A Rollercoaster Year

2020 was indeed one for the history books and from an investing perspective, it provided lessons that can take an individual a lifetime to learn! Some lessons we learned:

- In times of distress, markets are not rational.

- Market and the economy are not connected (until they’ll be linked again in the future).

- When Uncle Sam is writing blank checks, markets will do well.

- Being a contrarian is not easy, it requires patience but the payoff can be significant.

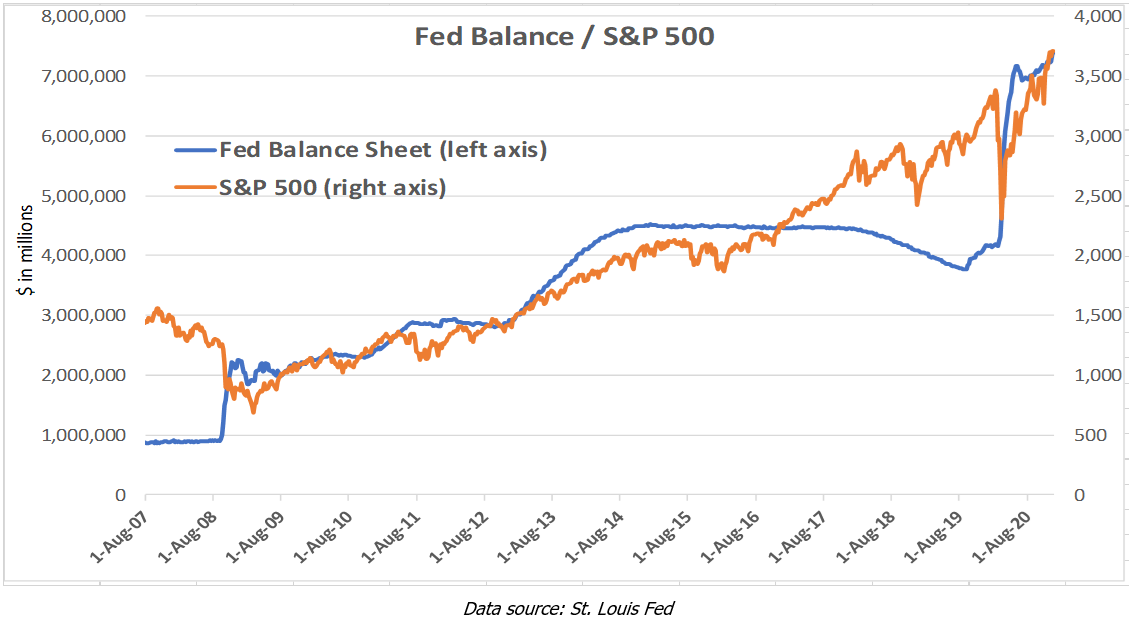

Recall we entered the year after a record 2019 which saw S&P 500 increase 29% and expectations were for the markets to continue to march higher. However, the pandemic came and drove everything into the ground in a flash in March. Despite continued concerns related to the pandemic, the markets marched higher from their March lows and have not looked back. The recovery was driven by extremely generous efforts of central banks across the world and it appears that any weakness in the market gets supported by central banks which provides a floor and prevents a market collapse.

The Fed decided to throw the proverbial kitchen sink at the market collapse caused by the pandemic and so far that approach has sent the markets soaring. As long as the markets continue to get supported by “QE infinity” the markets will remain afloat and we do not expect to see another March-like collapse.

