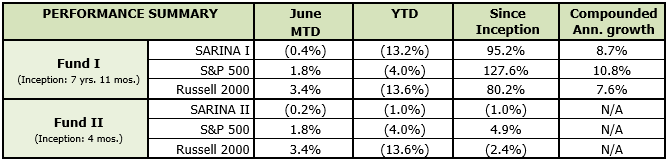

Both of our funds were essentially flat for the month of June as we continue to take a safe and conservative approach to investing as the gap between economic reality and equity markets continues to widen. The challenges posed by the current pandemic to our economy combined with the possibility of a change in the political landscape pose a great threat to the markets and could drive a market correction.

Second Wave

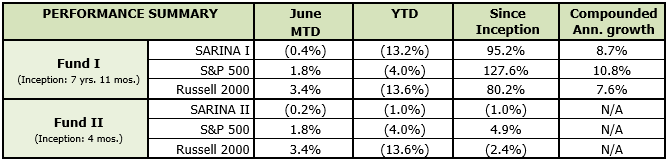

We could be looking at more delays on our road to recovery and a potentially a further deepening of the economic crisis as new COVID-19 cases spikes across the country and other parts of the world. A second wave was not expected to arrive until this fall, but unfortunately it appears that we may be ahead of the schedule.

After the surge we saw in March & April, the U.S. was doing well to flatten the curve; however, as the country has come out of the lockdown and as people started to return to “normal,” we have seen a sudden surge in cases across the U.S., particularly in Texas, Florida and Arizona. Florida by itself reported more new daily cases than what we saw in New York a couple of months ago.

We have come to this point due to lack of cohesive leadership and our individualistic natures. The lack of leadership issue is by no means meant to be a political statement as there are world leaders who we do not admire but have done fantastic work in handling this pandemic! Unfortunately the strategy in the U.S. to delegate decision making authority to state and local governments is backfiring now and the country does not have a single voice that can guide us through this crisis. Furthermore, medical experts are being asked to remain quiet in favor of economic progress. Individualism is also playing a large role in the spread as those who are asymptomatic or those who do not have the virus are choosing to ignore safety guidelines on social distancing and wearing a mask. It baffles us that we have made wearing a mask into a political statement rather than a way to contribute to the greater good! The combination of these two factors has led to an unfortunate rise in COVID-19 cases in our country, and we must collectively rise to the occasion and do our part in flattening the curve again because the consequences of not doing so can be extremely dire – both from a health and economic perspective!

Reality Check Needed

In the past, experts have said “Market is the economy and economy is the market;” however, that statement could not be further from the truth right now! Despite the continuing struggles related to economic recovery, the stock market is soaring to levels that would seem as if the current pandemic never even occurred. In our opinion, the optimism in stock market is driven by two factors:

- First and by far the biggest is the action by central banks. According to a study by Bank of America report, central banks across the world have pumped approximately $6+ trillion into the equity markets which has in turn led to a $16+ trillion surge in global equities off the March lows. The U.S. Fed has said that their current quantitative easing (QE) has no limit (i.e. QE infinity) and they are willing to provide any level of support necessary to keep the markets from collapsing. The Fed is a bottomless pit and is willing to do whatever it takes in the short-term to keep the markets afloat. Unfortunately, these actions will have long-term consequences, but those concerns have been brushed aside for now.

- Second and a much smaller component of the driver is the rise of retail traders (especially through apps such as Robinhood). You can now swipe left or right to buy and sell stocks – it’s so simple (sarcasm implied)! The rise in retail traders is driven by multiple factors. First, it is due to the extra liquidity provided by CARES Act – be it through the extra $600 weekly unemployment or via stimulus payments! Second, the markets have attracted many sports gamblers who need to fill that void in their lives. Lastly, it’s the app approach to trading – gives a whole new meaning to “in-app purchases.” The liquidity injection by central banks has given rise to equity prices and retail investors are realizing tremendous benefits from it.

