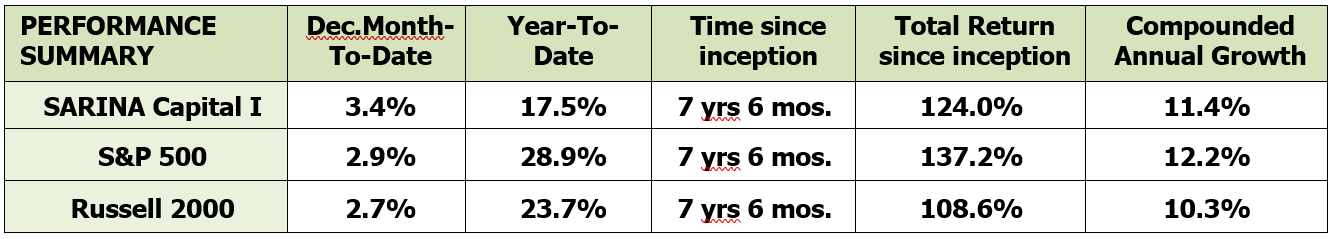

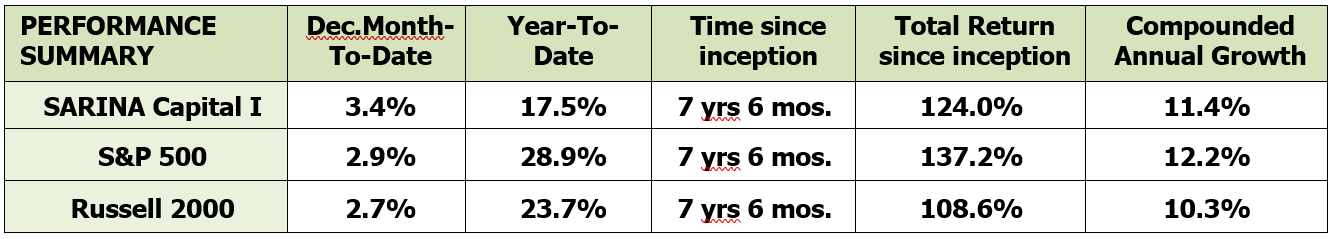

SARINA Capital Fund I was up 3.4% for the month of December 2019 compared to gains of 2.9% and 2.7% for the S&P 500 and Russell 2000, respectively. The stellar year for equities continued into December and in our view the tremendous returns provided by the markets were largely driven the expansion of Federal Reserve’s balance sheet rather than by the fundamentals. In the fourth quarter alone, the Fed’s balance sheet expanded by approximately $330 billion, which is the biggest pace of expansion since 2008. The fourth quarter expansion alone reversed almost half the reduction of the balance sheet the Fed had made through quantitative tightening. Given the election year, we expect the Fed to continue the balance sheet expansion and provide any support necessary to keep the markets up. As a result, any pull back in the markets is going to be aggressively monitored and bought into by the Fed and other investors.

