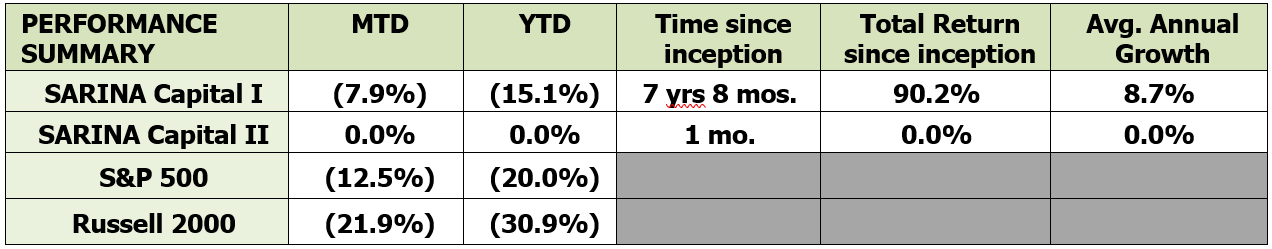

In the myriad of all the bad news, we are pleased to inform everyone that we have started our second fund, SARINA Capital II, which will focus on investments in the US and Gulf Cooperation Council (GCC) markets. Joining me in managing this portfolio will be Femina Huddani, a CFA charter holder based out of Dubai, UAE.

Every successful investor we have spoken to or read about has said that they had luck on their side and our story in starting SARINA Capital II is no different. Our initial plan was to start trading our second fund as early as January 1st 2020; however, due to numerous reasons we kept getting delayed and we sure are glad that we did not start trading in any earlier than March! The meltdown related to COVID-19 coupled with the oil crash would have meant disastrous results for our portfolio in the first few months of operation. But luck is indeed on our side and we plan to combine that with hard work and commitment to continue to achieve solid returns for our investors in both our funds!

We anticipate volatility will continue over the next few weeks (if not months), but this will also give rise to more investment opportunities. This is a time where we will be opportunistic in picking up investments that have a strong brand, long-term sustainable model, strong cash flow, rock solid balance sheet, and a strong management team. We are extremely confident that in a couple of years when we look back at this period, we will be glad that we took advantage of investment opportunities presented today!

If you are interested in investing with us, we will unabashedly tell you that this is absolutely the right time to invest with us! Our experiences in navigating through previous recessions and crises combined with our investment knowledge will surely serve you better in the long run!

By no means we are calling this the bottom nor do we or anybody else knows when the markets will bottom. What we do know is that this type of volatility and market dips create opportunities that could drive outsized returns and we are ready to pounce on this opportunity!

Epic Roller Coaster Ride

The past few weeks have been an epic rollercoaster ride (and even that seems like an understatement)! Here’s what we mean:

