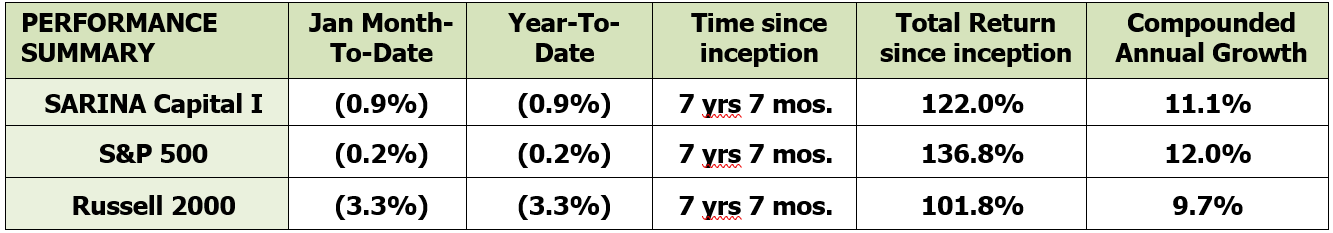

SARINA Capital Fund I was down 0.9% for the month of January 2020 compared to losses of 0.2% and 3.3% for the S&P 500 and Russell 2000, respectively. The coronavirus wreaked havoc on the market as there appeared to be no signs of stopping the virus. The fears were further worsened by the actions taken by Chinese government to put the city of Wuhan (the epicenter of the coronavirus) on a lockdown, coupled with travel bans by U.S. and other major trade countries. In order to ease a potential selloff in the Chinese markets, the Chinese government announced that it will inject up to $174 billion of liquidity. Now that the fears of coronavirus have eased slightly (not erased), the markets have rallied at a brisk pace with the S&P 500 adding a whopping 3.4% in the first 3 trading days this month! The liquidity injected by China combined with the continuation of liquidity injection by the Federal Reserve Board in the U.S. have largely contributed to the strong recovery. On February 6th, China also announced that it will cut tariffs in half on $75 billion worth of U.S. imports to help boost sentiment and ease market fears some more.

Additionally, economic data continues to show strength in the U.S. economy. The Institute of Supply Management (ISM) manufacturing index showed good signs of improvement as it jumped from 47.8% in December to 50.9% in January. Jobs in the manufacturing sectors also showed improvement in January. The employment index jumped from 45.1% in December to 46.4% in January and the new orders index increased from 46.8% in December to 52.0% in January. On the overall employment front, ADP’s private sector hiring data showed 291,000 jobs were created last month, which is the largest gain for this metric since May 2015.

Long-term Investing – Odds Are Very Favorable!

A recurring question we hear from investors all the time is how safe is investing in the markets and am I going to lose all my money! As fund managers, we are required to tell investors that 100% of their money is at risk; however, the likelihood of that occurring is extremely slim (miniscule, tiny, microscopic, etc. – we really want to highlight how unlikely it is to lose 100% of your money). What is important for investors to understand is that they must have a long-term horizon when gaining exposure to the market and there is strong data to show that the longer the time horizon, the better your odds of making more money in the stock market.

