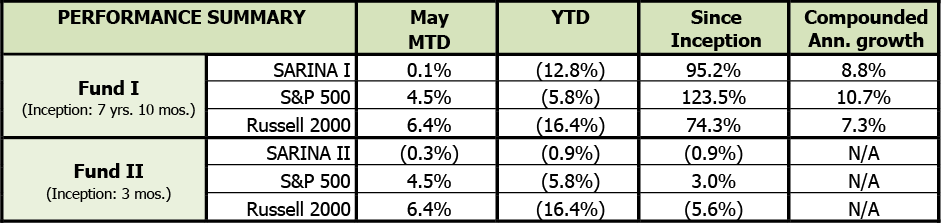

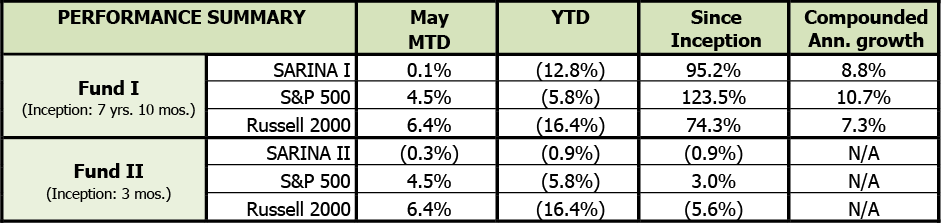

For the month of May 2020, SARINA Capital’s Fund I was up 0.1% while Fund II was down 0.3%. We have underperformed the markets over the past two months given our perspective about where the U.S. and global economy is currently and where it is headed in the future. We continue to anticipate market weakness in the near future because of COVID-19 impact and as such we are comfortable remaining on the sidelines for now. Our strategy is to be long-term investors in companies while being good custodians of our clients’ wealth!

We must do better!

The recent spotlight on Black Lives Matter movement has been an eye-opening experience. In a “developed” (yes, the quotations are there to make a point) country like the United States, no one should fear for their life when they leave their homes simply because of their race! The country whose Declaration of Independence states “We hold these truths to be self-evident, that all men are created equal, that they are endowed by their Creator with certain unalienable Rights, that among these are Life, Liberty and the pursuit of Happiness.” Clearly these unalienable rights have gone missing and after hearing countless voices, including the Mayor of Atlanta who spoke as a mother of young black boys, helped me better understand the gravity of the situation. We can all do better as individuals, and I am no exception in this regard. This is not a political issue, this is a human rights issue and it is time that we as individuals and collectively as a country live up to the words that were written back in 1776 in the Declaration of Independence. It is our sincere hope that the momentum of this movement continues and leads to real change in our society, policies, and justice system. Furthermore, we hope these changes will lead to an improvement in the quality of life of African Americans who have been and continue to be impacted by this systemic issue.

I would like to quote His Highness the Aga Khan’s speech made in Toronto, Canada on September 21, 2016: “Diversity is not a reason to put up walls, but rather to open windows. It is not a burden, it is a blessing. In the end of course, we must realize that living with diversity is a challenging process. We are wrong to think it will be easy. The work of pluralism is always a work in progress.” Let us commit to continuously work on being more pluralistic in our actions, thoughts, and attitudes!

Strong Economic Data

Moving over to the business side, we have witnessed an exceptional rally in the markets since the March lows and this past Friday seemed to the proverbial icing on the cake! Here’s a summary of the jobs data was published this past Friday:

The projections on net jobs created and unemployment rate were so off that many are casting a doubt on the methodology and relevancy of these numbers given the current crisis scenario. To put this in perspective, the closest and most optimistic projection by an economist on the net jobs created number was a decline of 800,000 jobs! Also, you must keep in mind that these are estimates based on a survey that was conducted in mid-May.

However, it is difficult to imagine survey respondents being so optimistic in mid-May at a time when economies were just starting to reopen. We seemed to have skipped the “flattening the curve” phase of the jobs recovery where it was expected to remain bad at a slower rate and instead have jumped directly to improving phase. Perhaps the impact PPP (Paycheck Protection Program) was so incredibly effective that employers took advantage of it to hire more workers. Or did the PPP program lead employers to report higher numbers as a way to justify the loan. Whatever the reason(s), the implications of these significantly better than expected numbers has already led the markets to fly higher and this could lead policy makers to change their stance and think the worse is behind us.

We must remember that despite the better than expected jobs data, the 13.3% unemployment rate is still much higher than the 10% rate we saw during the Great Recession. Additionally, remember that over 40 million American have filed the initial unemployment insurance claim over the past 10 weeks and in April the economy lost 20.5 jobs – so when comparing the 2.5 million jobs added relative to the jobs lost, the economy still has a long way to recover to where we were before COVID-19.

