We hope you were able to weather equity market free fall in March and are enjoying recovery. Coming out of the quickest correction ever in history, markets have made a very nice come back in April. However, we believe this bear market bounce is largely driven by QE funds rather than fundamentals. Furthermore, once the stimulus money runs out and as small businesses run out of PPP funding (theoretically 2.5 months of payroll based on the formula used to determine loan amount), the real impact of the current pandemic will become visible and we will get an idea of what the new normal looks like! According to many experts, outlook for the new normal is pretty scary, with some predicting the worst recession since the Great Depression!

Buffett’s words vs. actions

Warren Buffett held is annual shareholder meeting under unusual circumstances this year given the pandemic. The key takeaway for us was that the messages through his words versus his actions were starkly different. His long diatribe into the history of America was indeed a great history lesson and the key message in that was never bet against America! Buffett reiterated that message numerous times during the four-hour long meeting. We would certainly agree with that message, but the time horizon must also be factored into the equation.

“Never bet against America” is most definitely a long-term view that Buffett has held for many years now. However, when you look at Buffett’s actions, his short-term outlook is not so optimistic. Below are details that support our view:

- First and foremost, the amount of cash on Berkshire’s balance sheet (> $130 billion) that he is hoarding and his refusal to deploy that cash during the March dip is a sign that he either did not think valuations were attractive enough (despite 34% drop in S&P 500) or that he expects things to get worse. Either of these scenarios do not bode well for equities in the short-term.

- Berkshire A shares peaked at $344,900 in January of this year and dropped down to $240,000 per share in late March. Despite significant amount of cash, Buffett did not repurchase those shares and his explanation for his lack of action spoke volumes. He said, “including the option value of money,” Berkshire A shares were not more compelling at $240,000 versus $344,900! Essentially, he is saying that the value of cash has skyrocketed and despite a 30% drop in value of Berkshire’s shares, the value of cash is still more appealing to him.

- Lastly, Buffett sold out of all his airline holdings to the tune of $4 billion. Keep in mind he added to his Delta position in late February, bringing his ownership stake in the company to 11%! He also sold an additional $6 billion in equities (approximately 3% of his equity portfolio) in April even as the markets were rallying.

These actions in our view speak volumes from Buffett’s perspective about where the market is headed and we are also in alignment with that view. Hence, we are also in the same boat as Buffett where we want to keep cash on hand for potential weakness that may be on the horizon.

Bear Market Bounce History

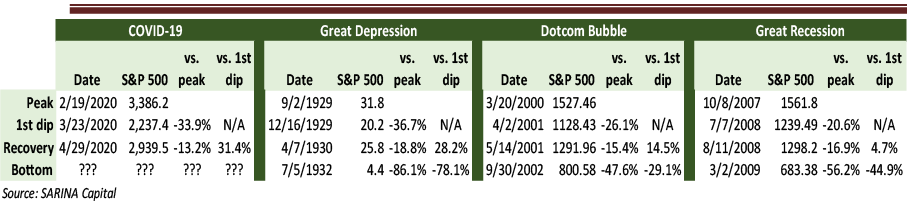

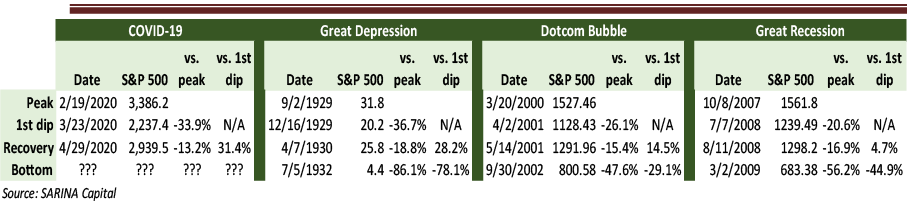

The month of April has seen quiet a remarkable turnaround for equities and those who were predicting a “V” shaped recovery have been right so far! But many are also thinking that this is simply bear market bounce and the real impact of COVID-19 has yet to be felt. We went back and compared the current bear market bounce to three other instances – the Great Depression, dotcom bubble, and Great Recession.