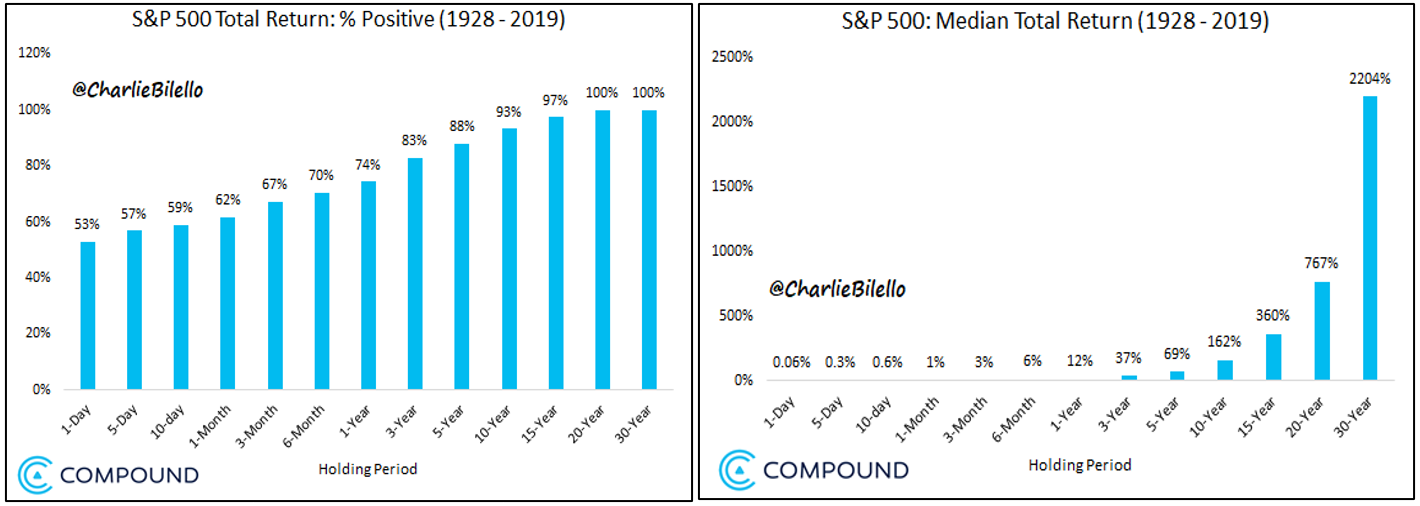

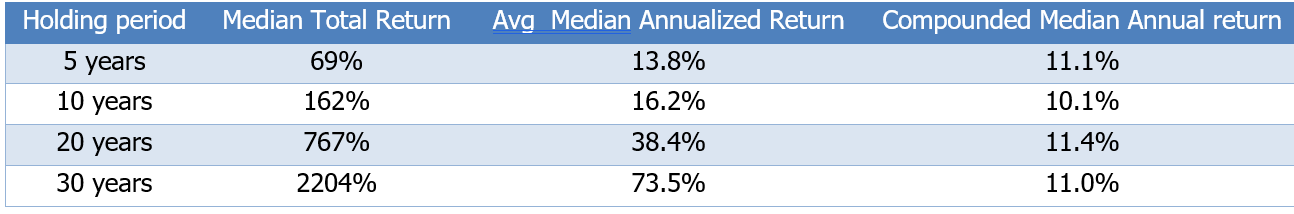

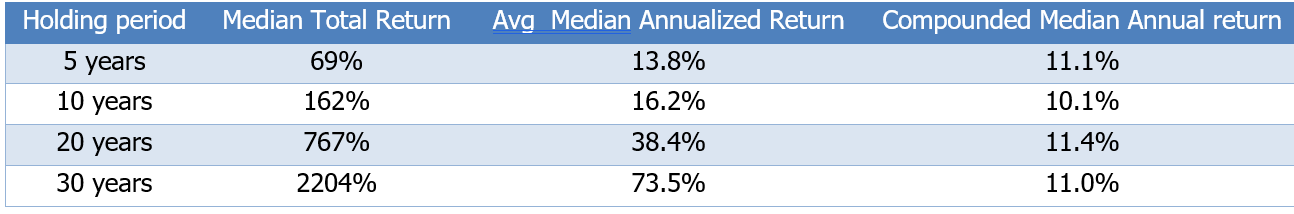

The chart above on the left from Compound advisors shows the odds of an investor yielding positive returns when investing in S&P 500 over various time horizons. As a day trade, odds of you making positive returns in the market are 53% and as you increase the holding period, the odds get to 100% at a 20 year holding period. Even at 10 years, there is 93% chance that you will end up making when investing in S&P 500. Additionally, the returns (chart above on the right) also get better (think compounding – the eighth wonder of the world!) as you increase your holding period. Below is a summary of S&P 500 returns over various holding periods:

We tend to be an extremely risk averse investors and it is our risk averse nature combined with all the historical data that gives us great confidence to invest in the markets. Furthermore, these returns are over a 90 year period from 1928 – 2019 and over that period, the U.S. has seen a World War, Great Depression, Great Recession, oil & gas crisis, savings & loan crisis, and countless other “bumps in the road.” Despite these bumps, the U.S. economy continues to be the strongest in the world and will continue to be the strongest given the strong governance standards, infrastructure, military presence and perhaps most importantly education institutions that foster and drive innovation. So if you are looking to invest for a long-term, you should invest in the U.S. markets with great confidence and not fear losing all your money!

