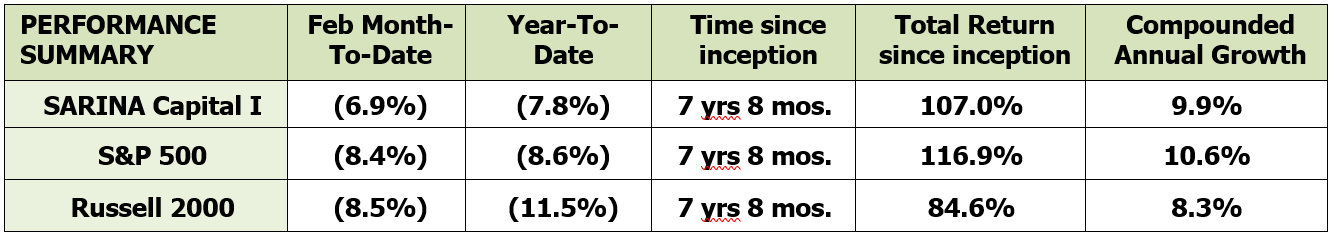

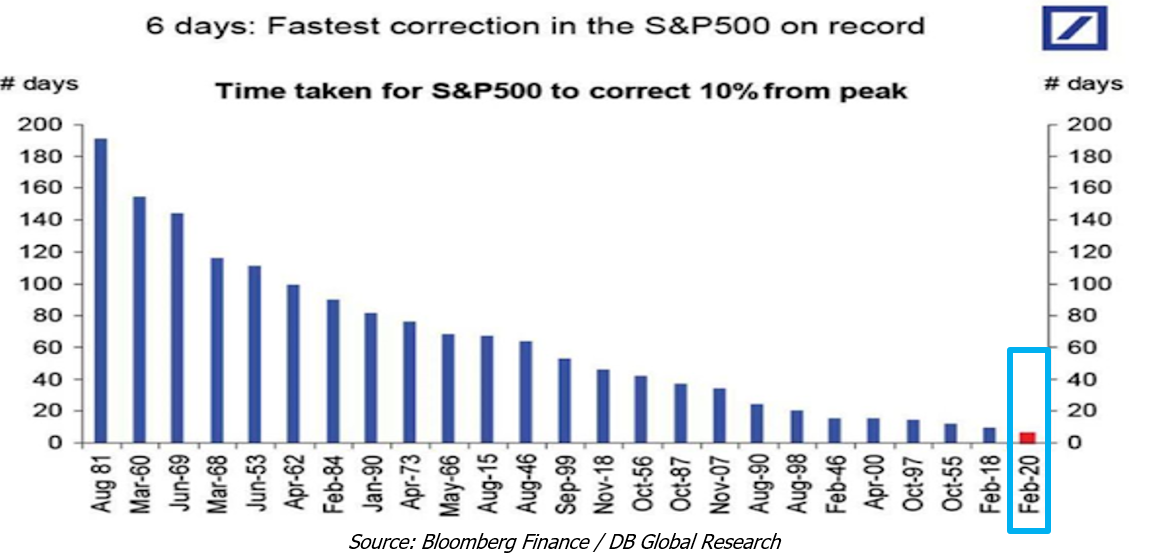

SARINA Capital Fund I was down 6.9% for the month of February2020 compared to losses of 8.4% and 8.5% for the S&P 500 and Russell 2000, respectively. The coronavirus virus’ impact on global supply chain instilled fear of epic proportions in the minds of investors. In a matter of just six days, the markets lost over 11% at the end February, the fastest drop of over 10% ever in the history!