Though the equity price recovery has been remarkable, we and many other prominent investors continue to sound alarms about the disconnect between stock market and economic reality. In his remarks at a congressional hearing Jerome Powell, the Fed Chair warned “The path forward for the economy is extraordinarily uncertain and will depend in large part on our success in containing the virus. A full recovery is unlikely until people are confident that it is safe to re-engage in a broad range of activities.”

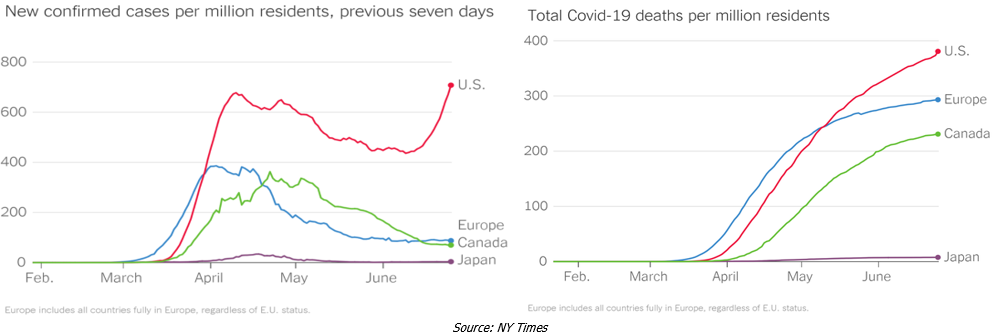

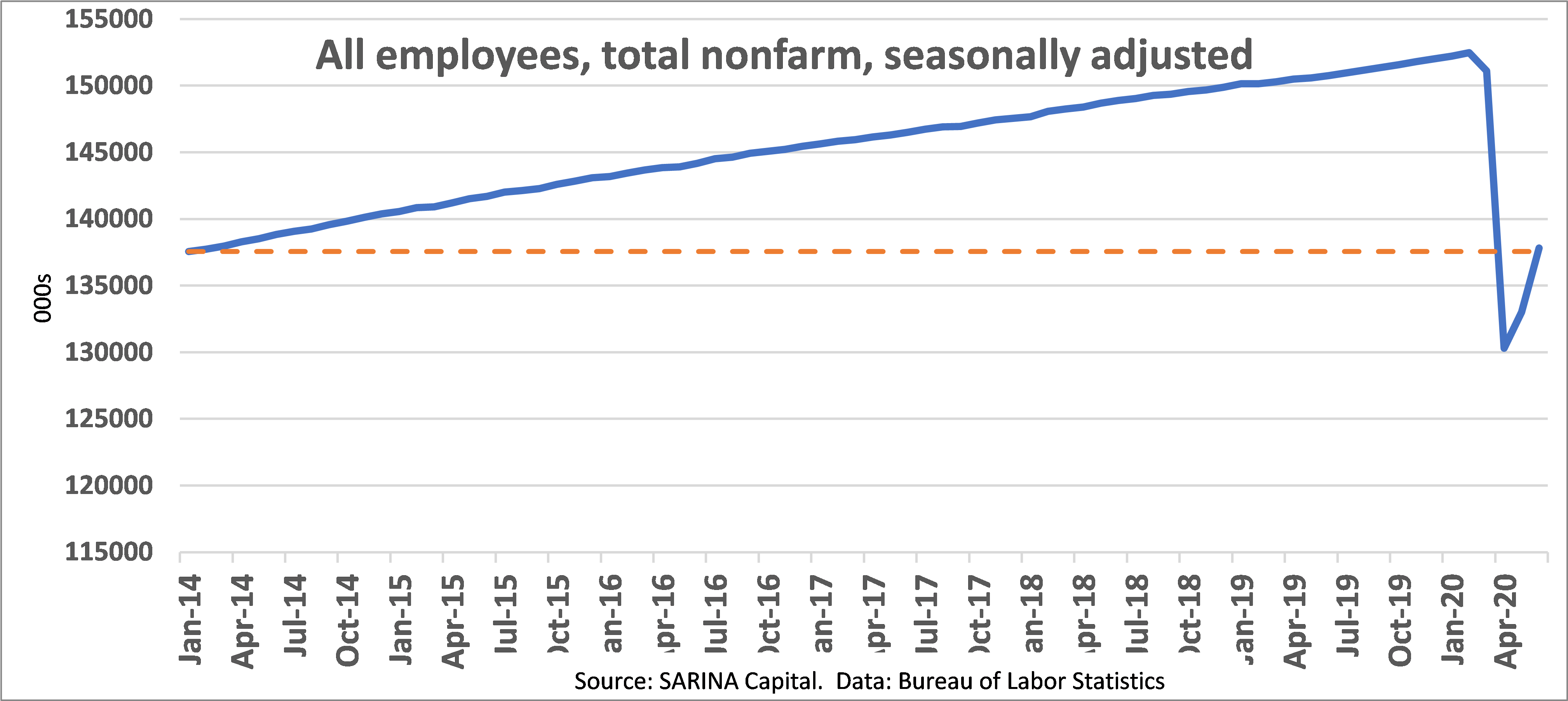

A simple example of the economic devastation can be seen when looking at total employment numbers.

Despite the significant gains in employment we have seen in the last couple of months, we are still at January 2014 level when it comes to total employment and about 14.7 million jobs away from the peak we saw in February 2020. The positive gains we have seen over the past couple of months have largely been driven by employees returning to work from the shutdown. According to a poll conducted for The New York Times by SurveyMonkey, nearly a third of the people who lost their jobs during the pandemic have returned to work and another quarter expected to return within a month. However, that still leaves about 40% of workers with no prospects of a job. Unemployment rate came down from a peak of 14.7% down to 11.1% in June, but that is still higher than any previous period since World War II. It should also be noted that monthly jobs data was collected in mid-June which is before the recent surge in COVID-19 cases in several states. Many of the hard-hit states have since closed beaches, bars, etc. and have delayed plans to fully reopen.

The markets did react negatively to the surge in new cases; however, hopes of a vaccine and Fed liquidity has kept the markets moving ahead with full steam. Only time will tell if this train will slow down on its own or come to a crashing stop!

Happy investing!

Disclosure Statements:

- This letter is confidential and may not be redistributed without the express written consent of SARINA Capital, LP.