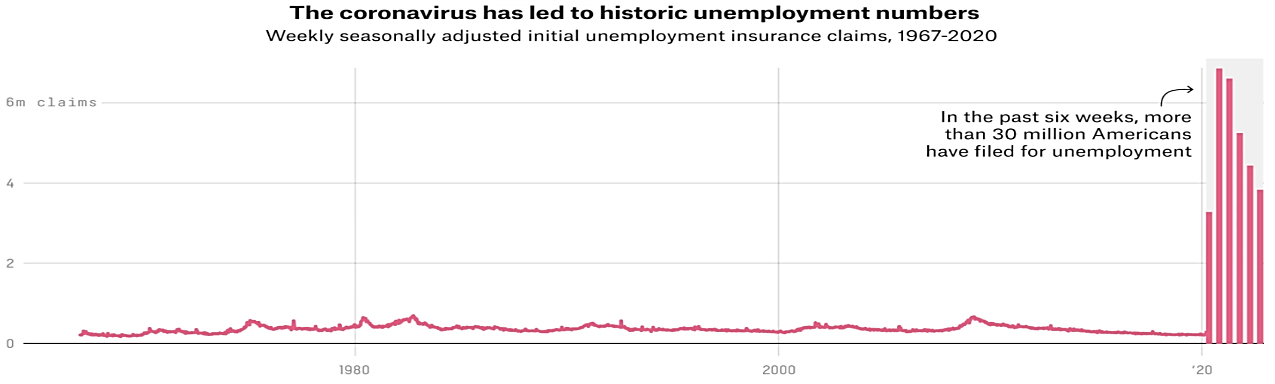

After the initial dip of 34% during the current pandemic, markets are up more than 30% from the bottom. During the Great Depression and Dotcom bubble, markets bounced up 28% and 15%, respectively, from the first dip. The only instance where markets did not see a significant bear market bounce was during the Great Recession. The scary part though is what comes after the brief recovery and in all three instances we have referenced above, markets took a significant dive! From its peak S&P 500 fell 86%, 56%, and 48% during Great Depression, Great Recession and dotcom bubble downturns, respectively. In the current situation, we have seen a decline of 34% and given the anticipated adverse impact to the economy, it is not too far-fetched to believe that there is more to come. Speaking of economic impact, most of you may have seen the unemployment charts and how wacky they look relative to historical levels.

As of the week ending April 24th, more than 30 million American have filed for unemployment, although the good news is that we have seen 4 consecutive weeks of decline in seasonally adjusted initial claims number. Since 1967, the initial unemployment claim number had never touched 1 million prior to COVID-19 and now almost 19% of the total U.S. labor force has filed an initial unemployment claim.

Though these numbers seem staggering at first, you must exercise caution in reading too much into it. Keep in mind that many who have filed for unemployment were furloughed – i.e. people who are currently out of work and can thus file for unemployment but can return to work once things start to reopen. During this furlough period, the government is providing $600 weekly to those who have filed for unemployment and has distributed $1,200 checks to each taxpayer as part of the CARES Act. This should help sustain those who were furloughed.

As many states start to reopen, the unemployment claims number should continue to come down. A recent survey conducted by California Policy Lab found that 90% of those who filed for unemployment in early April in California are expected to go back to work once things reopen. However, unemployment number will probably continue to remain stubbornly high as many employees may not be able to go back to 100% of the hours they used to work and thus will continue to file for partial unemployment.

Another metric that can help us better understand the severity of this crisis is continued claims, which reports the number of people receiving unemployment benefits in any given week. This figure lags a week behind initial claims but it can provide a faster-moving measure of where the crisis might be headed than the typical unemployment rate number which is released only monthly. The decline in continued claims is strongly correlated with the end of recessions and it will be of keen importance to observe how this number changes as many of states try to restart their economic engines.

The unknown though is if and how companies will survive this crisis – J. Crew has already filed for bankruptcy and Norwegian announced going concern worries! We believe it is the residual impact of COVID-19 to businesses that has Buffett concerned. In the current environment, the downside risk is twice (if not more) the upside and with that assessment of risk, we (along with Buffett) are happy to hoard our cash! Happy investing!

Disclosure Statements:

- This letter is confidential and may not be redistributed without the express written consent of SARINA Capital, LP.

- The information presented does not involve the rendering of personalized investment, financial, legal or tax advice, but is limited to the dissemination of general information on products and services. Before implementing any of the options presented, a professional adviser should be consulted about the legal, tax and financial suitability of this type of investment. This presentation should not be viewed as an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein.

- Past performance is no guarantee of future results. No person should invest who is not, either alone or with their advisers, capable of evaluating the merits and risks of prospective investments. No representation is made that SARINA Capital, LP will or is likely to achieve its investment objectives or that any investor will or is likely to achieve results comparable to those shown or will make any profit at all or will be able to avoid incurring substantial losses.

- Specific companies or securities mentioned in this document are meant to demonstrate SARINA Capital’s investment style and the types of industries and instruments in which we invest and are not selected based on past performance. The analyses and conclusions of SARINA Capital contained in this document include certain statements, assumptions, estimates and projections that reflect various assumptions by SARINA Capital concerning anticipated results that are inherently subject to significant economic, competitive, and other uncertainties and contingencies and have been included solely for illustrative purposes. No representations express or implied, are made as to the accuracy or completeness of such statements, assumptions, estimates or projections or with respect to any other materials herein. SARINA Capital may buy, sell, cover or otherwise change the nature, form or amount of its investments, including any investments identified in this letter, without further notice and in SARINA Capital’s sole discretion and for any reason. SARINA Capital hereby disclaims any duty to update any information in this letter.

- Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of preparation and are subject to change.

- Certain information has been provided by third-party sources and, although believed to be reliable, it has not been independently verified and its accuracy or completeness cannot be guaranteed.

- © 2020 SARINA Associates, LLC, all rights reserved.