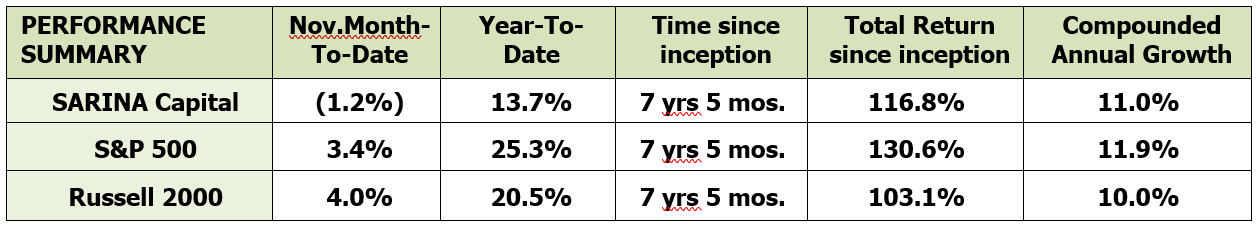

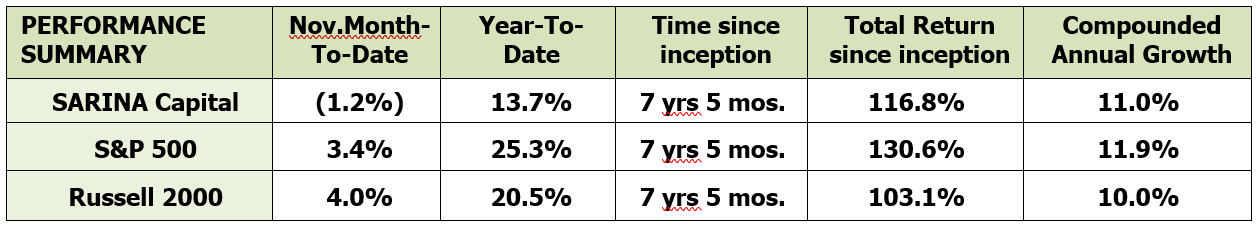

SARINA Capital was down 1.2% for the month of November 2019 compared to gains of 3.4% and 4.0% for the S&P 500 and Russell 2000, respectively. This has been a stellar year for equities and even the Russell 2000 index has caught fire of late. Though we are disappointed we have not been able to keep pace with the S&P 500 this year, we are content with our year-to-date return of ~14%. Given our cautious stance on our investment approach, we expect to underperform the S&P 500; however, we feel better positioned for a downturn and should outperform the S&P 500 in case of any weakness in the markets.

Black Friday Shopping – Online or Instore?

We hope you were able to enjoy your Thanksgiving break with your loved ones. As part of the Thanksgiving tradition, many U.S. consumers went shopping on Black Friday. To our surprise, retail shopping outlets did surprisingly well despite the enormous rise in retail e-commerce. When we looked at the numbers, it explained why instore retail shopping was still a thing and e-commerce still has ways to go to catchup.