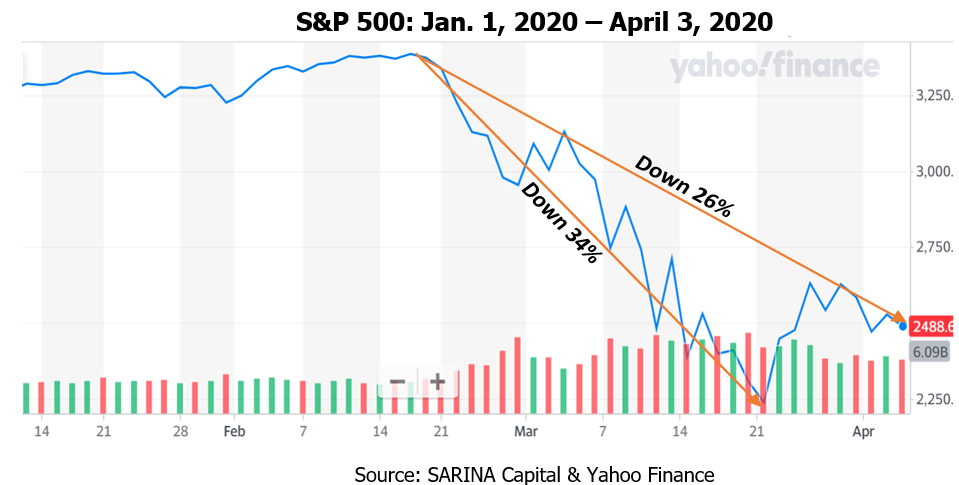

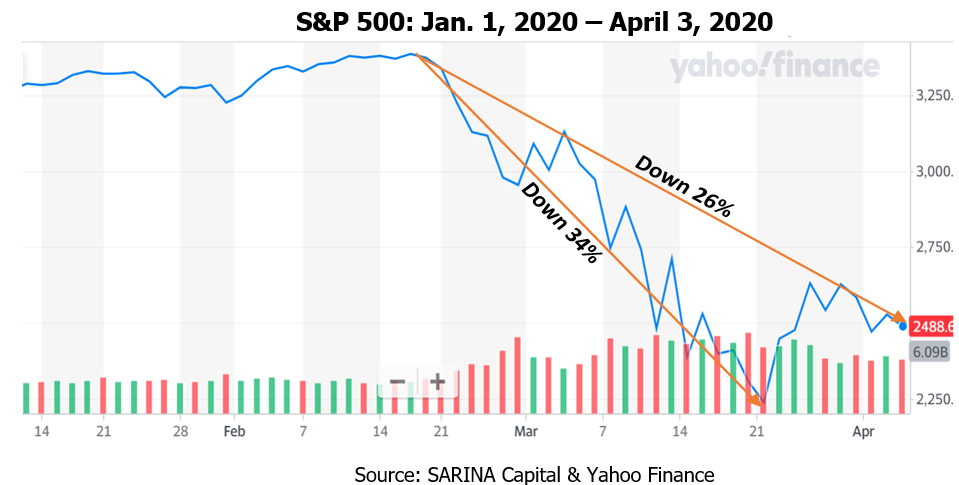

- Between February 19 and March 23rd, the S&P 500 saw the quickest drop in history – losing 33.9% over this very short period.

- Between March 24 and March 26, S&P 500 gained 17.5%, the best 3 days since 1930s.

- Between February 27 – March 27 (21 trading days), 18 days saw movement of 2% (up or down). Of those, eleven were down and seven were up.

- We saw the biggest one-day percentage gain since 1933 and the second biggest percentage loss since 1940 (highest one-day drop still belongs to Black Monday back on October 19, 1987).

- In addition to these drops, the intraday swings have also been enormous at times – swinging more than 10% within a day as if it’s no big deal!

