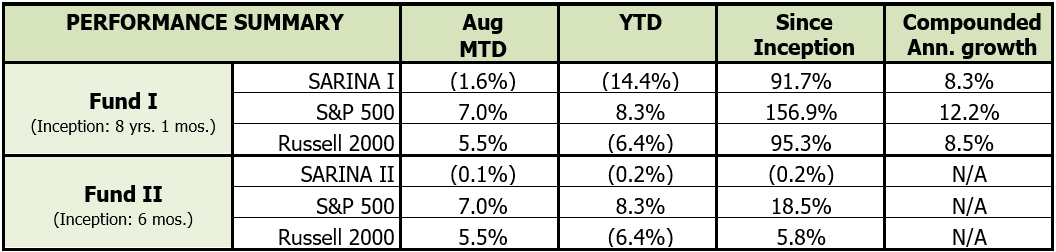

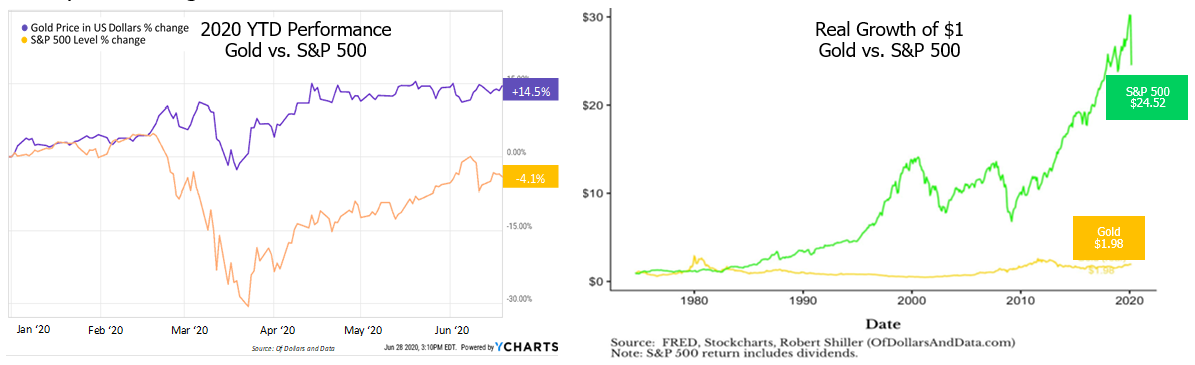

SARINA Capital’s Fund I was down 1.6% while Fund II was down 0.1% for the month of August. Though we continue to underperform the markets, the large declines in the few trading days of September give us further confidence that a cautious approach is required and absolutely appropriate. As of market close on September 8th, the S&P 500 is down 4.8% while the Russell 2000 index is down 3.7%, and we’ve only had 5 trading days this month!

Valuation vs. GDP

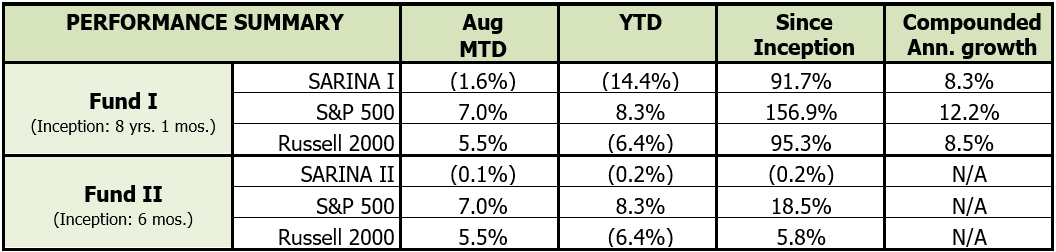

In last month’s newsletter, we discussed the cyclically adjusted price to earnings (CAPE) ratio, also known as Shiller P/E. We wanted to further expand the view of CAPE ratio to better understand where the current market valuation ranks relative to the GDP.