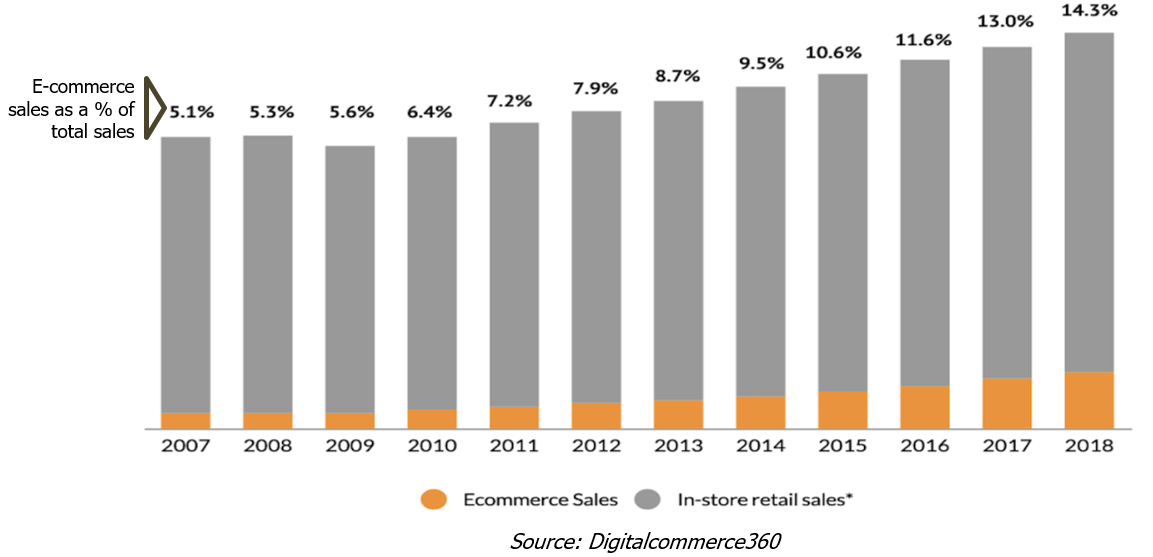

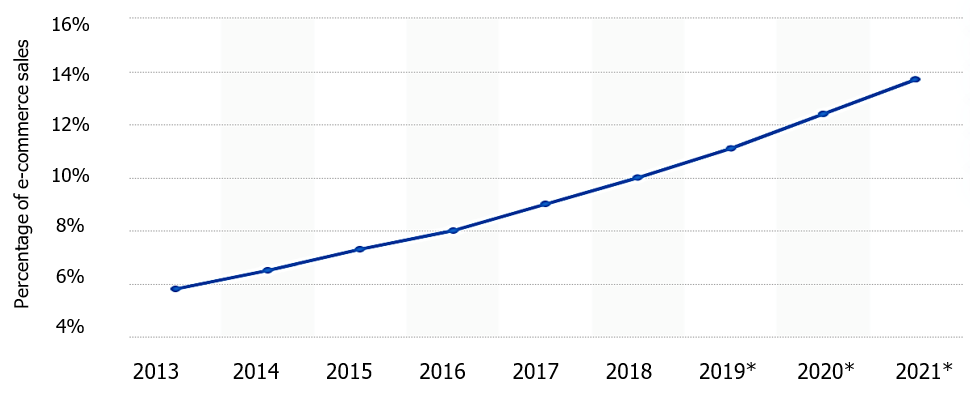

In 2018, online sales were $517 billion (14.3%) out to total retail sales of $3.62 trillion. The online sales number has doubled over the past decade and it is expected to continue rising in the upcoming years. Post the great recession, online sales have grown at an annual rate of 15%, which compares to an in-store retail growth of only 3.7% in 2018. To further put this in perspective, in 2007, 1 out of every $20 spent in retail went to e-commerce and now e-commerce account for 1 out of every $7 in retail sales!

Retail shopping centers grew at a disproportionate pace during the real estate boom that occurred before the Great Recession. Between 1995-2015, the number of shopping centers increased more than 23% while the U.S. population growth over that time was only 14%. The overbuilding of shopping centers combined with a strong increase in e-commerce sales has been a double whammy for investors in retail shopping centers. Furthermore, the growth in e-commerce sales is expected to continue rising as online retailers such as Amazon, Wal-Mart, and essentially all retail stores continue to boost their online platforms to attract the growing number of e-commerce shoppers. The chart below from Statista shows percentage of e-commerce sales to total sales and it appears that there is no slowing of e-commerce sales:

Giving Tuesday

Another holiday tradition that started in the U.S. is Giving Tuesday, which has now turned into a global generosity movement. The movement started in 2012 and the aim of the movement was very simple – following all the personal shopping that occurs over Thanksgiving weekend, individuals are asked to be generous and do good for others. Over the past seven years, this has become a global movement where charitable organizations and individuals are able to collaborate to make the most of out the donations.