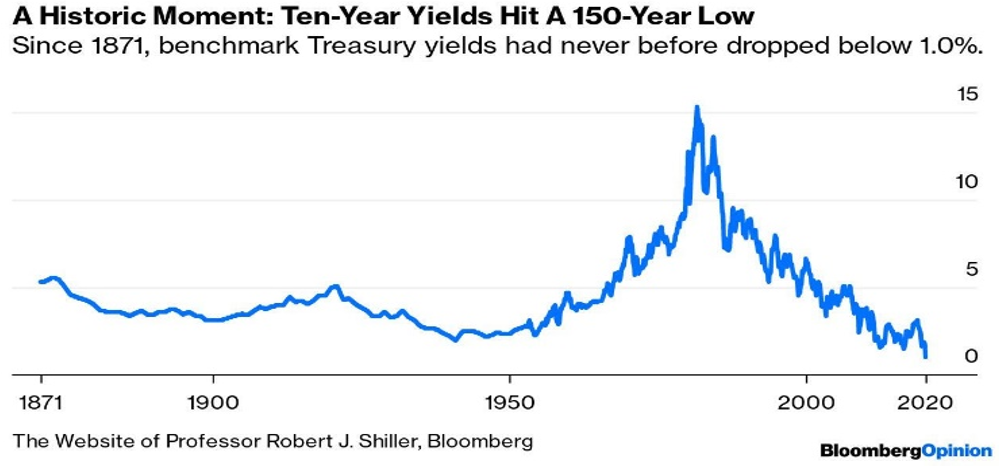

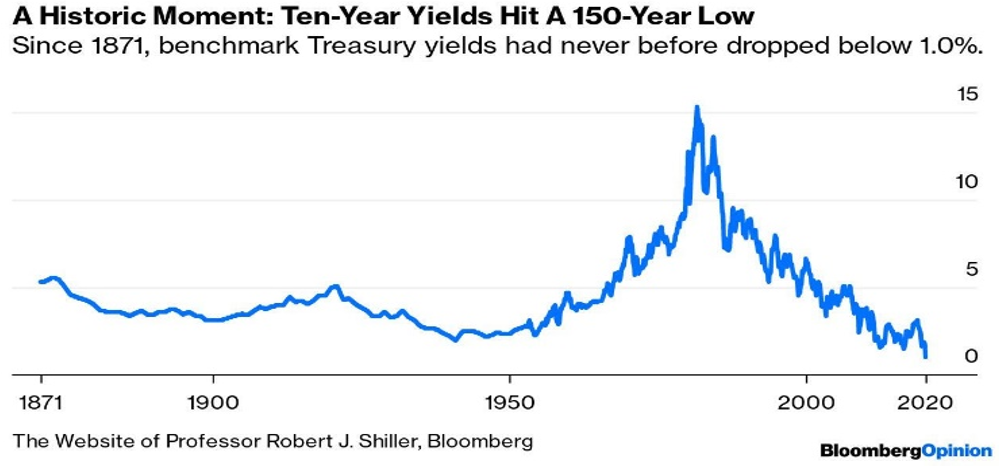

What is driving the dramatic movements in the markets is the fact that the investors in this case are at the mercy of healthcare professionals and there is no visibility on how this could end. Hence, any good news is treated with a large spike up in the markets and any bad news is treated with a significant decline. The central governments have also chimed in on the issue by slashing interest rates to spur the markets; however, their moves have not been very effective. Furthermore, making a move this early into the crisis may limit their ability to do anything in the future if this becomes a longer term issue. The reduction in interest rates has led to a sharp decline in treasury yields and another historic moment where the 10-year yield fell below 1% for the first time ever since 1871!