Tesla – What A Run!

Anyone following Tesla (Ticker: TSLA) surely has seen the meteoric rise in its stock price in 2020. The stock has doubled in value in 2020 primarily driven by reporting profits over two consecutive quarters! TSLA is one of the most polarizing stocks and there are those who have been short selling the stock. However, the short sellers suffered huge losses after the earnings release and many had to close their short positions, thus creating even more demand for the stock.

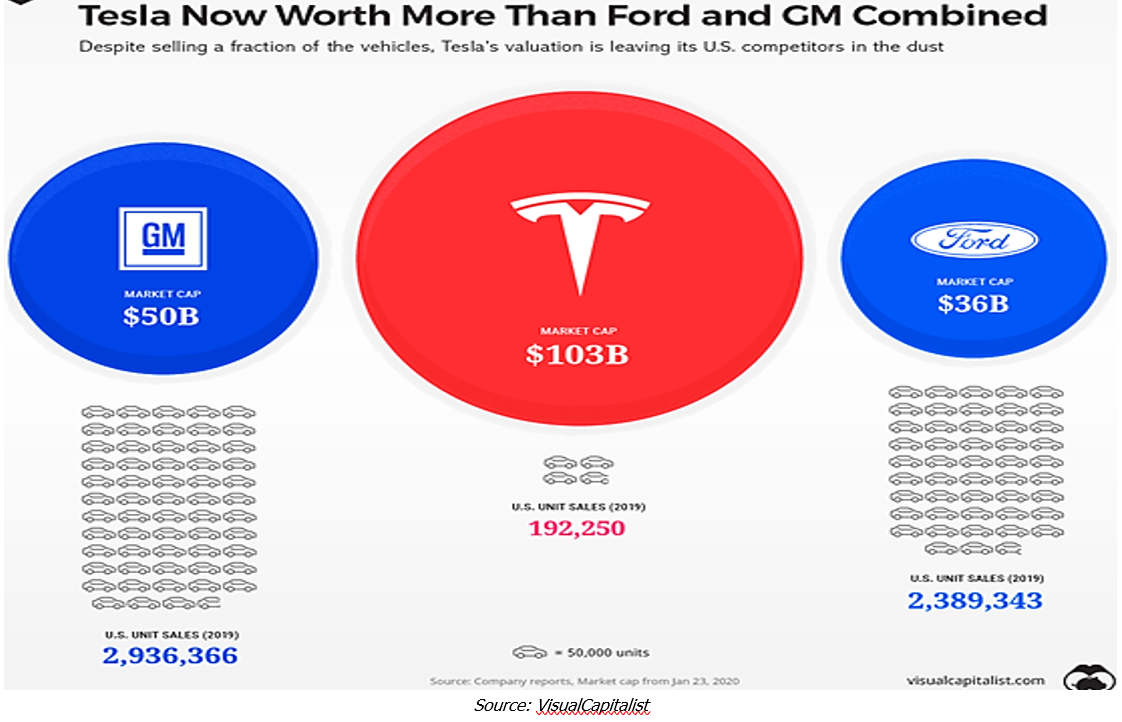

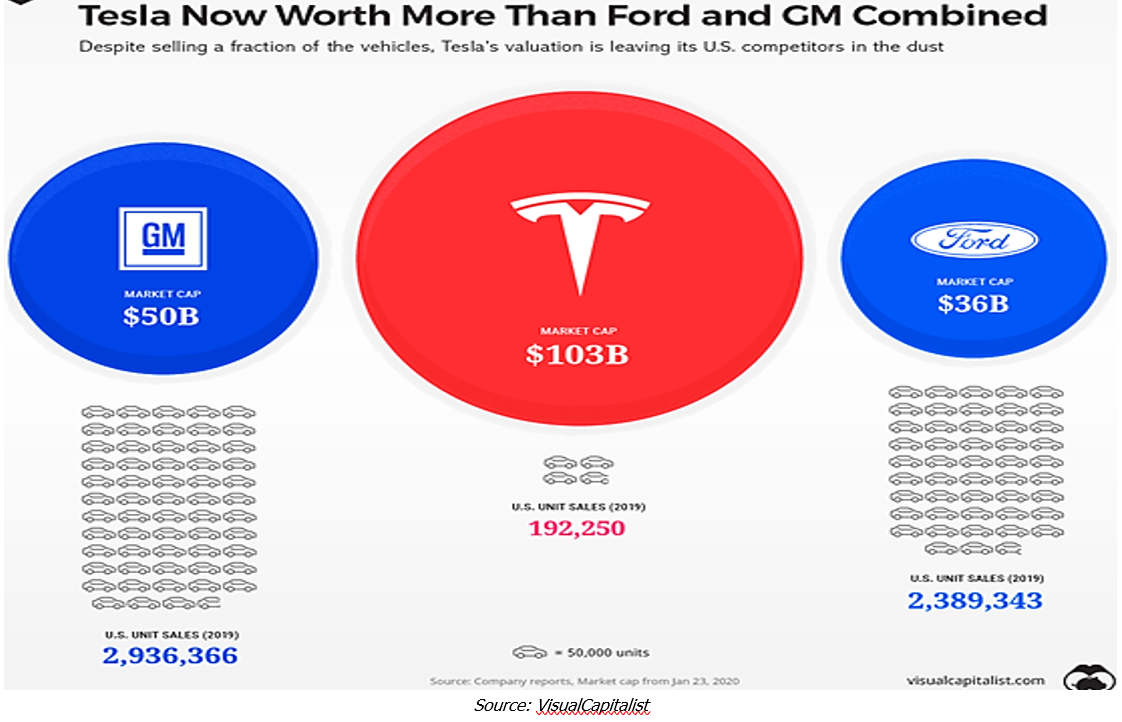

As we look at TSLA stock today though, it is important to observe what TSLA has produced so far and quite frankly we are not sure if the valuation and production numbers justify the price today. TSLA’s market cap is bigger than GM and Ford combined while its unit sales in 2019 were only 3.5% of total unit sales for these 3 companies.

We are by no means short the stock, but at today’s price point, we are also not buyers. TSLA does make great cars but at the same time, it has long ways to go in catching up to 100s of years of car manufacturing experience possessed by GM and Ford. The lack of competition has significantly helped TSLA but other manufacturers are catching up and once the electric car technology is combined with manufacturing prowess of current auto makers, TSLA may struggle to maintain its edge. But until then, enjoy the TSLA run!

Happy investing!

Disclosure Statements:

- This letter is confidential and may not be redistributed without the express written consent of SARINA Capital, LP.

- The information presented does not involve the rendering of personalized investment, financial, legal or tax advice, but is limited to the dissemination of general information on products and services. Before implementing any of the options presented, a professional adviser should be consulted about the legal, tax and financial suitability of this type of investment. This presentation should not be viewed as an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein.

