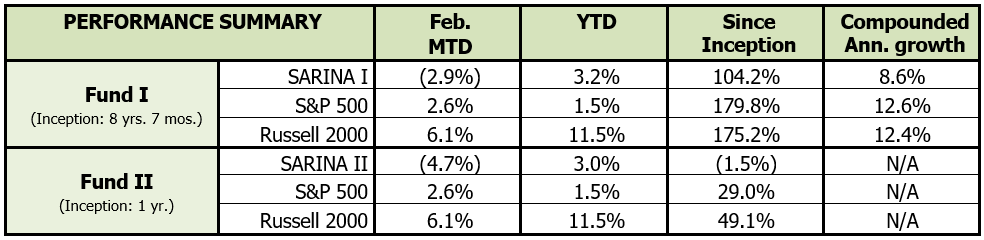

For the month of February, SARINA Capital fund I and II were down 2.9% and 4.7%, respectively compared to a gains of 2.6% and 6.1% in S&P 500 and Russell 2000 index. Since we have taken a contrarian view of the markets, we expected our performance to be weaker in February as markets continued to rise to new highs. We (and many other prominent investors) continue to believe that the markets are overvalued and the bubble needs to deflate and come back down to earth. If the market movement in the first week of March is any indication, the bubble may deflate sooner than we expected!

Inflation Risk

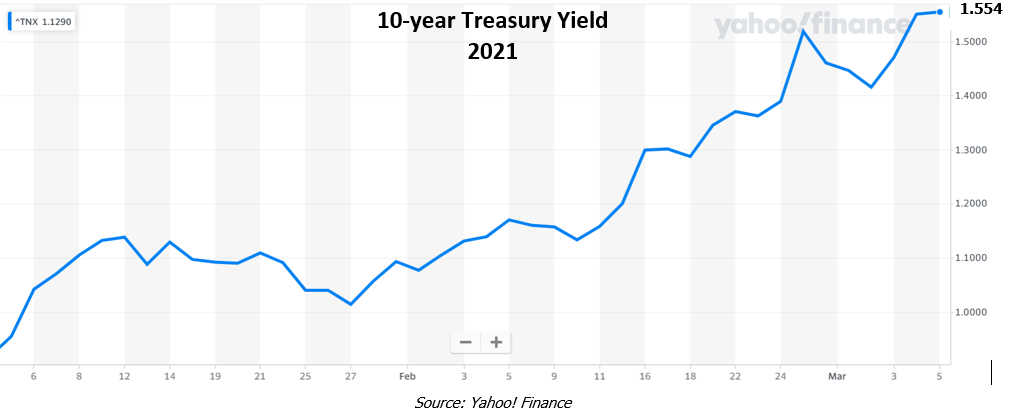

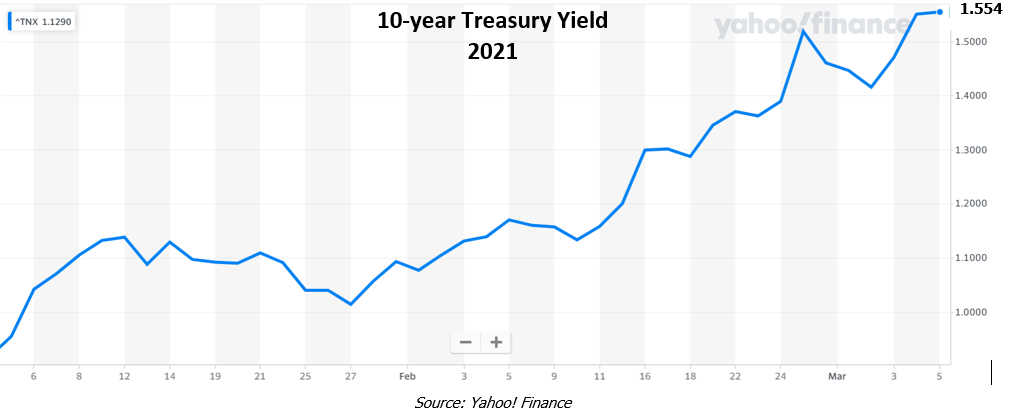

The recent volatility in stocks has largely been driven by inflation fears. Investors are keenly eyeing what is happening to the 10-year treasury yield and what the jump in yield means for inflation. The 10-year Treasury yield unexpectedly spiked to pre-pandemic levels, jumping from approximately 0.9% to around 1.6% (highest since February 2020) in a matter of only 3 months!