- The information presented does not involve the rendering of personalized investment, financial, legal or tax advice, but is limited to the dissemination of general information on products and services. Before implementing any of the options presented, a professional adviser should be consulted about the legal, tax and financial suitability of this type of investment. This presentation should not be viewed as an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein.

- Past performance is no guarantee of future results. No person should invest who is not, either alone or with their advisers, capable of evaluating the merits and risks of prospective investments. No representation is made that SARINA Capital, LP will or is likely to achieve its investment objectives or that any investor will or is likely to achieve results comparable to those shown or will make any profit at all or will be able to avoid incurring substantial losses.

- Specific companies or securities mentioned in this document are meant to demonstrate SARINA Capital’s investment style and the types of industries and instruments in which we invest and are not selected based on past performance. The analyses and conclusions of SARINA Capital contained in this document include certain statements, assumptions, estimates and projections that reflect various assumptions by SARINA Capital concerning anticipated results that are inherently subject to significant economic, competitive, and other uncertainties and contingencies and have been included solely for illustrative purposes. No representations express or implied, are made as to the accuracy or completeness of such statements, assumptions, estimates or projections or with respect to any other materials herein. SARINA Capital may buy, sell, cover or otherwise change the nature, form or amount of its investments, including any investments identified in this letter, without further notice and in SARINA Capital’s sole discretion and for any reason. SARINA Capital hereby disclaims any duty to update any information in this letter.

- Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of preparation and are subject to change.

- Certain information has been provided by third-party sources and, although believed to be reliable, it has not been independently verified and its accuracy or completeness cannot be guaranteed.

- © 2020 SARINA Associates, LLC, all rights reserved.