Valuation based on the CAPE ratio (left chart above) is currently at the 95th percentile while economic growth as measured by real GDP (right chart above) is only at the 4th percentile. This is based on a very generous assumption of only a 6% GDP decline in 2020. According to OECD (Organization for Economic Co-operation and Development), based on a single-hit scenario (i.e. we avoid a second wave) the U.S. GDP is expected to contract by 7.3% and in a double-hit scenario, which assumes a second wave and further lockdowns, GDP is expected to decline by 8.5%. Even in a simple reversion to mean scenario (i.e. we get to 50th percentile), valuations have to come down significantly. In the most simplistic approach, the reversion to mean occurs when either the numerator (price) decreases or the denominator (earnings) increases. Looking at the current economic conditions, it is difficult to see a scenario where earnings could see a strong surge (especially after coming out a very long bull run).

The current market valuation is a result of overoptimism (no second wave, vaccine will be ready sooner rather than later, economic output will return to pre-COVID level, etc.) and overconfidence (this investing thing is so easy…if I can use Tinder, I can use Robinhood!). This leads to a very dangerous combination of overestimation of return (“trend is your friend” attitude) and a significant underestimation of risk. Something has to give and in our opinion, it will be the equity prices!

Gold Rush!

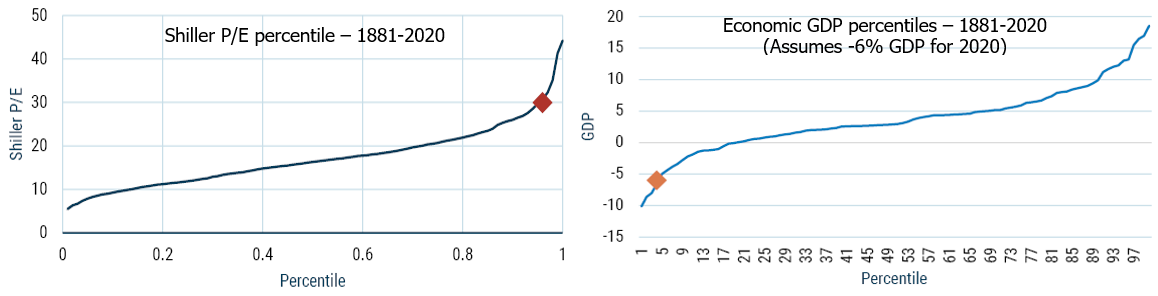

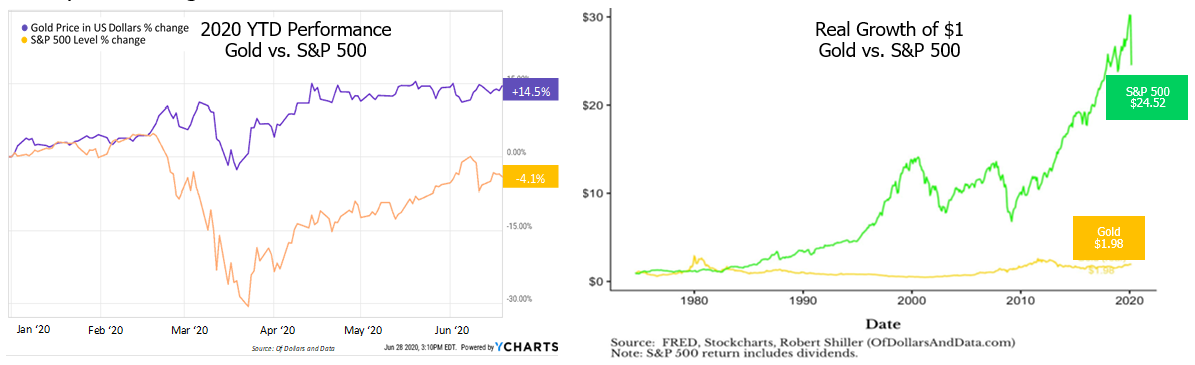

The U.S. abandoned the gold standard in 1973 and investors were allowed to own gold privately starting in August 1974. Since then, the price of gold has increased from $154 per ounce to around $1,900 today. More recently, Warren Buffett even put some exposure towards gold by investing in a gold miner – Barrick Gold (Ticker: GOLD). This after years of bashing gold as an investment choice due to weak long-term returns compared to the market. Additionally, given the market volatility and economic uncertainty, many other prominent investors are turning to gold as an investment option. Year-to-date, gold is up 14.5% while the S&P 500 is down 4.1%; however, long-term returns for gold pale in comparison to the S&P 500. After adjusting for inflation (i.e. real return), $1 invested in S&P 500 back in 1974 would have grown to $24.52 compared to a measly $1.98 for gold.