Risk-on Attitude

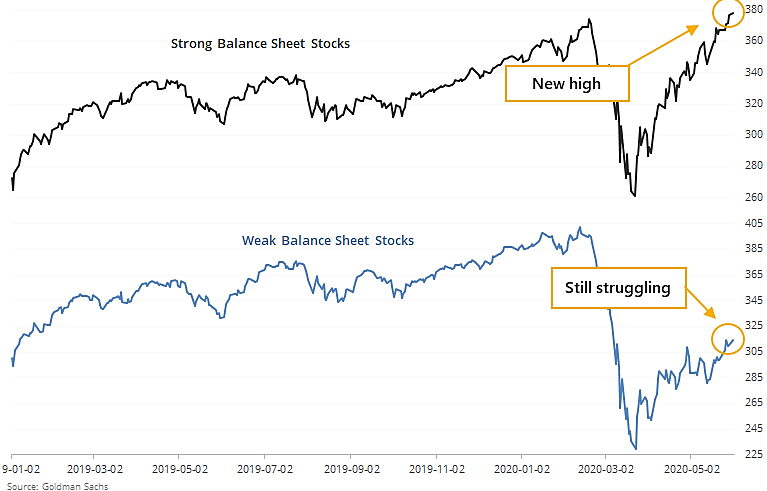

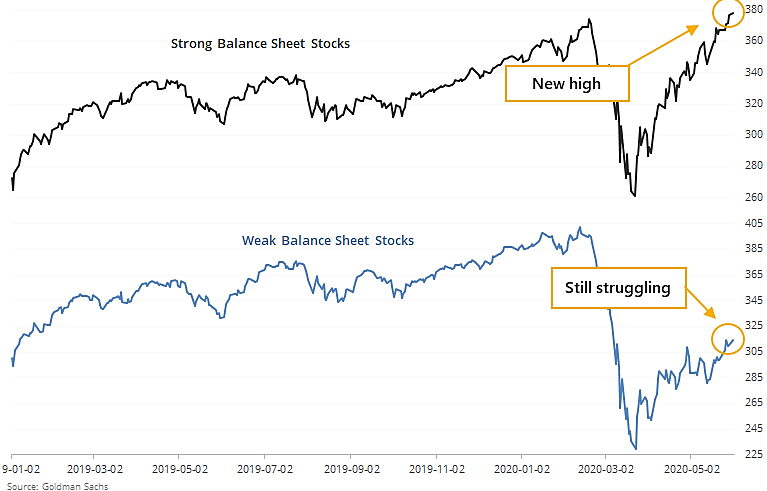

The markets have moved from a cautiously optimistic view to being so optimistic that we are now seeing riskier stocks now being in favor. The chart below shows how initially companies with strong balance sheet recovered quickly while those with weaker balance sheets remained near the March lows.

The strong balance sheet companies (defined by many metrics including debt-to-equity ratio, current assets to current liabilities, operating cash flow-to-short-term liabilities, bond rating, etc.) have fully recovered their COVID-19 losses and weaker balance names are trying to catch up. With the endless government support through QE infinity and strong economic data points such as the ones we discussed earlier, investors have now turned to a more “risk-on” attitude and are now buying up the weaker balance sheet names as investors don’t believe there is anything that will stop the current momentum in the near term.

It is important to note that the weekly $600 unemployment insurance claim payment coupled with $1,200 stimulus payment for each adult taxpayer and $500 per child provided through CARES act have caused a significant jump in personal income, which was up a staggering 10.5% in April! As a result, savings rates for Americans jumped to 33%, the highest number on record since the government began tracking this information in 1959. Robinhood (Google’s free trading platform) accounts have shot up exponentially and retails traders have poured much of their additional income into the markets. Being a consumer driven economy, it is worrisome to see consumer spending decrease by 13.6% in April despite the huge boost in income provided by the CARES act; however, this can be partially explained by the shutdown. As things start to open up again, consumer spending number needs to reverse in order for the U.S. economy to move forward.

We continue to believe that the downside risk is at least twice as great than the upside and with that assessment of risk, we (along with many other prominent investors/economists/CEOs like Stanley Druckenmiller, Mohamed El-Erian, Larry Fink, etc.) continue to remain cautious and thus on the sidelines! Happy investing!

Disclosure Statements:

- This letter is confidential and may not be redistributed without the express written consent of SARINA Capital, LP.

- The information presented does not involve the rendering of personalized investment, financial, legal or tax advice, but is limited to the dissemination of general information on products and services. Before implementing any of the options presented, a professional adviser should be consulted about the legal, tax and financial suitability of this type of investment. This presentation should not be viewed as an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein.

- Past performance is no guarantee of future results. No person should invest who is not, either alone or with their advisers, capable of evaluating the merits and risks of prospective investments. No representation is made that SARINA Capital, LP will or is likely to achieve its investment objectives or that any investor will or is likely to achieve results comparable to those shown or will make any profit at all or will be able to avoid incurring substantial losses.

- Specific companies or securities mentioned in this document are meant to demonstrate SARINA Capital’s investment style and the types of industries and instruments in which we invest and are not selected based on past performance. The analyses and conclusions of SARINA Capital contained in this document include certain statements, assumptions, estimates and projections that reflect various assumptions by SARINA Capital concerning anticipated results that are inherently subject to significant economic, competitive, and other uncertainties and contingencies and have been included solely for illustrative purposes. No representations express or implied, are made as to the accuracy or completeness of such statements, assumptions, estimates or projections or with respect to any other materials herein. SARINA Capital may buy, sell, cover or otherwise change the nature, form or amount of its investments, including any investments identified in this letter, without further notice and in SARINA Capital’s sole discretion and for any reason. SARINA Capital hereby disclaims any duty to update any information in this letter.

- Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of preparation and are subject to change.

- Certain information has been provided by third-party sources and, although believed to be reliable, it has not been independently verified and its accuracy or completeness cannot be guaranteed.

- © 2020 SARINA Associates, LLC, all rights reserved.