Roaring Recovery

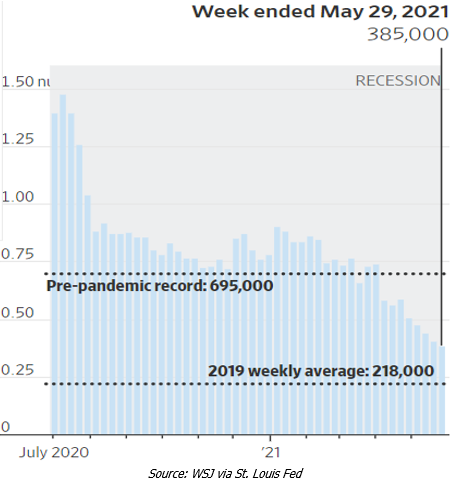

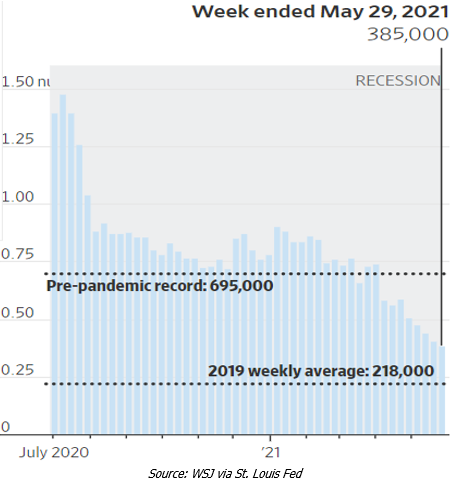

The U.S. economy continues its amazing recovery while vaccination effort is finally providing a sense of finally coming out of the pandemic. The U.S. weekly unemployment claims, which is a proxy for layoffs, fell to 385,000 in the last week of May compared to a revised 405,000 number from the prior week. This was the fifth straight week that new unemployment filings had fallen starting from 590,000 for the week-ended April 24th. However, despite the continuous drop, the unemployment filing number is nearly twice what it was pre-pandemic.

For the month of May, employers added 559,000 jobs, dropping the unemployment rate to 5.8%. Though the economy added over half a million jobs, the payroll increase fell short of economist expectations of 675,000. Furthermore, the gains still leaves the U.S. job markets about 7.6 million jobs short of the pre-pandemic level. The number of long-term unemployed (people who have been out of work for 27 weeks or longer) dropped by 431,000 in May, the most since 2011. This suggests that Americans who lost their jobs early in the pandemic are returning to work. The labor force participation rate remained steady month-over-month at 61.6% but well below the pre-pandemic level of 63.3%. Despite the higher than average unemployment rate, workers who are quitting their jobs – a proxy for labor market strength – is at the highest level on record. As the economic recovery continues to bounce back, a higher labor force participation rate would be vital to increase productivity in the U.S.