- Past performance is no guarantee of future results. No person should invest who is not, either alone or with their advisers, capable of evaluating the merits and risks of prospective investments. No representation is made that SARINA Capital, LP will or is likely to achieve its investment objectives or that any investor will or is likely to achieve results comparable to those shown or will make any profit at all or will be able to avoid incurring substantial losses.

- Specific companies or securities mentioned in this document are meant to demonstrate SARINA Capital’s investment style and the types of industries and instruments in which we invest and are not selected based on past performance. The analyses and conclusions of SARINA Capital contained in this document include certain statements, assumptions, estimates and projections that reflect various assumptions by SARINA Capital concerning anticipated results that are inherently subject to significant economic, competitive, and other uncertainties and contingencies and have been included solely for illustrative purposes. No representations express or implied, are made as to the accuracy or completeness of such statements, assumptions, estimates or projections or with respect to any other materials herein. SARINA Capital may buy, sell, cover or otherwise change the nature, form or amount of its investments, including any investments identified in this letter, without further notice and in SARINA Capital’s sole discretion and for any reason. SARINA Capital hereby disclaims any duty to update any information in this letter.

- Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of preparation and are subject to change.

- Certain information has been provided by third-party sources and, although believed to be reliable, it has not been independently verified and its accuracy or completeness cannot be guaranteed.

- © 2020 SARINA Associates, LLC, all rights reserved.