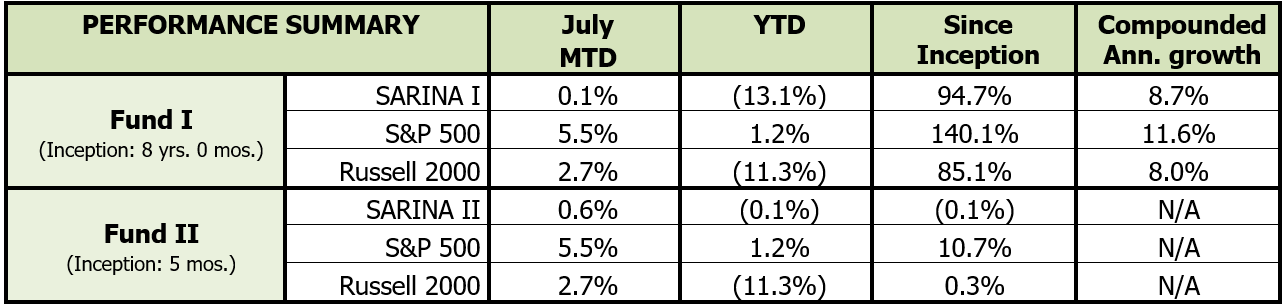

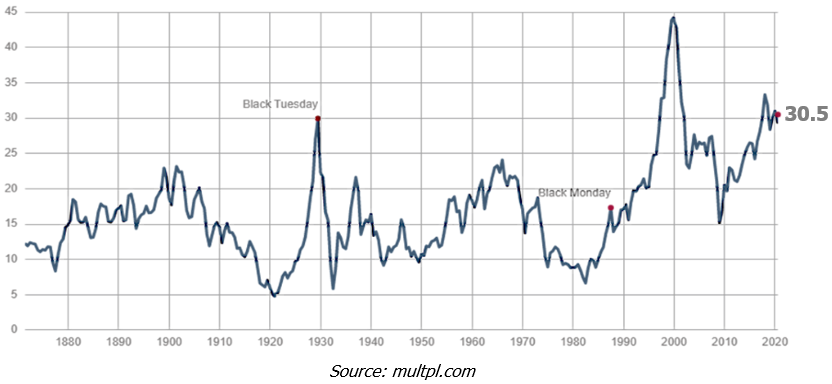

Both of our funds were up slightly for the month of July as we continue to take a measured and cautious approach to investing. Interestingly, calls from Wall Street big shots are starting to get louder about the markets being overpriced. Seth Klarman of Baupost Group (approx. $30B in assets) recently issued a 16 page letter in which he said that the Fed is essentially treating investors like spoiled bratty children and in turn is creating market conditions that are not supported by economic data. He said “It’s as if the Fed considers them foolish children, unable to rationally set the prices of securities so it must intervene. When the market has a tantrum, the benevolent Fed has a soothing yet enabling response.” He also said that he was a ‘significant’ seller during second quarter.

The off-the-charts GDP decline (down 32.9%) in the second quarter was historic by any measure. Even during the Global Recession of 2007-09, the worst GDP decline was 4%! The Eurozone GDP declined by 40% in the second quarter, but that can be explained by the more stringent lockdowns than what we saw here in the U.S. Eurozone certainly paid the price for stringent lockdowns, but they are far ahead of the U.S. in terms of their reopening efforts. The severe GDP decline coupled with the quadrupling of the unemployment rate is sure to create major economic disruption that many of us have yet to feel thanks to the stimulus money and various government programs that are artificially keeping the markets and economy afloat. However, Frank Borman said it best – “Capitalism without bankruptcy is like Christianity without hell.” Sooner or later, we will have our calling and we hope the pitchforks and fire of capitalism are not too severe for us.