Current situation vs. Great Recession

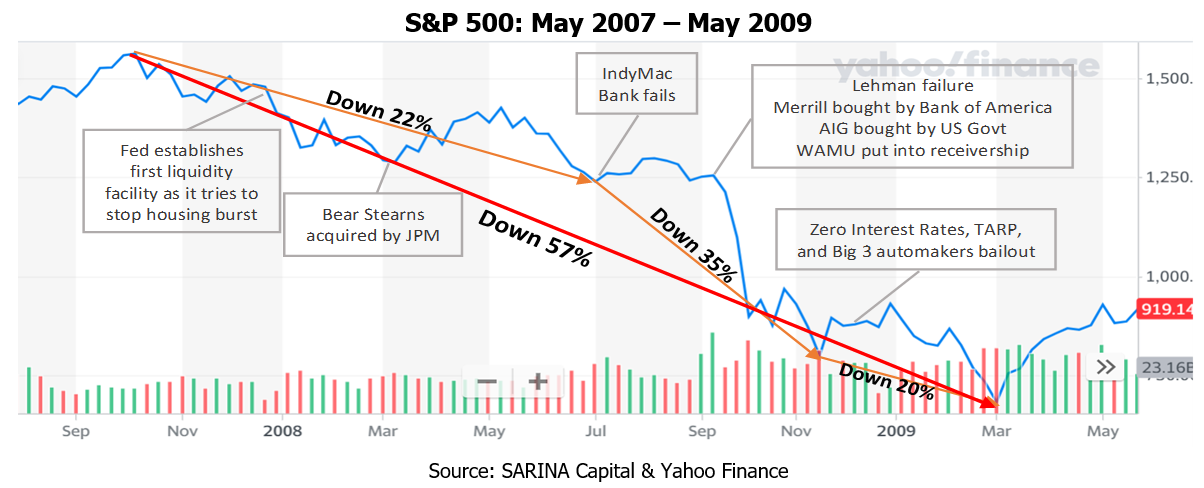

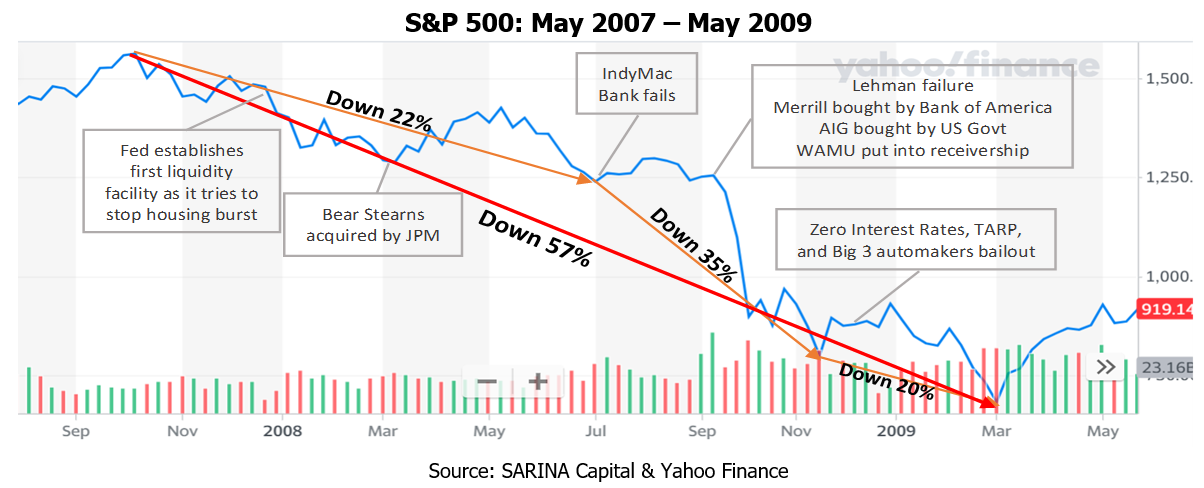

Jamie Dimon, CEO of JP Morgan, recently published a letter to shareholders where talked about the impact of the current crisis. He said “…we assume that it will include a bad recession combined with some kind of financial stress similar to the global financial crisis of 2008.” Many industry experts are also comparing this downturn to the Great Depression of the 1930s. History is always a great teacher, so we went back and looked at the downturn of 2008-09.

At the onset of the Great Recession, the S&P 500 lost 22% between October 2007 – June 2008. However, as more bad news continued to follow (IndyMac failure, Lehman failure, etc.), the markets plunged another 35% between July 2008 – November 2008. The bottom occurred in May 2009 and by that point, markets had lost 57% from its peak! Now let’s look at the current scenario:

This story has just begun and as Jamie Dimon and others have pointed out, we could be in a similar situation to the Great Recession we saw about 12 years ago. Once the lock downs and other restricutions are lifted and as we start to return to normal, the impact of this crisis will truly start to come out.

The positive case for a quick recovery is based on how the earliest countries that contracted the virus have slowed the spread and some have even fully recovered. The other argument for a quick recovery is the efforts by the governments to provide ‘life support’ to the economy through its various economic relief packages.

On the negative side, the uncertainty of the virus is scary and until we have a vaccine, people may be afraid to return to normalcy. Furthermore, the economy is not an engine that you could simply shut down and crank it back up. Last week, 6.6 million Americans filed for unemployment benefits and this does not only shatter all previous records, it obliterates them by a wide margin! We do not know what unemployment will look like a few months from now, but predictions range from low- to mid-teens. We do not have clarity on when and if businesses will reopen and how much additional aid will be provided to those who continue to struggle as a result of this crisis. Expectations for second-quarter GDP is a decrease of 15-30% from one year ago level, the worst decline in history was 10% in first quarter 1958. This economic shutdown will also impact earnings – prediction for earnings decline range from 30-75% for the year for S&P 500 companies!

In addition to COVID-19 and oil price instability, investors are also grappling with the possibility of a new administration as Trump’s response to this crisis continues to be criticized. The possibility of not having a business-friendly Trump in the White House is definitely a worrisome prospect for investors.

Stay safe, do your part, and happy investing!

Disclosure Statements:

- This letter is confidential and may not be redistributed without the express written consent of SARINA Capital, LP.

- The information presented does not involve the rendering of personalized investment, financial, legal or tax advice, but is limited to the dissemination of general information on products and services. Before implementing any of the options presented, a professional adviser should be consulted about the legal, tax and financial suitability of this type of investment. This presentation should not be viewed as an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein.

- Past performance is no guarantee of future results. No person should invest who is not, either alone or with their advisers, capable of evaluating the merits and risks of prospective investments. No representation is made that SARINA Capital, LP will or is likely to achieve its investment objectives or that any investor will or is likely to achieve results comparable to those shown or will make any profit at all or will be able to avoid incurring substantial losses.

- Specific companies or securities mentioned in this document are meant to demonstrate SARINA Capital’s investment style and the types of industries and instruments in which we invest and are not selected based on past performance. The analyses and conclusions of SARINA Capital contained in this document include certain statements, assumptions, estimates and projections that reflect various assumptions by SARINA Capital concerning anticipated results that are inherently subject to significant economic, competitive, and other uncertainties and contingencies and have been included solely for illustrative purposes. No representations express or implied, are made as to the accuracy or completeness of such statements, assumptions, estimates or projections or with respect to any other materials herein. SARINA Capital may buy, sell, cover or otherwise change the nature, form or amount of its investments, including any investments identified in this letter, without further notice and in SARINA Capital’s sole discretion and for any reason. SARINA Capital hereby disclaims any duty to update any information in this letter.

- Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of preparation and are subject to change.

- Certain information has been provided by third-party sources and, although believed to be reliable, it has not been independently verified and its accuracy or completeness cannot be guaranteed.

- © 2020 SARINA Associates, LLC, all rights reserved.