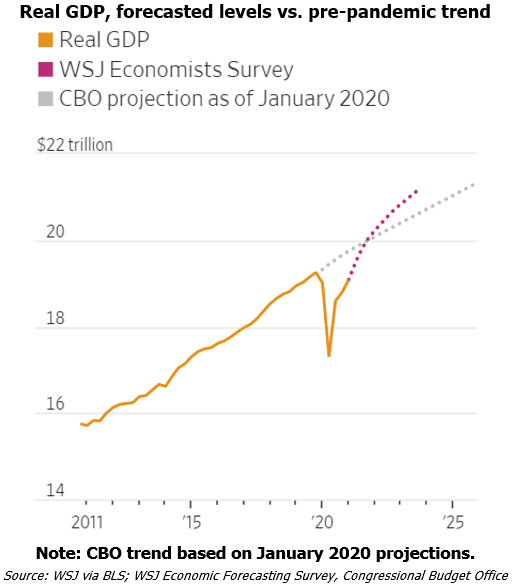

GDP Growth

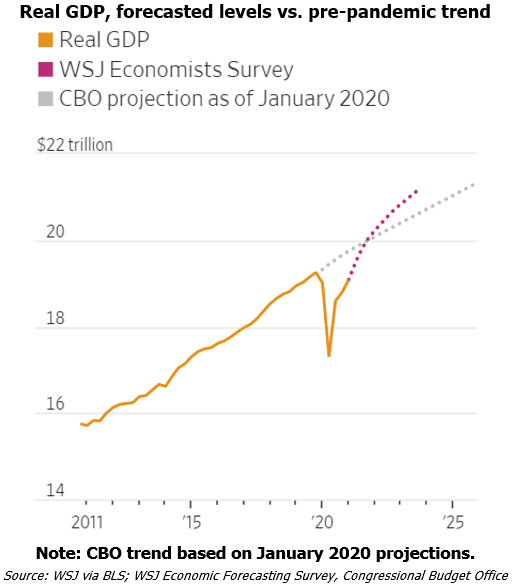

The stronger than expected recovery is also driving GDP growth powered by consumer with higher than ever saving rates, businesses that are eager to hire, and bottomless stimulus support! Additionally, new businesses are popping up at record pace.

Recessions in the past have typically shown stubbornness in labor markets where job seekers outnumber job openings while high unemployment and weak wage growth hinder consumer spending and discourage businesses spending. However, this recession appears to be unique in every which way possible and is avoiding the typical vicious recession cycle.

The unexpected speed of recovery is causing havoc in the supply chain leading to shortage of goods, raw materials, and labor – challenges that typically occur at the end of an expansion but are appearing much sooner than expected. The COVID-19 crisis response has been well coordinated by governments across the globe who have unleashed a faster and bigger than ever fiscal and monetary response than in any of the previous recessions. The Fed’s balance sheet shot up from $4.2 trillion in March 2020 to $7.1 trillion by late May. Additionally, Congress’s fiscal response will total $5.1 trillion – which puts the response to the Great Recession (a once in a century crisis that shook the financial world like never before) of $1.8 trillion to shame. Though this has averted a potentially massive disaster, only time will tell if the response has simply kicked the can down the road or if this was a truly genius and calculated move by the powers that be!

Happy investing!

Disclosure Statements:

- This letter is confidential and may not be redistributed without the express written consent of SARINA Capital, LP.

- The information presented does not involve the rendering of personalized investment, financial, legal or tax advice, but is limited to the dissemination of general information on products and services. Before implementing any of the options presented, a professional adviser should be consulted about the legal, tax and financial suitability of this type of investment. This presentation should not be viewed as an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein.

- Past performance is no guarantee of future results. No person should invest who is not, either alone or with their advisers, capable of evaluating the merits and risks of prospective investments. No representation is made that SARINA Capital, LP will or is likely to achieve its investment objectives or that any investor will or is likely to achieve results comparable to those shown or will make any profit at all or will be able to avoid incurring substantial losses.

- Specific companies or securities mentioned in this document are meant to demonstrate SARINA Capital’s investment style and the types of industries and instruments in which we invest and are not selected based on past performance. The analyses and conclusions of SARINA Capital contained in this document include certain statements, assumptions, estimates and projections that reflect various assumptions by SARINA Capital concerning anticipated results that are inherently subject to significant economic, competitive, and other uncertainties and contingencies and have been included solely for illustrative purposes. No representations express or implied, are made as to the accuracy or completeness of such statements, assumptions, estimates or projections or with respect to any other materials herein. SARINA Capital may buy, sell, cover or otherwise change the nature, form or amount of its investments, including any investments identified in this letter, without further notice and in SARINA Capital’s sole discretion and for any reason. SARINA Capital hereby disclaims any duty to update any information in this letter.

- Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of preparation and are subject to change.

- Certain information has been provided by third-party sources and, although believed to be reliable, it has not been independently verified and its accuracy or completeness cannot be guaranteed.

- © 2021 SARINA Associates, LLC, all rights reserved.