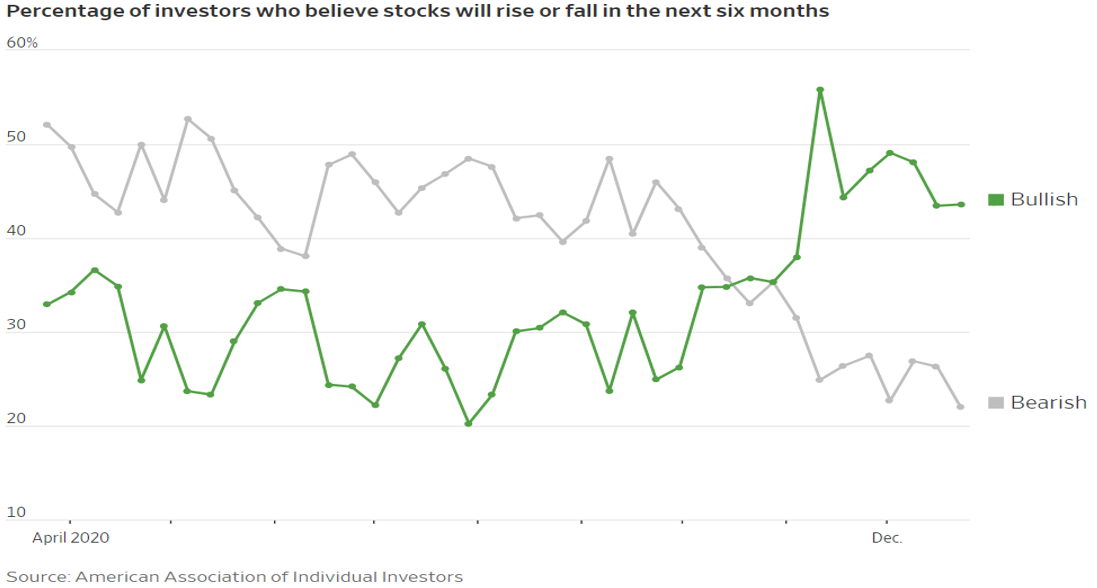

The pandemic gave us the quickest drop and fastest recovery in markets’ history and has turned a bear market into a full blown bull market in a matter of few months! At the onset of the pandemic, investors quickly piled into momentum and large cap trades and then turned to value and small cap names towards the end of the year. The speedy market recovery has many investors calling the current market a bubble, similar to the one we saw during the technology boom. However, investors on the other side are questioning what other alternatives are available to earn real (i.e. inflation adjusted) returns. The 10-year treasury yield remains below 1% while safe havens such as gold have already seen large spikes this year. Investors willing to take on more risk on the bond side are not getting paid for that risk – options-adjusted yield for BBB rated corporate bonds are a moderate 1.8 percentage points higher than the Treasuries. Additionally, with interest rates near zero cash in the bank is not earning anything meaningful either. The lack of options combined with a risk-on attitude led the markets higher in 2020 and expectations are for that to continue into 2021. The risk-on mood is also reflected in investors’ expectations for stocks over the next 6 months.

As shown in the chart above, the bears are converting over to the bullish side and this bodes well for the markets to continue marching higher. As long as there is central bank support, investors sentiment remains optimistic, and vaccine rollout continues to go smoothly, we expect markets to go higher albeit in a very volatile manner. There is no way to know what will cause volatility in the markets but given the current valuation, any bad news could be received with a large negative shock.

