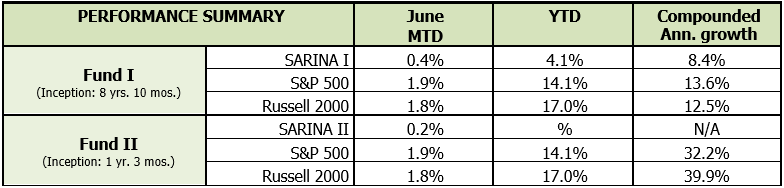

Inflation Worries Overblown?

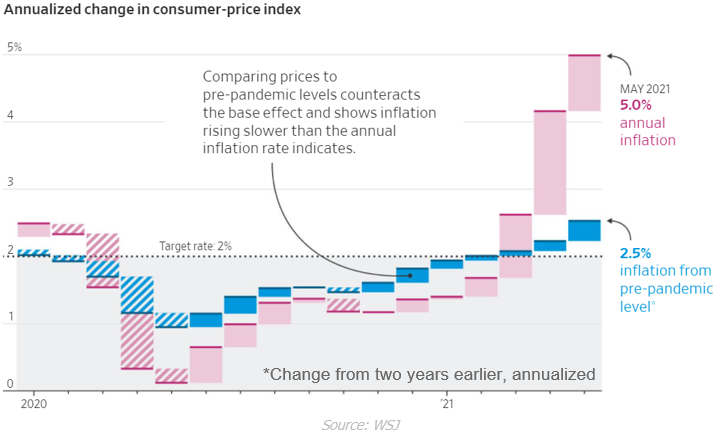

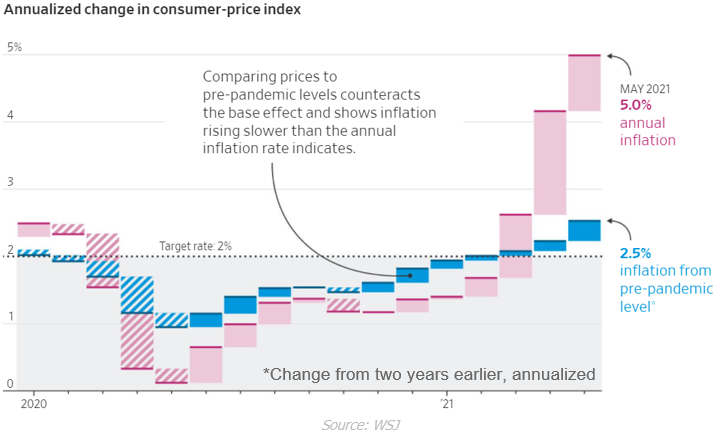

Fears about inflation have come to a screeching halt. While the inflation rate of 5% is at a 13-year high (measured by annual change in consumer price index), it is important to understand the base effect – which occurs when one of the two data points being compared is unusual to the next. In this instance, the calculation for inflation is based off numbers that were recorded in the heart of the pandemic to current numbers. If the impact of the low baseline number is removed, the current inflation does not look nearly as bad. At 2.5%, the pandemic-adjusted inflation number is much closer to the Fed target of around 2%.

The Fed in this instance has been right all along as they were ok with overshooting inflation in the short run and did not panic when the current reading reached 5%. The Fed’s argument was that by overshooting inflation in the short-term they would be able to bring the long-term inflation number to their targeted rate of 2%.

Inflation concerns were also getting mixed up with supply chain issues. A great example of this is what happened to lumber pricing – it went from approximately $675 in mid-January to $1,670 by mid-May, an increase of nearly 150% in a matter of few months. This was driven by lack of production as many of the factories were shut down due to the pandemic. The supply shortage was met with a very high demand driven by the U.S. housing market, thus creating a perfect storm for prices to skyrocket in a very short time span. However, as supply issues have subsided the prices of lumber has also come back down to earth to around $725. Another example of supply-related issues has been seen in the automobile industry driven by chip shortages around the world. This has caused used car prices to skyrocket (up 30% in May from a year earlier); however, as the chip shortage issues get addressed, it is reasonable to expect used car prices to come back down to earth. The next shortage that we are starting to hear about is going to be rubber. Usage of rubber in automobile tires has grown as automakers push to get new cars out as quickly as possible while labor shortage and shutdowns in Asia are limiting supply.

As industries come back online and as demand is kick started for many industries, we may see a sudden bump in pricing caused by supply chain issues. However, as normalcy returns from the supply / production side, prices should also return to normal. Many pundits cite the hyper-inflationary period but current policy makers in our opinion are very astute observers of history and have used previous historical crisis and the subsequent responses to learn and enhance what they do during a time of crisis. If prices become sticky and do not come down at the same rate as lumber prices have, inflation numbers will be higher than projected and this could cause the Fed to raise interest rates earlier and at a faster pace than expected. However, so far we do not see any signs of inflation being excessive and much beyond the Fed’s targeted rate of 2%.