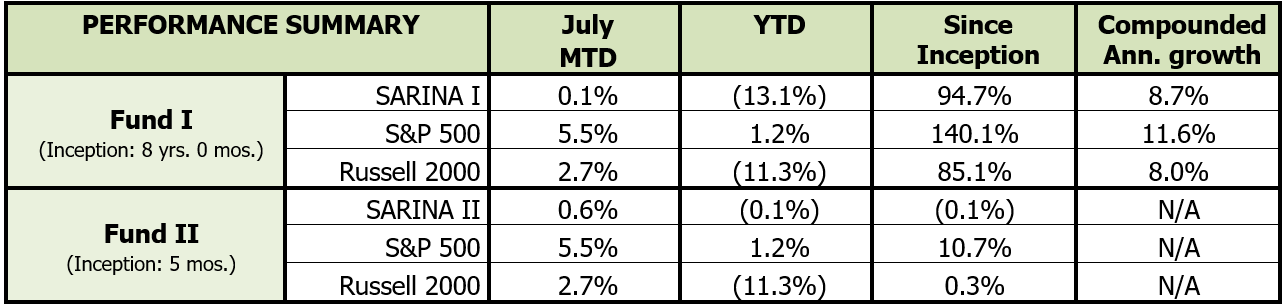

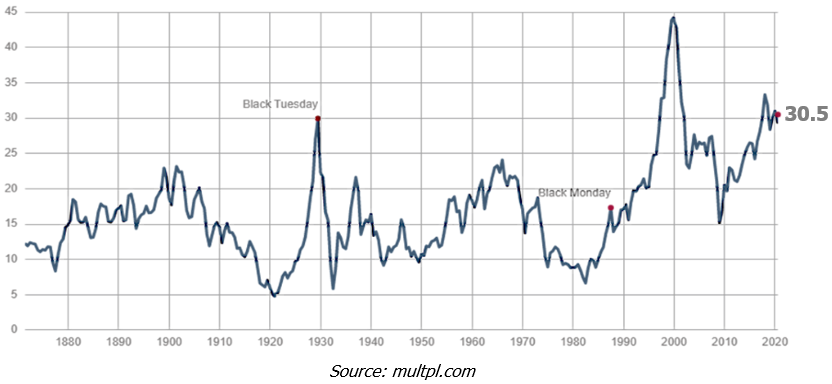

CAPE Ratio

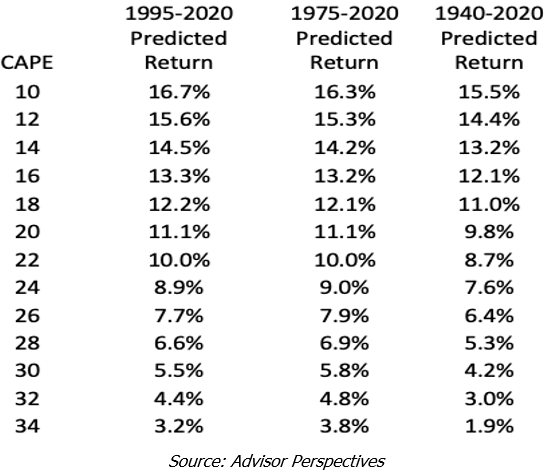

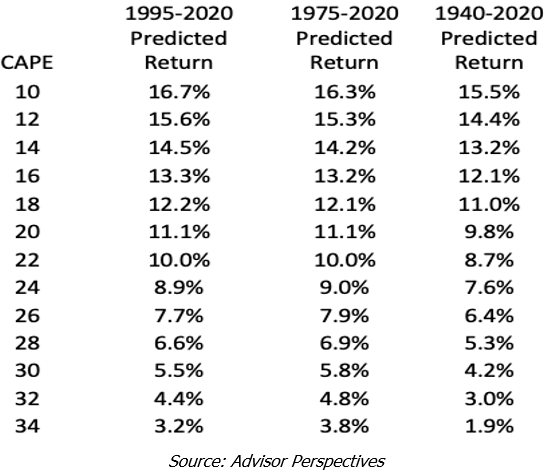

In the past, we have discussed the Cyclically Adjusted Price to Earnings (CAPE) ratio that has been developed by Noble laureate and Yale Professor Robert Shiller. This ratio smooths compares price to earnings over a ten year period rather than the most recent earnings to allow for peaks and valleys of an economic cycle.

The peak for CAPE ratio occurred in 2000 (Tech bubble) when it reached nearly 45 and the second highest recording came in 1929 (thanks to the roaring 20s). The chart above shows a 140 year history of the CAPE ratio and over that time span, the average CAPE ratio is about 17. At just 30.5 at the end of July 2020, we are way above the average CAPE ratio and that is of great importance as we look to the future. According to research conducted by Michael Finke, the CAPE ratio can be a great predictor of returns over the next 10 years. He looked at returns from 2005–2020, 1985-2020, and 1940-2020 using CAPE ratios from 1995-2010, 1975-2020, and 1940-2020, respectively. The results speak from themselves:

Looking at both nominal and real returns, we can see a strong correlation between the CAPE ratio and the subsequent 10-year annualized returns. If so, we should all curtail our expectations over the next ten years given the current CAPE ratio of 30 – according to the data above, we should expect annual returns from anywhere between 4.2% to 5.8%! If you want double digit returns, you have to go down to a CAPE ratio of 22!

