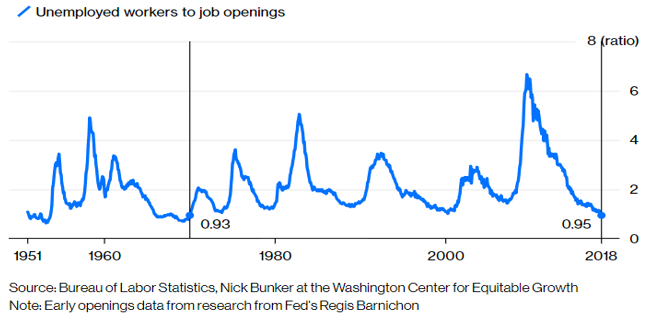

If you are looking for work or interested in switching jobs, now is a good time as any to do so. The ratio between unemployment level and job vacancies (seen in the chart below) is at its lowest level in a half-century.

Most companies are looking to hire while layoffs have fallen to a 50-year low. Given this dynamic, it is now taking employers longer to fill vacancies and the market has clearly shifted in the favor of those who are hunting for jobs. This is also resulting in wage increase, which has lagged during this recovery. However, wage increase spiked in September 2018, up 2.9% year-over-year, which is highest since June 2009.

The combination of low unemployment and higher wages is one of the key factors contributing to higher consumer spending and thus higher consumer confidence. However, this is also going to push inflation higher (simply look at the home prices) which will encourage the Federal Reserve to continue raising interest rates. Higher interest rates are pushing bond yields higher as the 10-year Treasury note (3.23% yield) sits at the highest level since 2011.

As we start the fourth quarter of 2018, economic data will remain a critical factor that investors will focus on as the impact of trade wars will need to be offset by other positive news. We have received some mixed news in the first week of October and that has scared the investors. For the week, Nasdaq has dropped 3% and the Russell index has tumbled 3.6%, the biggest weekly losses in more than 6 months. Positive earnings surprises should ease the fears, but we could see some volatility after earnings season! Enjoy the ride!

Happy investing!

Disclosure Statements:

- This letter is confidential and may not be redistributed without the express written consent of SARINA Capital, LP.

- The information presented does not involve the rendering of personalized investment, financial, legal or tax advice, but is limited to the dissemination of general information on products and services. Before implementing any of the options presented, a professional adviser should be consulted about the legal, tax and financial suitability of this type of investment. This presentation should not be viewed as an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein.

- Past performance is no guarantee of future results. No person should invest who is not, either alone or with their advisers, capable of evaluating the merits and risks of prospective investments. No representation is made that SARINA Capital, LP will or is likely to achieve its investment objectives or that any investor will or is likely to achieve results comparable to those shown or will make any profit at all or will be able to avoid incurring substantial losses.

- Specific companies or securities mentioned in this document are meant to demonstrate SARINA Capital’s investment style and the types of industries and instruments in which we invest and are not selected based on past performance. The analyses and conclusions of SARINA Capital contained in this document include certain statements, assumptions, estimates and projections that reflect various assumptions by SARINA Capital concerning anticipated results that are inherently subject to significant economic, competitive, and other uncertainties and contingencies and have been included solely for illustrative purposes. No representations express or implied, are made as to the accuracy or completeness of such statements, assumptions, estimates or projections or with respect to any other materials herein. SARINA Capital may buy, sell, cover or otherwise change the nature, form or amount of its investments, including any investments identified in this letter, without further notice and in SARINA Capital’s sole discretion and for any reason. SARINA Capital hereby disclaims any duty to update any information in this letter.

- Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of preparation and are subject to change.

- Certain information has been provided by third-party sources and, although believed to be reliable, it has not been independently verified and its accuracy or completeness cannot be guaranteed.

- © 2020 SARINA Associates, LLC, all rights reserved.