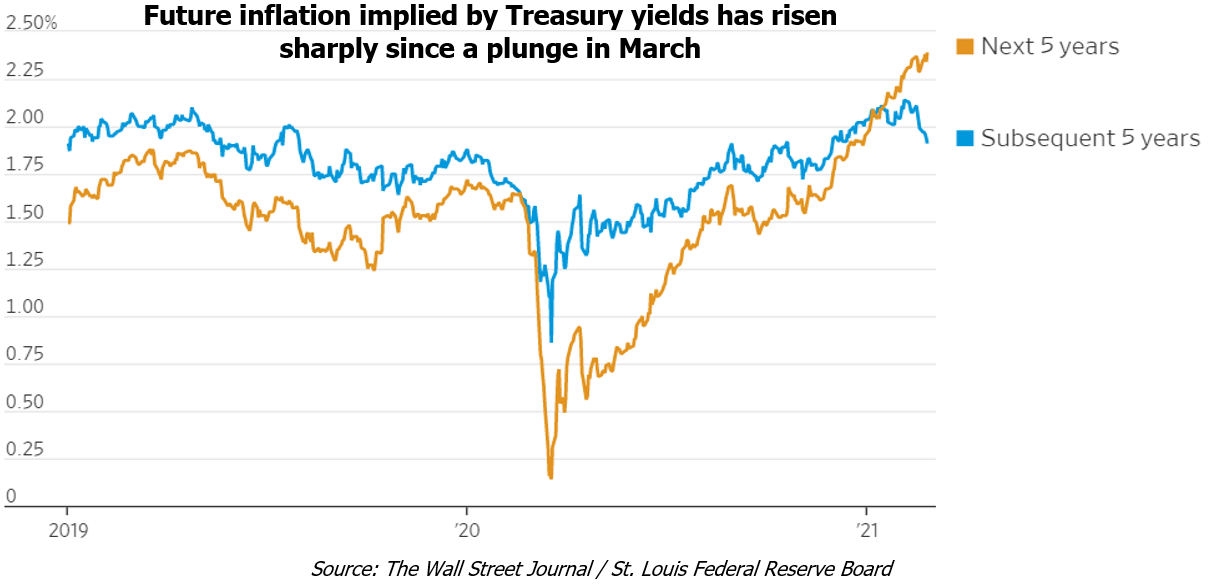

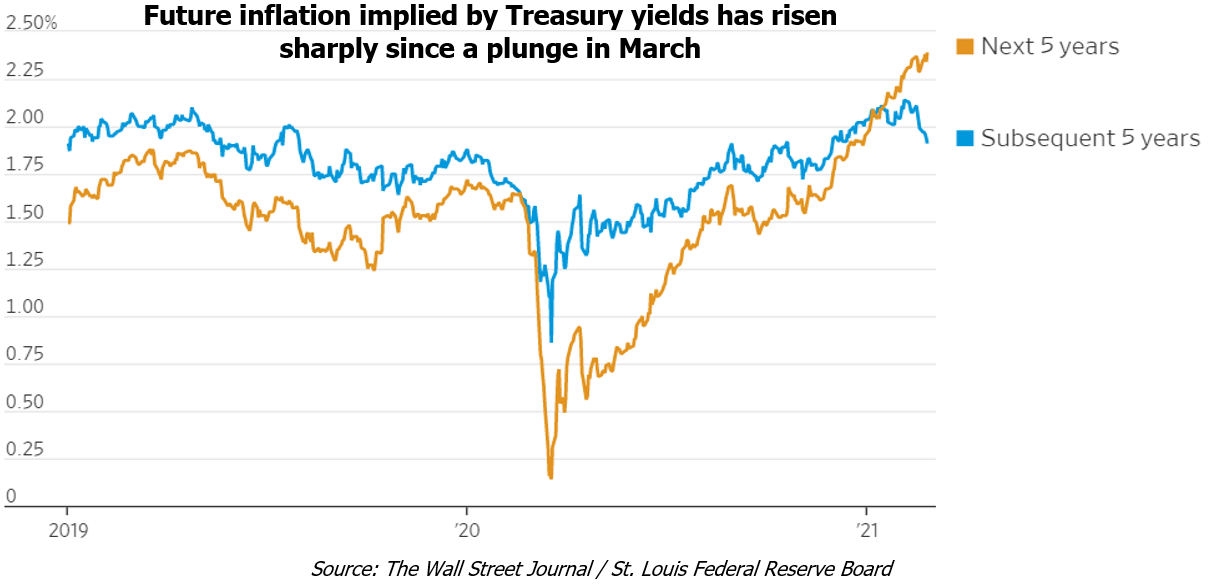

The unexpected price jump caused Fed governor Lael Brainard to comment: “I am paying close attention to market developments. Some of those moves last week, and the speed of the moves, caught my eye.” The reason for this comment is the direct linkage between the Treasury yields and inflation. The Fed has set a 2% inflation target but factors that contribute to inflation can be debated ad nauseum by economists and other experts. The Fed is now saying that they would prefer to overshoot their 2% inflation target to stave off any possibilities of deflation or stagflation that have taken haunted advanced economies for decades. Given the recent rise in yield, inflation is expected to be well above 2% over the next 5 years:

Though the rate of increase in the yield is indeed concerning, the bigger disconnect is around the current economic conditions and Fed’s accommodative stance, especially around keeping interest rates low. The Fed closely tracks employment number and the current unemployment rate of 6.2% is well above the “natural” rate of 4.1% that the Fed targets. Therefore, inflation concerns were not expected to arise until the economic was closer to full employment. Adding fuel the the inflation fire is also the most recently passed $1.9 trillion stimulus package, which will push purchasing power of the consumers even higher.

