Unintended Consequences

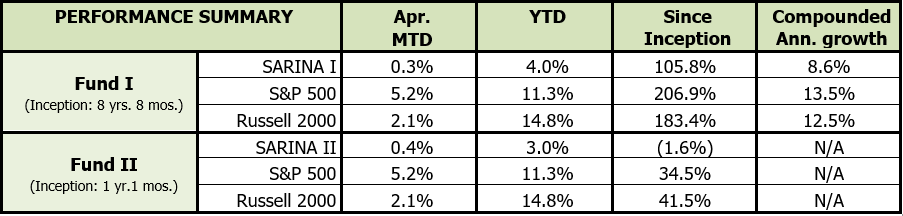

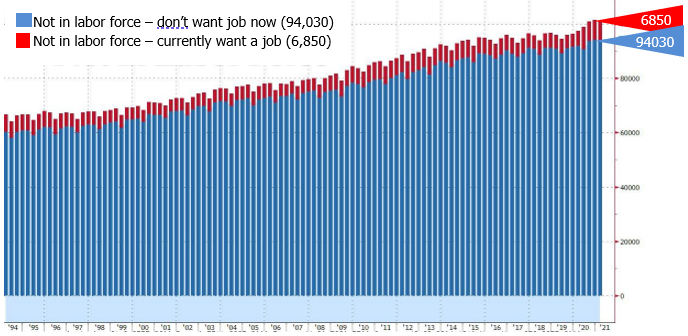

Something rather strange is occurring in the U.S. labor markets – despite the high unemployment rate, business owners are complaining that they are not able to hire to fill their open positions. In the aftermath of the pandemic, Bureau of Labor Statistics (BLS) data shows that there are over 100 million Americans who are out of the labor force; however, of that number merely 6.9 million are looking for a job and the remaining record 94 million are not actively seeking employment!

As the pandemic hit, the U.S. unemployment rate jumped to 14.8% and it has slowly come down to around 6% currently. Many economists are forecasting the unemployment to drop to 5% by second quarter of 2022. Despite the strong recovery, the economy remains well off the pre-pandemic unemployment rate of 3.5%. Of the 94 million who are not seeking jobs, many individuals are stuck in scenarios do not allow them to return to the workforce – this includes parents of children who are remote, those who have vulnerable health conditions, and others who genuinely have been shaken by the virus and are afraid. However, apart from this group there are individuals who are also enjoying the stimulus money and would rather live off the trillions the government is providing in free money.

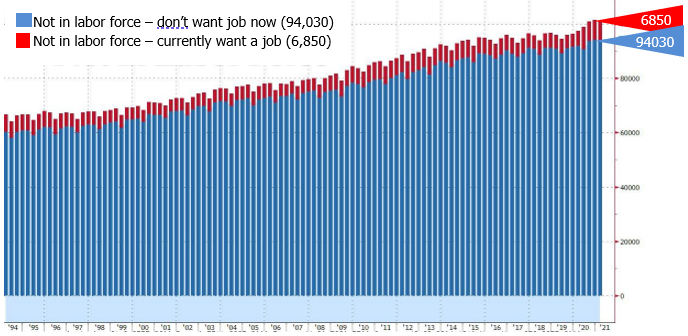

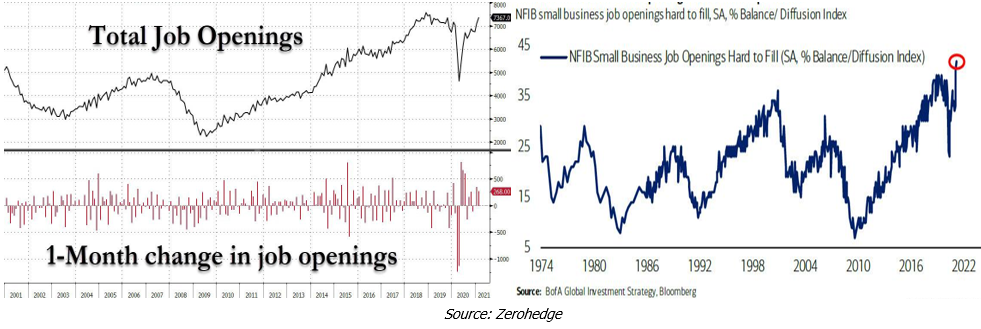

One of the biggest unintended consequences of the stimulus money is that it is incentivizing potential job seekers not to seek gainful employment! There are many anecdotal stories about small business employers who are looking to bring their employees back but the employees are refusing to come back to work. This has caused the total job openings number to spike and has led to a huge labor shortage.