Reflecting Back On The Year And Decade

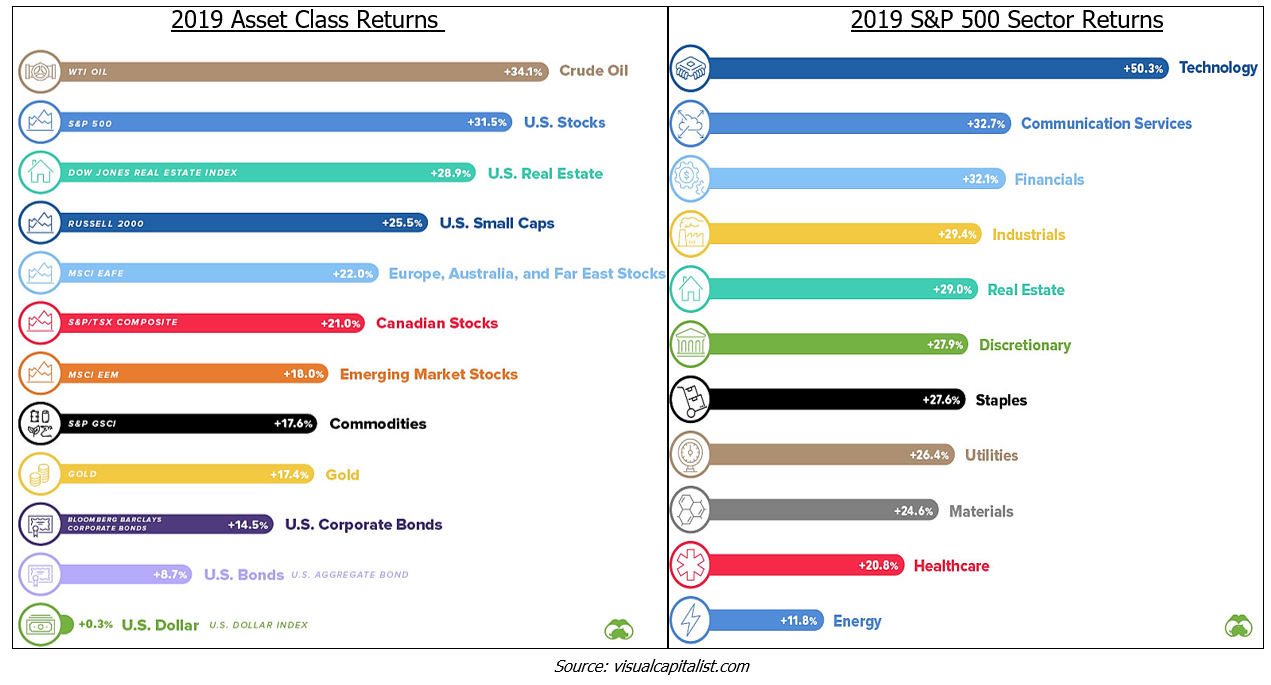

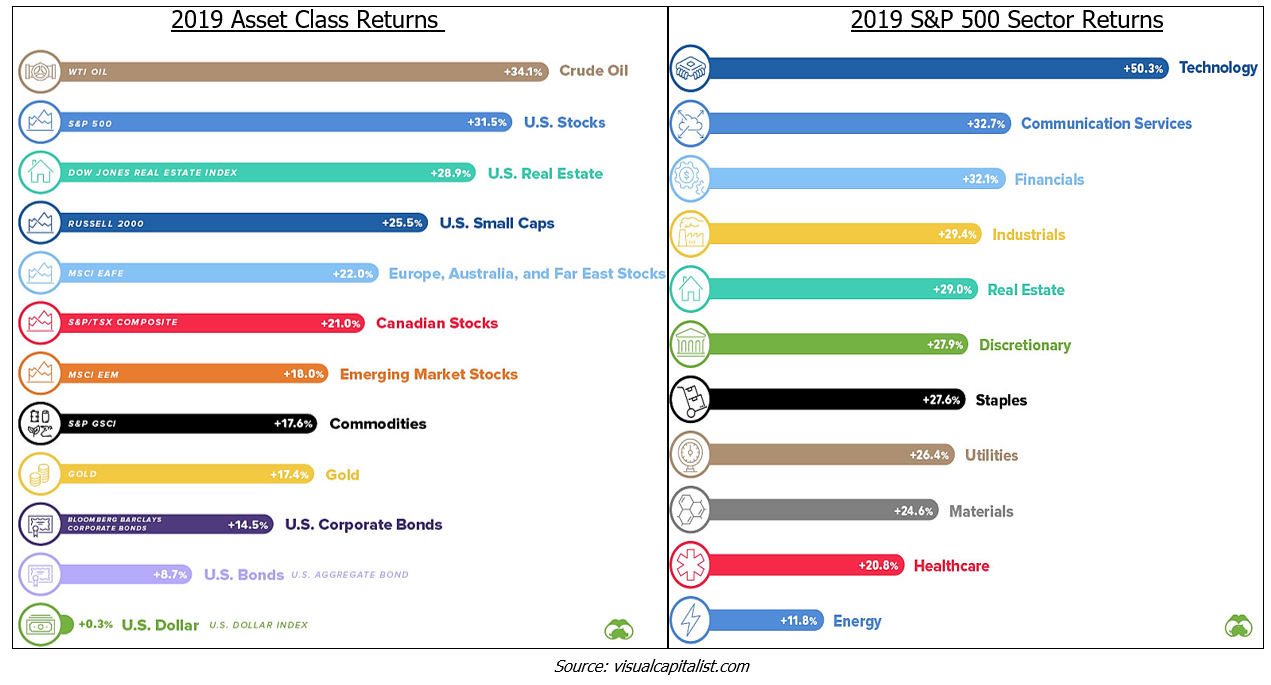

As we mentioned earlier, 2019 was indeed one for the history books as investors were able to ride a nice wave after seeing a disappointing end to 2018. After the sharp sell-off in November and December of 2018 and partially into January 2019, there was no looking back for investors in 2019. Below is summary of how all the major asset classes performed this year. Note: all indices below (i.e. S&P 500, Russell 2000, etc.) are using total returns, with dividends re-invested.

Despites the recent struggles, oil ended up being the top asset class of 2019 as it came off a very low base at the end of 2018 at around $50. After including the dividends, S&P 500 was up 31.5% and the returns were led in large part by Technology while the energy sector came in last with gains of only 11.8%.