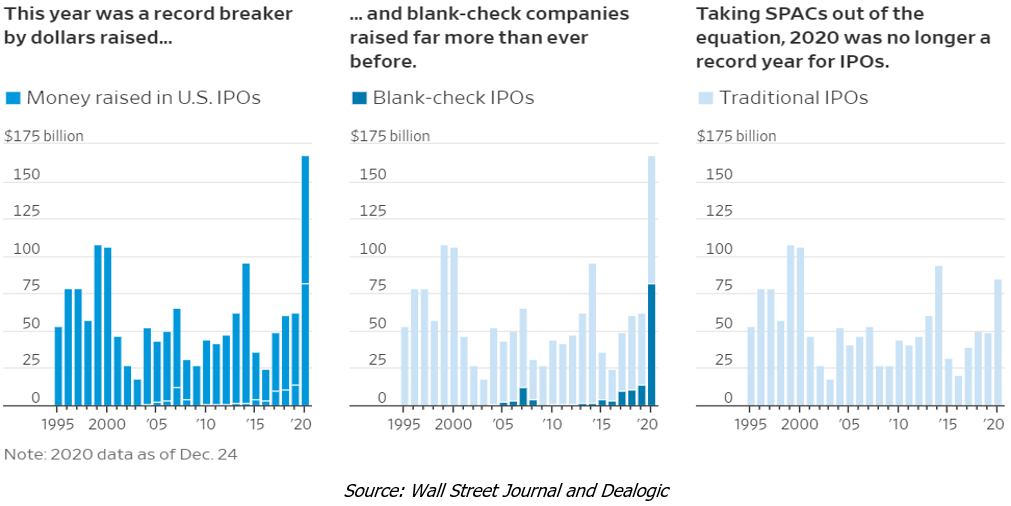

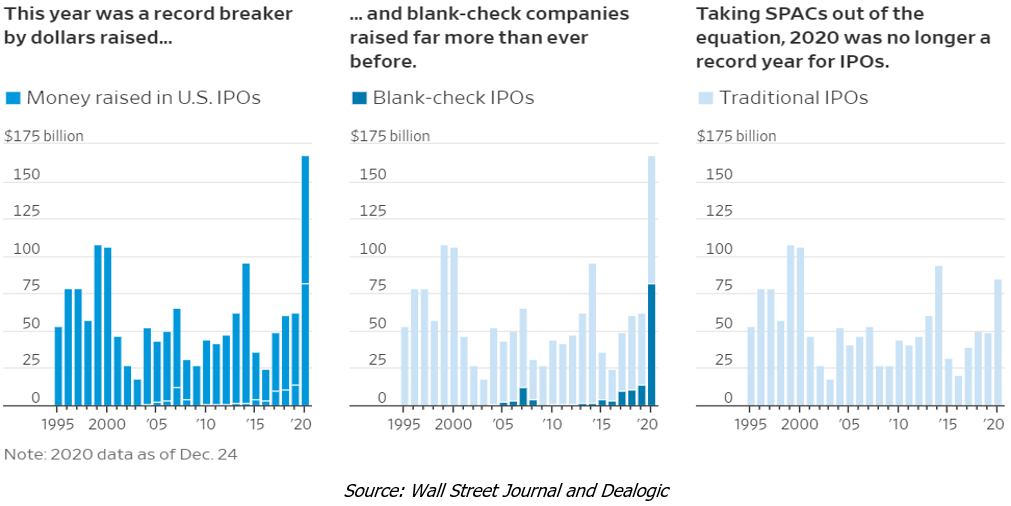

IPOs – Let’s Party Like It’s 1999

Despite the pandemic, 2020 was one of the best years for IPOs. Investors piled into IPOs as companies were able to raise $167.6 billion through 457 offerings. The IPO boom was driven by special-purpose acquisition companies (SPACs) which accounted for nearly half of the total IPO funds raised ($82.4 billion) in 2020. SPACs are shell companies that raise money through IPOs with the aim of buying a private company and making the acquired company public. The inherent risk involved in SPACs is that these companies represent a bet on an unknown business that has yet to be identified and that this business will generate steep returns. Some of these SPACs are backed well-known investors which has given smaller investors a vote of confidence to also invest in SPACs.

The IPO frenzy was further magnified by interest from individual investors who were attracted to trendy offerings such as Airbnb, Snowflake, and Doordash. Excluding SPACs, the average first day gains for IPOs in 2020 was 36%. This represents the largest first day gains since 2000 when IPOs gained an eye popping average of 57% on the first day of trading.

Many are expecting the IPO boom to continue into 2021 as investors look to put the remaining cash on the sidelines to work. However, many seasoned investors are drawing parallels to the 1990s technology IPO boom and are afraid that individual investors will be left holding the bag on many of these IPOs. Until that happens, it appears that the IPO party train appears to be moving full steam ahead!

Happy investing!

Disclosure Statements:

- This letter is confidential and may not be redistributed without the express written consent of SARINA Capital, LP.

- The information presented does not involve the rendering of personalized investment, financial, legal or tax advice, but is limited to the dissemination of general information on products and services. Before implementing any of the options presented, a professional adviser should be consulted about the legal, tax and financial suitability of this type of investment. This presentation should not be viewed as an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein.

- Past performance is no guarantee of future results. No person should invest who is not, either alone or with their advisers, capable of evaluating the merits and risks of prospective investments. No representation is made that SARINA Capital, LP will or is likely to achieve its investment objectives or that any investor will or is likely to achieve results comparable to those shown or will make any profit at all or will be able to avoid incurring substantial losses.

- Specific companies or securities mentioned in this document are meant to demonstrate SARINA Capital’s investment style and the types of industries and instruments in which we invest and are not selected based on past performance. The analyses and conclusions of SARINA Capital contained in this document include certain statements, assumptions, estimates and projections that reflect various assumptions by SARINA Capital concerning anticipated results that are inherently subject to significant economic, competitive, and other uncertainties and contingencies and have been included solely for illustrative purposes. No representations express or implied, are made as to the accuracy or completeness of such statements, assumptions, estimates or projections or with respect to any other materials herein. SARINA Capital may buy, sell, cover or otherwise change the nature, form or amount of its investments, including any investments identified in this letter, without further notice and in SARINA Capital’s sole discretion and for any reason. SARINA Capital hereby disclaims any duty to update any information in this letter.

- Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of preparation and are subject to change.

- Certain information has been provided by third-party sources and, although believed to be reliable, it has not been independently verified and its accuracy or completeness cannot be guaranteed.

- © 2021 SARINA Associates, LLC, all rights reserved.