Investment Considerations

We would like to share some of our investment ideas, but as we consider investment ideas, we remain concerned about the continued disconnect between the economy and the markets. Even though we approach our investment decisions on a bottom up approach, we do factor in macro conditions, which at the moment are not looking very favorable. Despite these challenges, we believe there are investment opportunities that have not only done well during the pandemic but will continue to do so after we return to our pre-pandemic lifestyle.

The first investment we want to highlight is DocuSign (Ticker: DOCU). At its core, the company provides e-signature solution that enables businesses to digitally prepare, execute, and act on agreements. Chances are most of you have used DOCU’s service during the pandemic to sign any form of documentation – be it for a business or personal transaction. As we continue to fight the current pandemic, organizations continue to carry-on with their day-to-day activities by using DOCU not only for its e-signature solution, but also their workflow automation, contract generation directly from Salesforce, AI tools to assist with legal concepts and clauses, etc. More importantly, this technology will continue to exist (and perhaps dominate) as this environmentally friendly service will help saves many trees and provides convenience that will be difficult to take away from people. The stock has taken off since the March lows and now sits near all-time highs. Despite the great run, we are bullish on this stock as we believe this stock will do well even after the pandemic is over.

The second name we are bullish on is Teladoc (Ticker: TDOC), which provides virtual healthcare services on a business-to-business basis. Prior to COVID-19, we were eyeing this stock as trends in telemedicine were very favorable. The pandemic fast forwarded these trends at an exponential rate and people are starting to adopt telemedicine as the new way to visit their doctor. On the other side, doctors and other medical professionals are also adopting this new way of life and are getting more and more comfortable using this technology to interact with their patients virtually. The good thing about telemedicine is its ‘stickiness,’ i.e. once both parties try this technology, the chances of them using it again are very high. Similar to DocuSign, the convenience factor is significant and people will continue to use this technology post-pandemic. Despite its huge gains since the March lows, we are bullish on TDOC as we see an opportunity to invest in a growth stock that is here to stay for the long-term. TDOC is growing not only organically but also through acquisition – the company completed the acquisition of InTouch Health, which provides innovative telehealth capabilities linking providers to one another in complex medical environments. The growth opportunities of the combined companies are going to be tremendous and the ‘stickiness’ of telehealth will ensure TDOC will be a long-term player.

In addition to the business models of DOCU and TDOC, we are also impressed by the strength of their balance sheets. Yes, the valuation is rich for both of these names, but that is expected for growth companies. However, as these companies continue to grow, it will be important to also keep an eye on the ability of these companies to generate positive earnings in the near future.

Happy investing!

Disclosure Statements:

- This letter is confidential and may not be redistributed without the express written consent of SARINA Capital, LP.

- The information presented does not involve the rendering of personalized investment, financial, legal or tax advice, but is limited to the dissemination of general information on products and services. Before implementing any of the options presented, a professional adviser should be consulted about the legal, tax and financial suitability of this type of investment. This presentation should not be viewed as an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein.

- Past performance is no guarantee of future results. No person should invest who is not, either alone or with their advisers, capable of evaluating the merits and risks of prospective investments. No representation is made that SARINA Capital, LP will or is likely to achieve its investment objectives or that any investor will or is likely to achieve results comparable to those shown or will make any profit at all or will be able to avoid incurring substantial losses.

- Specific companies or securities mentioned in this document are meant to demonstrate SARINA Capital’s investment style and the types of industries and instruments in which we invest and are not selected based on past performance. The analyses and conclusions of SARINA Capital contained in this document include certain statements, assumptions, estimates and projections that reflect various assumptions by SARINA Capital concerning anticipated results that are inherently subject to significant economic, competitive, and other uncertainties and contingencies and have been included solely for illustrative purposes. No representations express or implied, are made as to the accuracy or completeness of such statements, assumptions, estimates or projections or with respect to any other materials herein. SARINA Capital may buy, sell, cover or otherwise change the nature, form or amount of its investments, including any investments identified in this letter, without further notice and in SARINA Capital’s sole discretion and for any reason. SARINA Capital hereby disclaims any duty to update any information in this letter.

- Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of preparation and are subject to change.

- Certain information has been provided by third-party sources and, although believed to be reliable, it has not been independently verified and its accuracy or completeness cannot be guaranteed.

- © 2020 SARINA Associates, LLC, all rights reserved.