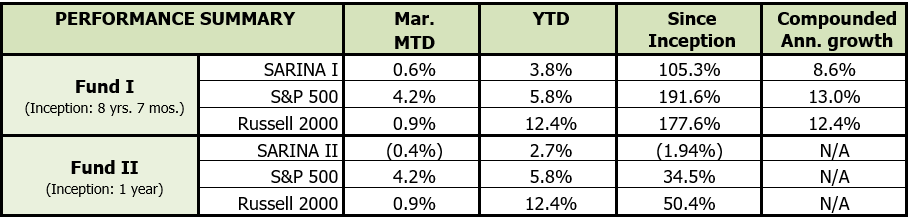

Strong Economic Recovery

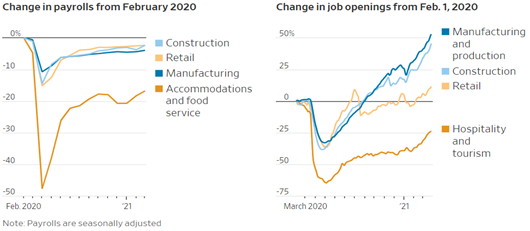

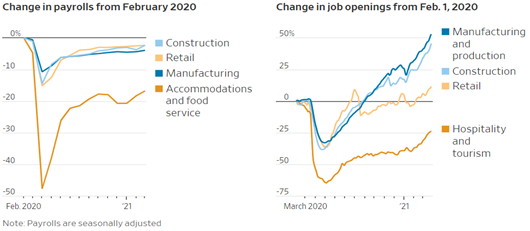

U.S. employers added a seasonally adjusted 916,000 jobs in March, far ahead of the Dow Jones estimate of 675,000. This is the best job gains since August, leading to a pandemic-low unemployment rate of 6.0%.

As states lift restrictions and vaccine rollout remains ahead of schedule, consumers are gaining more confidence and their fears are subsiding. Industries that suffered the greatest losses led the job recovery last month. Restaurants and bars added 176,000 jobs, arts, entertainment and recreation added 64,000 jobs, and accommodations added 40,000 jobs. Despite these gains, employment in the leisure and hospitality sector is down by about 3 million (18.5%) from February 2020.

Consumer booking data around restaurant, hotels and airlines is also up as some of the pent-up demand is now materializing. Though the economy has not returned to pre-COVID levels, vaccines have given hopes of returning to ‘normal’ at a faster than expected pace and the jobs data reflects it

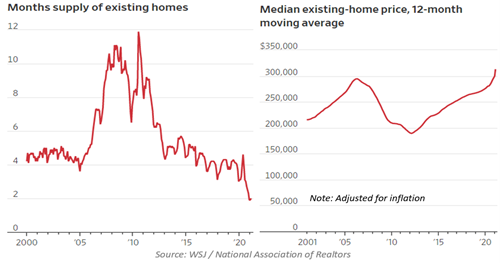

Housing Boom…Again

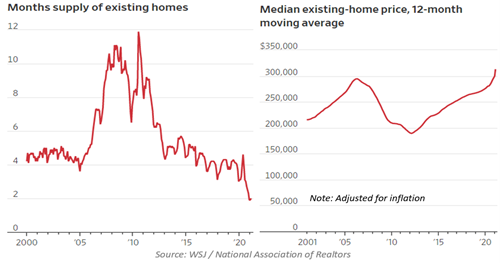

Home prices have been on the rise at an extremely rapid pace over the past few months and there are no signs of it slowing down anytime soon. The National Association of Realtors (NAR) reported that February year-over-year price increase was a whopping 15.8% to $313,000 – the biggest annual increase since 1991. The recent boom has been driven by the following factors:

- Low interest rates

- Decreasing supply of existing homes

- Increased demand from pension funds / private equity

- Increased demand from permanent stay-at-home work force

Low Interest Rates

At the onset of the pandemic, the Fed clearly signaled their “lower for longer” intent as it relates to their strategy on interest rate. The lower Fed interest rates also drove mortgage rates to historical lows – the 30-year fixed mortgage rate dropped as low as 2.65% back in early January 2021. However, as expectations of economic recovery continue to strengthen, the 10-year US Treasury yield and along with it the mortgage rates have started to rise. The 30-year fixed mortgage rate now stands at approximately 3.2% and though it has recently increased, it remains very low compared to historical standards. The rising mortgage rates are adding more fuel to the hot housing markets as house hunters are feeling the urge to act quickly to lock in the lower rates.