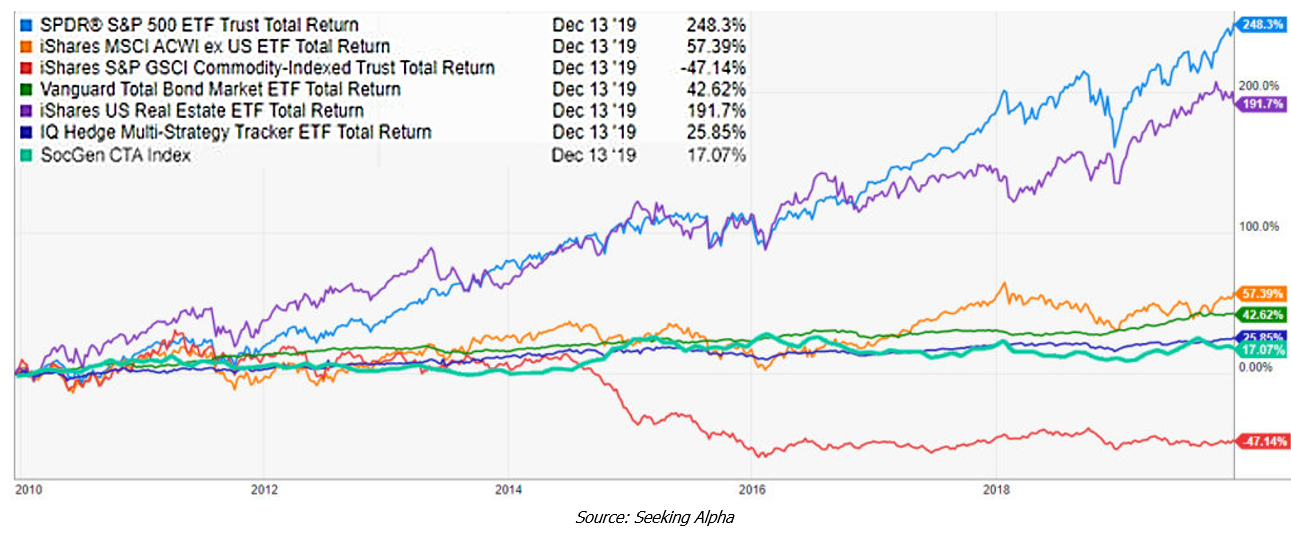

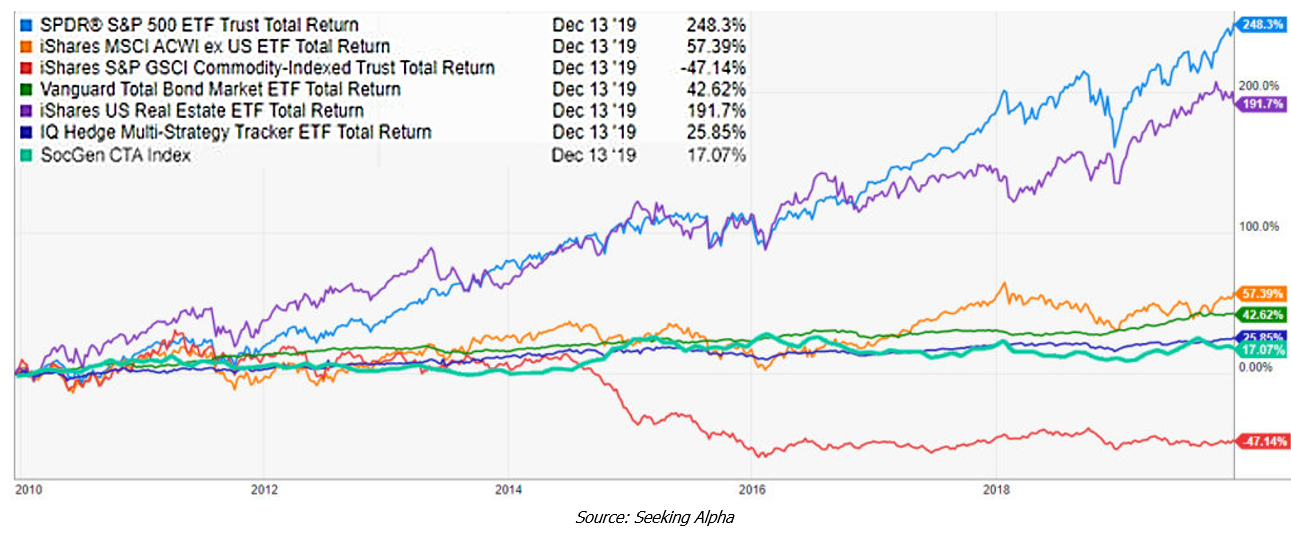

Over the past decade, investors have enjoyed solid returns across various asset classes, but the S&P 500 (up 248%) and real estate (up 192%) are the picks of the decade by a long shot. The large S&P 500 returns for the decades were driven mostly by FAANG stocks (Facebook, Amazon, Apple, Netflix and Google) as technology played a dominant role in the S&P 500 gains for the decade. As we further evaluate returns over the past decade, it is surprising to see strong returns by bonds (Vanguard total bond market ETF was up 43%) during a bull run. The expectation for bonds was not so rosy as the near-zero interest rate environment meant that interest rates were headed much higher which would drive bond prices down. Despite that expectation, bond markets continued to rally and we now have trillions of dollars parked in negative yielding debt!

The combination of a stellar decade for equities and a solid bond returns is highly unusual. Given the Fed’s efforts of pumping money into the markets while keeping interest rates low could potentially be dangerous for future returns. In our view, the Fed’s efforts could lead to returns that could be the drastically lower over the next decade for both the bond and equity markets. That said, investing in the S&P 500 (i.e. the top 500 companies in the U.S.) is always a strong and safe long-term bet.

SECURE Act – Changes To Retirement

Last month, the SECURE Act was signed into law as part of a $1.4 trillion spending package. The Setting Every Community Up for Retirement Enhancement (SECURE) Act represents the most sweeping set of changes to retirement in over a decade and there are some important aspects of this act that everyone know. A key change of the act is the elimination of what is referred to as “stretch IRA.” Prior to this act, non-spouse beneficiaries could stretch the IRA distributions over their lifetime, thus stretching the associated tax burden also. The new law generally requires any beneficiary who is more than 10 years younger than the account owner to liquidate the account within 10 years of the account owner’s death unless the beneficiary is a spouse, a disabled or chronically ill individual, or a minor child. The shorter maximum distribution period could result in unanticipated tax bills for the beneficiaries (including trusts) who are in line to inherit high-value traditional IRAs. The other key aspects of the SECURE Act include the following:

- The act makes it easier for employers to offer lifetime income annuities within retirement plans. The onus of fiduciary responsibility is now on the insurance companies that offer these products and not the employer (which was the case previously)

- Required minimum distribution age for traditional IRAs and retirement plans increased from 70½ years to 72 years. The 70½ age was set in 1960s and has been updated to reflect current life expectancy

- Small businesses can now pool together to offer retirements plans to their employees. This should allow small employers to offer affordable retirement benefits with the same features as larger employers