Reasons to Sell

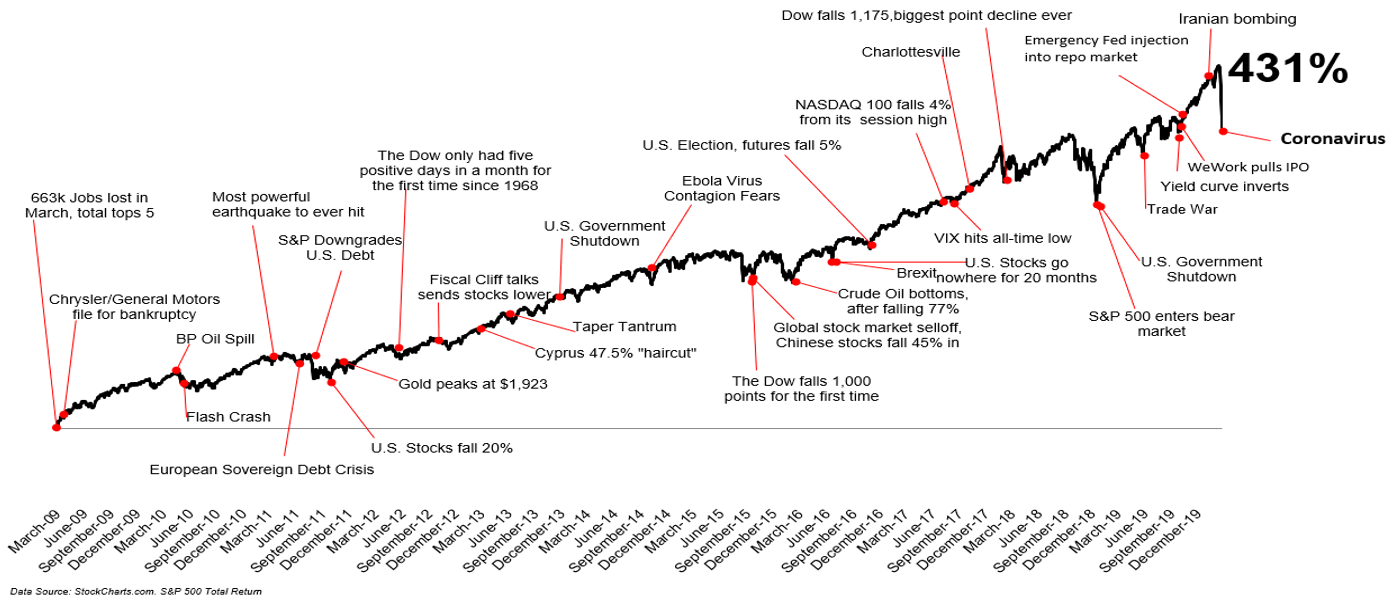

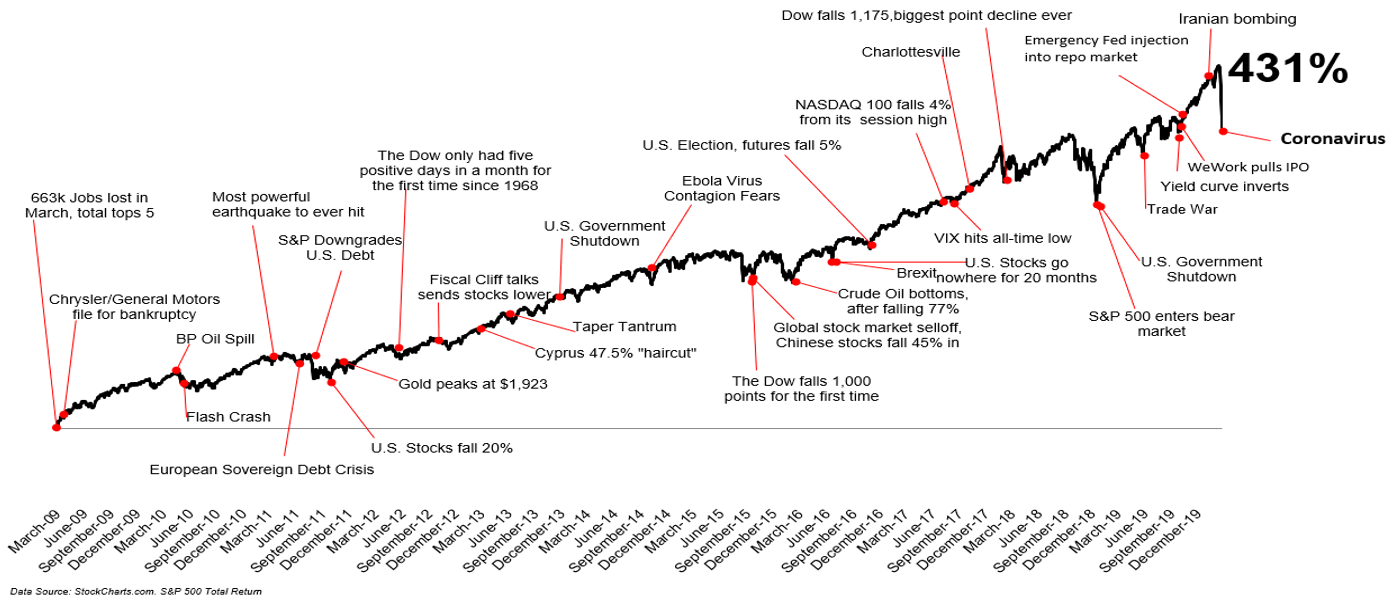

Since the financial crisis of 2008, investors have been given many reasons to sell their but despite the ‘bumps in the road,’ markets are up approximately 430% since the lows we saw in March 2009.