According to a March 2022 survey of small business owners, a record-high 42% of them said that they had jobs openings they were unable to fill, this compares an average of only 22% since 1974. And even more stunning stat coming out of the survey was that 91% of respondents said they had few or no qualified applicants for job openings in the past three months. The labor shortage has also led to higher voluntary departures – in March the number of people quitting jobs hit 2.3% of overall employment in January, just a tenth of a percentage point below the record going back to 2001!

Another unintended consequence of the stimulus money is that this is perhaps quickly becoming an under-the-radar experiment on Universal Basic Income (UBI). Recall, Andrew Yang, an early democrat candidate for the Presidential race, originally proposed providing $1,000 to every American adult and he was quickly met with cries that his strategy would move U.S. towards socialism. UBI has worked well some parts of the world as it provides much needed financial support to those who are mired in ultra-poverty. There will always be individuals who abuse the system but if administered correctly UBI can be a powerful tool to pull people out of poverty. We are in the early stages of our experiment and only time will tell if the unintentional UBI experiment will be successful. Until then, labor shortages may persist in the short run and it will most likely lead to higher wages and thus higher expenses for businesses. This will in turn push prices higher further adding to inflation concerns!

Stock ownership

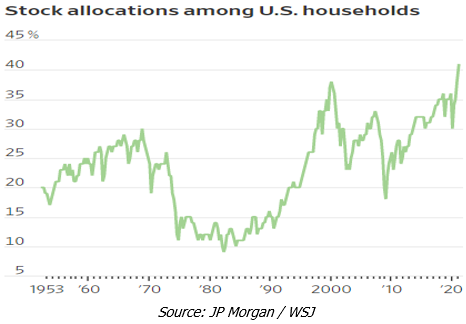

Given the strong recovery, excess liquidity and ease of trading, stock ownership is at an all-time high of 41% of total financial assets. The exuberance towards stock ownership is further solidified by the fact that the markets keep hitting new highs while market volatility edges lower. Furthermore, the prospect of the economy fully opening combined with better than expected earnings is adding more fuel to a stock market that is already on fire.

Given the low interest rate environment, investment alternatives have essentially become limited to stock and digital currencies. Investors are not only using their excess liquidity, but they are also using leverage through margin to buy more stocks! The use of leverage through margin is contributing to the rise as margin debt, which is also at a record level! So long as the Fed maintains its accommodative stance towards the markets, the downside risk will always be protected for investors. This understanding is providing a boost of confidence to investors as they know their floor is protected by Uncle Sam!

Happy investing!

Disclosure Statements:

- This letter is confidential and may not be redistributed without the express written consent of SARINA Capital, LP.

- The information presented does not involve the rendering of personalized investment, financial, legal or tax advice, but is limited to the dissemination of general information on products and services. Before implementing any of the options presented, a professional adviser should be consulted about the legal, tax and financial suitability of this type of investment. This presentation should not be viewed as an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein.

- Past performance is no guarantee of future results. No person should invest who is not, either alone or with their advisers, capable of evaluating the merits and risks of prospective investments. No representation is made that SARINA Capital, LP will or is likely to achieve its investment objectives or that any investor will or is likely to achieve results comparable to those shown or will make any profit at all or will be able to avoid incurring substantial losses.

- Specific companies or securities mentioned in this document are meant to demonstrate SARINA Capital’s investment style and the types of industries and instruments in which we invest and are not selected based on past performance. The analyses and conclusions of SARINA Capital contained in this document include certain statements, assumptions, estimates and projections that reflect various assumptions by SARINA Capital concerning anticipated results that are inherently subject to significant economic, competitive, and other uncertainties and contingencies and have been included solely for illustrative purposes. No representations express or implied, are made as to the accuracy or completeness of such statements, assumptions, estimates or projections or with respect to any other materials herein. SARINA Capital may buy, sell, cover or otherwise change the nature, form or amount of its investments, including any investments identified in this letter, without further notice and in SARINA Capital’s sole discretion and for any reason. SARINA Capital hereby disclaims any duty to update any information in this letter.

- Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of preparation and are subject to change.

- Certain information has been provided by third-party sources and, although believed to be reliable, it has not been independently verified and its accuracy or completeness cannot be guaranteed.

- © 2021 SARINA Associates, LLC, all rights reserved.