The pandemic has made measuring inflation a bit complicated as the shut down last spring caused prices for gasoline, hotel, airfares, etc. to plummet. Inflation is measured as a 12-month change in consumer price index. Despite the economy being in a recovery mode, inflation is expected to be 2.75% in the second quarter (given the low base of last spring) but then drop again as the low pandemic prices drop out of the calculations. Core inflation, which excludes the volatile food and energy components, is expected to fall 1.2% because rent – the biggest component of core inflation – is being pushed down by unemployment and moratoriums. However, with the recent rise in yields and better than expected job market, economists are rushing to revise their year-end inflation targets.

What Rising Treasury Yield Means For Stocks?

The rising 10-year Treasury yield and the strong February jobs data means that the economy is recovering better than expected. In the current highly valued market conditions, bad economic news is of course bad for the markets, but good economic news is also considered bad news for the markets. Here is the thought process:

- Strong jobs data >> economic recovery better than expected >> inflation could be rampant, Fed will start tapering and raise interest rates faster than expected à sell equities.

- Weak jobs data >> economic recovery weaker than expected >> current earnings and valuations cannot be supported à sell equities.

Rising yields and improving job market may force the Fed’s hand in raising rates much earlier than expected. Furthermore, inflation fears could also lead the Treasury to taper their bond buying and we saw the impact of that in the first week of March through the resurgence of “taper tantrum” that investors showed towards the equity markets.

Rising treasury yields also means that investors will have options when making investment decisions. Equity prices for the past year have continued to increase because of large inflows that have come in due to lack of alternatives in the Treasury and bond markets. However, as Treasury yields rise investors will consider the risk-free alternative.

Bond traders have gone all-in on the potential of Treasury yields continuing to rise and as a result have made large short bets in the $21 trillion Treasuries market. Remember bond/Treasury yields and their prices are inversely related so as the yields continue to rise, treasuries and bond prices will continue to fall. The combination of fiscal stimulus, ultra-easy monetary policy and an accelerated vaccine rollout are bringing post-pandemic reality much closer.

In our view inflation and rising yield are not always bad news – they are signs of strong economic recovery. Investors are simply getting spooked because this recovery was not expected much later in the cycle and stocks now face the daunting reality of withdrawal of easy money via tapering and rising interest rates which will impact company bottom lines negatively via higher interest expense. In the process, astronomical valuations could come back down to earth and we could see a correction which could deflate this bubble. Once the dust has settled though, the strong companies with good balance sheet strength will continue to prosper as the economy performs well and things return to ‘normal.’ March is shaping up to be a roller coaster month, fasten your belts and enjoy the ride!

Happy investing!

Disclosure Statements:

- This letter is confidential and may not be redistributed without the express written consent of SARINA Capital, LP.

- The information presented does not involve the rendering of personalized investment, financial, legal or tax advice, but is limited to the dissemination of general information on products and services. Before implementing any of the options presented, a professional adviser should be consulted about the legal, tax and financial suitability of this type of investment. This presentation should not be viewed as an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein.

- Past performance is no guarantee of future results. No person should invest who is not, either alone or with their advisers, capable of evaluating the merits and risks of prospective investments. No representation is made that SARINA Capital, LP will or is likely to achieve its investment objectives or that any investor will or is likely to achieve results comparable to those shown or will make any profit at all or will be able to avoid incurring substantial losses.

- Specific companies or securities mentioned in this document are meant to demonstrate SARINA Capital’s investment style and the types of industries and instruments in which we invest and are not selected based on past performance. The analyses and conclusions of SARINA Capital contained in this document include certain statements, assumptions, estimates and projections that reflect various assumptions by SARINA Capital concerning anticipated results that are inherently subject to significant economic, competitive, and other uncertainties and contingencies and have been included solely for illustrative purposes. No representations express or implied, are made as to the accuracy or completeness of such statements, assumptions, estimates or projections or with respect to any other materials herein. SARINA Capital may buy, sell, cover or otherwise change the nature, form or amount of its investments, including any investments identified in this letter, without further notice and in SARINA Capital’s sole discretion and for any reason. SARINA Capital hereby disclaims any duty to update any information in this letter.

- Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of preparation and are subject to change.

- Certain information has been provided by third-party sources and, although believed to be reliable, it has not been independently verified and its accuracy or completeness cannot be guaranteed.

- © 2021 SARINA Associates, LLC, all rights reserved.