In times of correction or bear market, we tend to look for opportunities to buy and the simple reason for that is because we remain bullish on the U.S. outlook over the long-term time horizon, that is over the next 5 to 10 years U.S. economy will do just fine.

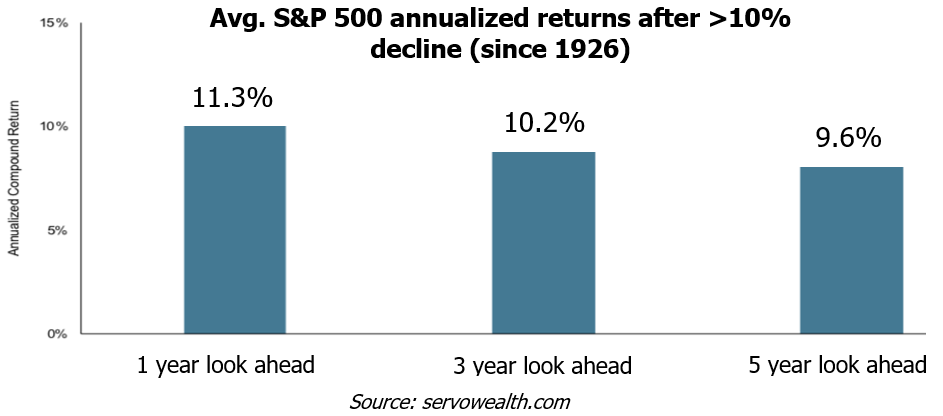

Corrections and bear markets bring opportunities to buy some solid assets at a more reasonable price. Given the terrific performance of S&P 500 in 2019, our view was that valuation were very high for many of the companies we were interested in buying. Now that prices have come back down to earth, this correction may present a good opportunity to buy some solid businesses. We also have good empirical evidence to buy the dip. Below is a look at how markets have performed after a correction:

Of course, the narrative of “this time it’s different” is out there as we have never seen anything like this before. Today the world is more dependent on Chinese goods and never before has anything brought the global supply chain to a halt at this level! However, you can use the words ‘never before’ for every correction and history tells us that the markets do rebound. On average markets have gained approximately 10% or more in the one-, three- and five-years following a 10% correction. Anyone remember late 2018/early 2019?

In uncertain times as these, it is always important to stay focused on the long-term picture. Setbacks such as these are not uncommon in the markets and this won’t be the last time that “it’s different.” The key is to ignore the noise that is all around us and remain focused on the things that we can control.

Happy investing!

Disclosure Statements:

- This letter is confidential and may not be redistributed without the express written consent of SARINA Capital, LP.

- The information presented does not involve the rendering of personalized investment, financial, legal or tax advice, but is limited to the dissemination of general information on products and services. Before implementing any of the options presented, a professional adviser should be consulted about the legal, tax and financial suitability of this type of investment. This presentation should not be viewed as an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein.

- Past performance is no guarantee of future results. No person should invest who is not, either alone or with their advisers, capable of evaluating the merits and risks of prospective investments. No representation is made that SARINA Capital, LP will or is likely to achieve its investment objectives or that any investor will or is likely to achieve results comparable to those shown or will make any profit at all or will be able to avoid incurring substantial losses.

- Specific companies or securities mentioned in this document are meant to demonstrate SARINA Capital’s investment style and the types of industries and instruments in which we invest and are not selected based on past performance. The analyses and conclusions of SARINA Capital contained in this document include certain statements, assumptions, estimates and projections that reflect various assumptions by SARINA Capital concerning anticipated results that are inherently subject to significant economic, competitive, and other uncertainties and contingencies and have been included solely for illustrative purposes. No representations express or implied, are made as to the accuracy or completeness of such statements, assumptions, estimates or projections or with respect to any other materials herein. SARINA Capital may buy, sell, cover or otherwise change the nature, form or amount of its investments, including any investments identified in this letter, without further notice and in SARINA Capital’s sole discretion and for any reason. SARINA Capital hereby disclaims any duty to update any information in this letter.

- Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of preparation and are subject to change.

- Certain information has been provided by third-party sources and, although believed to be reliable, it has not been independently verified and its accuracy or completeness cannot be guaranteed.

- © 2020 SARINA Associates, LLC, all rights reserved.