High Investor Optimism

The markets appear to be in extremely optimistic mood, so much so that the typical “sell in May and go away” has not had a negative impact on the markets. There are some good reasons to be optimistic in this market:

- Vaccinations rates are reaching the targeted level and vaccines are proving to be effective against COVID-19 and all its variants. Family vacations, weddings, and other forms of social gathering are back to the same level as before the pandemic.

- There is tremendous amount of pent-up demand that is starting to come out, especially as it relates to travel/tourism, hotel, and restaurant industries. Additionally, this demand will lead to job opportunities which will further spur economic growth and activity.

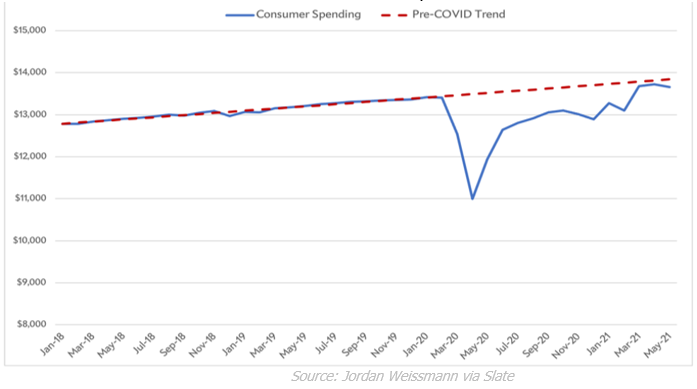

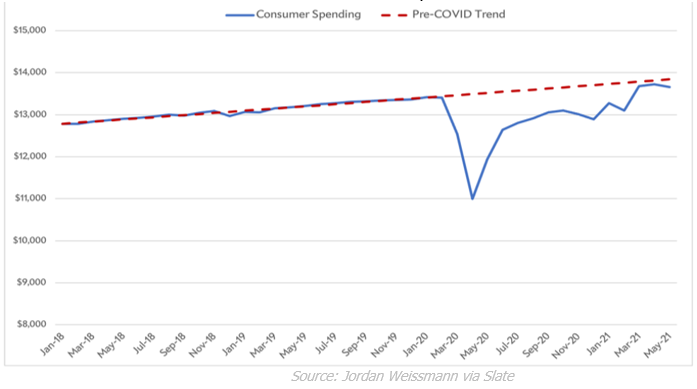

- Consumer spending plunged at the beginning of the pandemic and many experts predicted it would take years for consumer spending to recover to pre-COVID levels. However, consumer spending has roared back and is now on the same trajectory of growth as it was pre-COVID. Given that consumer spending is by far the biggest contributor to Gross Domestic Product (GDP), this will also have a ripple effect on the commercial and could further drive business activity.

The factors noted above combined with abatement of inflation worries has created a strong sense of optimism in the market. However, investors should be careful by keeping valuations in mind. The S&P 500 price to earnings ratio is currently at 46x and there have been only two instances in the past when this number has reached above 40 – in 2001 and 2008-09. In both instances, a recession ensued and investors lost a significant amount of their wealth. Though there are many reasons for market optimism, we believe investors should proceed with caution rather than blindly making bets on the markets continuing to rise.

Happy investing!

Disclosure Statements:

- This letter is confidential and may not be redistributed without the express written consent of SARINA Capital, LP.

- The information presented does not involve the rendering of personalized investment, financial, legal or tax advice, but is limited to the dissemination of general information on products and services. Before implementing any of the options presented, a professional adviser should be consulted about the legal, tax and financial suitability of this type of investment. This presentation should not be viewed as an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein.

- Past performance is no guarantee of future results. No person should invest who is not, either alone or with their advisers, capable of evaluating the merits and risks of prospective investments. No representation is made that SARINA Capital, LP will or is likely to achieve its investment objectives or that any investor will or is likely to achieve results comparable to those shown or will make any profit at all or will be able to avoid incurring substantial losses.

- Specific companies or securities mentioned in this document are meant to demonstrate SARINA Capital’s investment style and the types of industries and instruments in which we invest and are not selected based on past performance. The analyses and conclusions of SARINA Capital contained in this document include certain statements, assumptions, estimates and projections that reflect various assumptions by SARINA Capital concerning anticipated results that are inherently subject to significant economic, competitive, and other uncertainties and contingencies and have been included solely for illustrative purposes. No representations express or implied, are made as to the accuracy or completeness of such statements, assumptions, estimates or projections or with respect to any other materials herein. SARINA Capital may buy, sell, cover or otherwise change the nature, form or amount of its investments, including any investments identified in this letter, without further notice and in SARINA Capital’s sole discretion and for any reason. SARINA Capital hereby disclaims any duty to update any information in this letter.

- Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of preparation and are subject to change.

- Certain information has been provided by third-party sources and, although believed to be reliable, it has not been independently verified and its accuracy or completeness cannot be guaranteed.

- © 2021 SARINA Associates, LLC, all rights reserved.