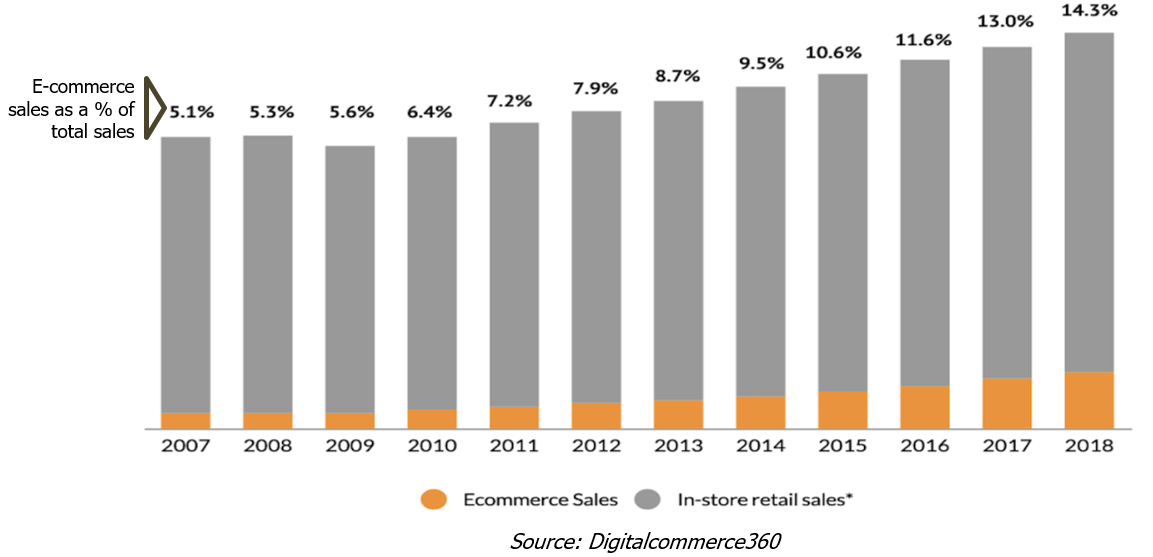

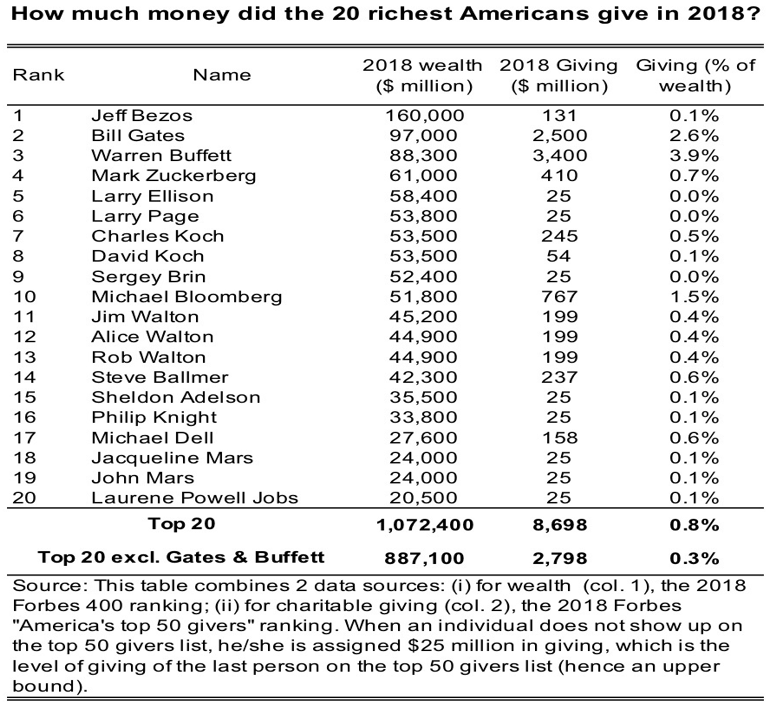

Of late there has been plenty of discussion about income and wealth inequality where the billionaires and top 1% of society have received some strong criticism for not doing enough to help those who are less fortunate in society. We came across a chart that shows the “generosity” of the wealthiest in the U.S.:

Looking at the chart, it is disappointing to see that the wealthiest Americans are not doing more than what is shown above. However, the chart helps us further appreciate Warren Buffett as he is by far the highest giver on this list. Along with his amazing investing track record, Buffett is also one of the most generous individuals in the U.S. In addition to his annual giving, Buffett and Bill and Melinda Gates started the Giving Pledge whereby they and many other billionaires across the world have committed to donate majority of their wealth to philanthropy. We hope the Giving Tuesday and Giving Pledge movement continues to grow as civil society must do its part to help those who are less fortunate.

Happy giving and happy investing!

Disclosure Statements:

- This letter is confidential and may not be redistributed without the express written consent of SARINA Capital, LP.

- The information presented does not involve the rendering of personalized investment, financial, legal or tax advice, but is limited to the dissemination of general information on products and services. Before implementing any of the options presented, a professional adviser should be consulted about the legal, tax and financial suitability of this type of investment. This presentation should not be viewed as an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein.

- Past performance is no guarantee of future results. No person should invest who is not, either alone or with their advisers, capable of evaluating the merits and risks of prospective investments. No representation is made that SARINA Capital, LP will or is likely to achieve its investment objectives or that any investor will or is likely to achieve results comparable to those shown or will make any profit at all or will be able to avoid incurring substantial losses.

- Specific companies or securities mentioned in this document are meant to demonstrate SARINA Capital’s investment style and the types of industries and instruments in which we invest and are not selected based on past performance. The analyses and conclusions of SARINA Capital contained in this document include certain statements, assumptions, estimates and projections that reflect various assumptions by SARINA Capital concerning anticipated results that are inherently subject to significant economic, competitive, and other uncertainties and contingencies and have been included solely for illustrative purposes. No representations express or implied, are made as to the accuracy or completeness of such statements, assumptions, estimates or projections or with respect to any other materials herein. SARINA Capital may buy, sell, cover or otherwise change the nature, form or amount of its investments, including any investments identified in this letter, without further notice and in SARINA Capital’s sole discretion and for any reason. SARINA Capital hereby disclaims any duty to update any information in this letter.

- Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of preparation and are subject to change.

- Certain information has been provided by third-party sources and, although believed to be reliable, it has not been independently verified and its accuracy or completeness cannot be guaranteed.

- © 2020 SARINA Associates, LLC, all rights reserved.