- Individuals who work beyond 70½ years can continue to contribute to their traditional IRAs

- 529 account assets can now be used to pay for student loan repayments ($10,000 lifetime maximum) and costs associated with registered apprenticeships

- Withdraw up to $5,000 penalty free to pay for birth or adoption (regular income taxes will still apply)

- Tax credit provided to employers who automatically enroll workers into their retirement plans

Individuals and employers need to be aware of these changes and should take full advantage of the benefits provided by the SECURE Act.

Happy investing!

Disclosure Statements:

- This letter is confidential and may not be redistributed without the express written consent of SARINA Capital, LP.

- The information presented does not involve the rendering of personalized investment, financial, legal or tax advice, but is limited to the dissemination of general information on products and services. Before implementing any of the options presented, a professional adviser should be consulted about the legal, tax and financial suitability of this type of investment. This presentation should not be viewed as an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein.

- Past performance is no guarantee of future results. No person should invest who is not, either alone or with their advisers, capable of evaluating the merits and risks of prospective investments. No representation is made that SARINA Capital, LP will or is likely to achieve its investment objectives or that any investor will or is likely to achieve results comparable to those shown or will make any profit at all or will be able to avoid incurring substantial losses.

- Specific companies or securities mentioned in this document are meant to demonstrate SARINA Capital’s investment style and the types of industries and instruments in which we invest and are not selected based on past performance. The analyses and conclusions of SARINA Capital contained in this document include certain statements, assumptions, estimates and projections that reflect various assumptions by SARINA Capital concerning anticipated results that are inherently subject to significant economic, competitive, and other uncertainties and contingencies and have been included solely for illustrative purposes. No representations express or implied, are made as to the accuracy or completeness of such statements, assumptions, estimates or projections or with respect to any other materials herein. SARINA Capital may buy, sell, cover or otherwise change the nature, form or amount of its investments, including any investments identified in this letter, without further notice and in SARINA Capital’s sole discretion and for any reason. SARINA Capital hereby disclaims any duty to update any information in this letter.

- Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of preparation and are subject to change.

- Certain information has been provided by third-party sources and, although believed to be reliable, it has not been independently verified and its accuracy or completeness cannot be guaranteed.

- © 2020 SARINA Associates, LLC, all rights reserved.