Decreasing Supply

As the pandemic hit, many homeowners decided to put off selling their existing home. In person home viewing was no longer an option and this led to potential sellers staying put due to not having an option on the other side. The fear for existing homeowners has now shifted to affordability as current owners fear that they may not be able to compete for a new home in the current market. Recall, new home construction essentially came to a standstill following the Great Recession and remained low in the subsequent years. The aging baby boomer population is also opting to stay in their current homes rather than downsizing as they opt for a better quality of life. These factors have led to existing homeowners staying put, which of course has led to a continuous decrease in the supply of homes that are on the market. According to Realtor.com, the number of homes for sales in March was approximately half of what it was a year ago. In some of the hot markets, the number of new homes for sale in March was a whopping 70% lower than a year ago!

Increased Demand

Individual home buyers are now facing stiff competition in their search for new homes from institutional buyers. Pension funds and private equity buyers in search of yield are competing for single family homes across the U.S. creating demand that has not been seen before. John Burns Real Estate Consulting firm estimates that investors have accounted for 24% of all recent home purchases in Houston. We have all heard of anecdotal stories about the number of cash offers homeowners are receiving on their listing at or far above their asking price. John Burns estimates that though the real estate bubble is growing at a fast pace, the firm expects average home prices to continue to rise by double digits this year on top of the 11% rise in 2020 and by high single digit in 2022. Individual buyers are rushing to lock in historically low interest rates that have started to increase the economic recovery picks up steam. Additionally, millions of millennials are entering their 30s, which is a typical age for home buying, and these millennials are moving out of densely populated cities in favor of suburban homes. These millennials who were able to transition from office to work-from-home jobs also have excess liquidity as the impact of job losses during the pandemic was felt far less in the white-collar sector.

The housing price appreciation this time is different than what we saw in early 2000. The boom prior to the Great Recession was driven by speculative individuals combined with laxed lending standards and the crash that followed wiped out nearly $11 trillion in household wealth and nearly caused the financial system in the U.S. to collapse. This time lending standards have not been relaxed and the price appreciation is driven by supply demand dynamics, lower interest rate, and pent-up cash supply.

These factors have created a perfect storm that have led to skyrocketing home prices, especially in hot markets like Austin, Houston, Miami, Phoenix, and Las Vegas. Unfortunately though this is also contributing to a widening inequality gap as affordability of homes for the lower income strata continues to slip out of their reach. The formula to slow the astronomical rise is: increasing interest rates, new construction, and higher inventory of existing homes as we come out of the pandemic. These factors tend to be slow to move, so the boom may continue in the near future – enjoy the ride!

Happy investing!

Disclosure Statements:

- This letter is confidential and may not be redistributed without the express written consent of SARINA Capital, LP.

- The information presented does not involve the rendering of personalized investment, financial, legal or tax advice, but is limited to the dissemination of general information on products and services. Before implementing any of the options presented, a professional adviser should be consulted about the legal, tax and financial suitability of this type of investment. This presentation should not be viewed as an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein.

- Past performance is no guarantee of future results. No person should invest who is not, either alone or with their advisers, capable of evaluating the merits and risks of prospective investments. No representation is made that SARINA Capital, LP will or is likely to achieve its investment objectives or that any investor will or is likely to achieve results comparable to those shown or will make any profit at all or will be able to avoid incurring substantial losses.

- Specific companies or securities mentioned in this document are meant to demonstrate SARINA Capital’s investment style and the types of industries and instruments in which we invest and are not selected based on past performance. The analyses and conclusions of SARINA Capital contained in this document include certain statements, assumptions, estimates and projections that reflect various assumptions by SARINA Capital concerning anticipated results that are inherently subject to significant economic, competitive, and other uncertainties and contingencies and have been included solely for illustrative purposes. No representations express or implied, are made as to the accuracy or completeness of such statements, assumptions, estimates or projections or with respect to any other materials herein. SARINA Capital may buy, sell, cover or otherwise change the nature, form or amount of its investments, including any investments identified in this letter, without further notice and in SARINA Capital’s sole discretion and for any reason. SARINA Capital hereby disclaims any duty to update any information in this letter.

- Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of preparation and are subject to change.

- Certain information has been provided by third-party sources and, although believed to be reliable, it has not been independently verified and its accuracy or completeness cannot be guaranteed.

- © 2021 SARINA Associates, LLC, all rights reserved.