Looking at long-term performance of gold on a standalone basis, it is easy to write it off as an investment option, but the true value of gold is realized when it is used in a portfolio. Ritholtz Wealth Management evaluated portfolio returns to determine the impact of gold. They compared two portfolios with the following asset class distribution:

- Portfolio 1: 33% S&P 500 (SPY), 33% long-term U.S. bonds (TLT), 33% emerging market stocks (VWO)

- Portfolio 2: 25% S&P 500, 25% long-term U.S. bonds, 25% emerging market stocks, 25% gold (GLD)

The addition of gold would have resulted in higher total return for portfolio 2 (267%) vs. portfolio 1 (251%). Not only that, the portfolio risk, measured by standard deviation, is also lower for portfolio 2 (0.87%) compared to portfolio 1 (1.03%). The evidence clearly shows the benefit of including gold in your portfolio, both from a return and risk perspective.

Another attractive reason for investing in gold is due to the expectation of weakness in the dollar and inflation. Since late March, the U.S. dollar has fallen about 10% compared to a basket of foreign currencies. Part of the decline is driven by the spike in dollar in March as investors flocked to a safer currency. The decline is also due to the fact that the government continues to expand its balance sheet driven by quantitative easing (QE) infinity and stimulus funding. It is impossible to predict whether the decline in dollar will continue, but if it does, the implications to an investment portfolio could be large. When the dollar is up, gold, foreign markets, and emerging market stocks tend to perform poorly. However, in years of weakness in the dollar, foreign stocks have risen 85% of the time, gold is up 80% of the time and emerging markets have increased 65% of the time.

We have also acquired exposure to gold in our portfolio as we believe it is an excellent hedge to market volatility and potential inflation. Given the uncertain economic times and the lavish spending by U.S. government to support the markets and the economy, we believe gold will outperform the broader markets. The holding period will depend on the opportunity cost of holding gold for minimal returns versus identifying opportunities that would a better risk/reward. As we discussed earlier, current market valuations vis-à-vis economic conditions do not look attractive to us and therefore we like gold in our portfolio as a hedge not only against market volatility but also inflation.

Happy investing!

Disclosure Statements:

- This letter is confidential and may not be redistributed without the express written consent of SARINA Capital, LP.

- The information presented does not involve the rendering of personalized investment, financial, legal or tax advice, but is limited to the dissemination of general information on products and services. Before implementing any of the options presented, a professional adviser should be consulted about the legal, tax and financial suitability of this type of investment. This presentation should not be viewed as an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein.

- Past performance is no guarantee of future results. No person should invest who is not, either alone or with their advisers, capable of evaluating the merits and risks of prospective investments. No representation is made that SARINA Capital, LP will or is likely to achieve its investment objectives or that any investor will or is likely to achieve results comparable to those shown or will make any profit at all or will be able to avoid incurring substantial losses.

- Specific companies or securities mentioned in this document are meant to demonstrate SARINA Capital’s investment style and the types of industries and instruments in which we invest and are not selected based on past performance. The analyses and conclusions of SARINA Capital contained in this document include certain statements, assumptions, estimates and projections that reflect various assumptions by SARINA Capital concerning anticipated results that are inherently subject to significant economic, competitive, and other uncertainties and contingencies and have been included solely for illustrative purposes. No representations express or implied, are made as to the accuracy or completeness of such statements, assumptions, estimates or projections or with respect to any other materials herein. SARINA Capital may buy, sell, cover or otherwise change the nature, form or amount of its investments, including any investments identified in this letter, without further notice and in SARINA Capital’s sole discretion and for any reason. SARINA Capital hereby disclaims any duty to update any information in this letter.

- Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of preparation and are subject to change.

- Certain information has been provided by third-party sources and, although believed to be reliable, it has not been independently verified and its accuracy or completeness cannot be guaranteed.

- © 2020 SARINA Associates, LLC, all rights reserved.