2021 Strategy

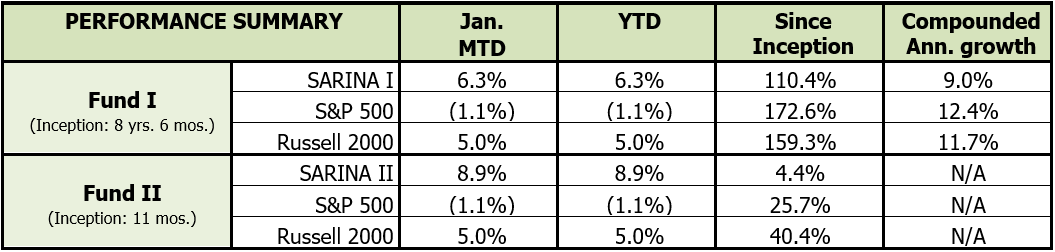

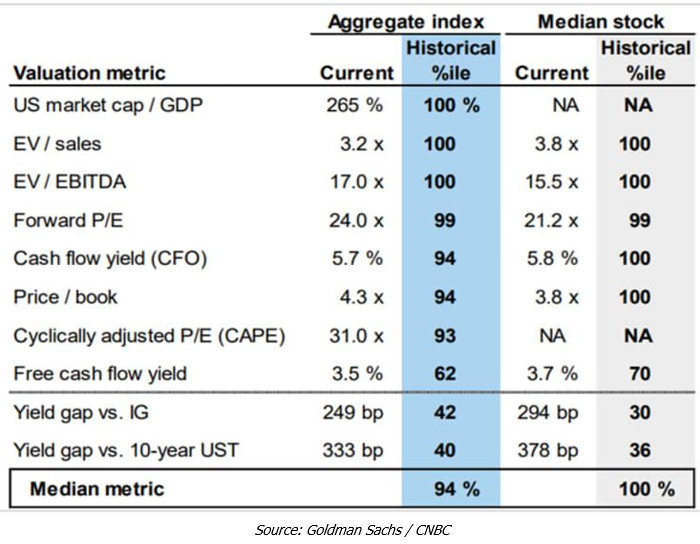

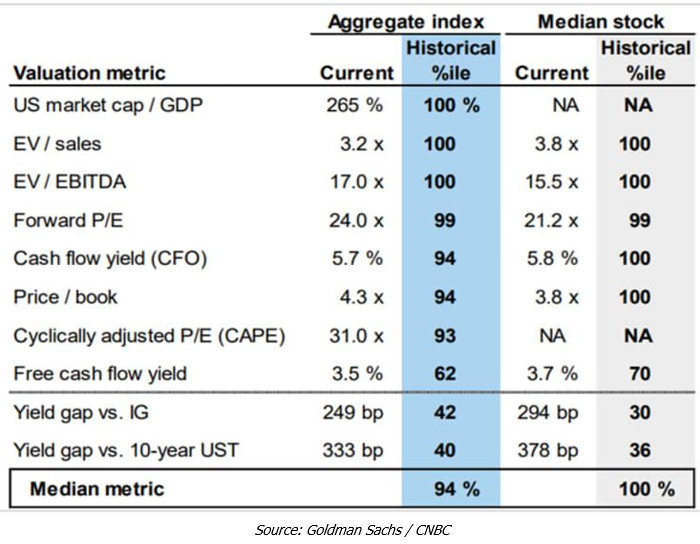

2021 markets came out of the gates with a great deal of optimism but we have already seen huge volatility in the markets driven by uncertainty about the COVID-19 spread (especially what we are seeing in UK and Europe overall), government’s ability to effectively distribute the vaccine, and concerns about inflationary pressures that could force Fed’s hand into prematurely tapering QE and raising interest rates. Despite these significant unknowns, thanks to Uncle Sam’s accommodative policies the markets are continuing to reach new highs and will perhaps continue to do so until one the factors listed above (or something else) breaks the momentum. Markets are currently trading some of their highest multiples compared to their historical average according to Goldman Sachs analysis (see chart below):

In our view, this is an extremely edgy period for the market where the negative news could lead to a large market declines. With the above as a backdrop, our trading strategy for 2021 involves being mindful of the Fed’s accommodative policy while also hedging against any future market volatility. On the long side we have invested in companies that we expect will continue to perform well during and post-pandemic (namely DOCU, WTRH, T, KHC, etc.). To hedge against volatility and inflation we have invested in the VIX index and gold. So far this strategy has performed well and we expect it to payoff handsomely for us and our investors in 2021. We’ve buckled up for a wild ride in 2021, we hope you have also!

Short Squeeze

Speaking of a wild ride, we all followed the short squeeze saga that unfolded with names like Gamestop (GME), Nokia (NOK), Blackberry (BB), Koss (KOSS), etc. Those of you who are not familiar with the concept of short squeeze, here’s a short definition from Investopedia: “A short squeeze occurs when a stock or other asset jumps sharply higher, forcing traders who had bet that its price would fall, to buy it in order to forestall even greater losses. Their scramble to buy only adds to the upward pressure on the stock’s price.” Many hedge funds employ the technique of shorting stocks as a way to hedge while others use it as a way to drive performance.

Though we are also in favor of stomping out the greed that some of these hedge fund managers have, we believe the approach taken by retail bloggers seems to have only helped the hedge funds make more money (minus Melvin Capital of course). WallStreet Journal reported that Senvest Management made $700MM in GME as the price unexpectedly skyrocketed to well above $400. Another news report states that the true drivers of the GME’s price increase were institutional investors and not the retail investors. It appears that the retail investors fell prey to the age old “pump and dump” strategy and in the process ended up only hurting their other fellow investors (i.e. those who are not caught holding the bag) while helping larger institutional investors. Below is a chart that shows a wild 2-week price action for GME.

From a fundamentals perspective, we did not see anything in GME’s strategy to justify a higher PE multiple than Tesla, Apple, and Microsoft! Ultimately the earnings would have had to catch up to valuation and realistically that was simply never going to happen with GME. By the way, the earning valuation we are using is for 2023 because GME is expected to lose money in 2021 and 2022! Investors can certainly put a higher valuation on growth names, but if someone called GME a growth company, they will most likely get laughed out of the room! When we shared this viewpoint with other fellow investors, we were quickly reminded of a “new” category of traders who traded on market sentiment. Of course, the sentiment fizzled up and out very quickly and we will never know who it helped or hurt the most!

We view stock ownership as owning a company and if you ask us to buy GME as a company for $25+ billion, we simply cannot get there looking at the current financials or their most optimistic projections. Even if we became a speculative investor, it would have been very difficult to make the call to invest into GME at $400+. This is where the “greater fool” theory comes into play! Quick definition from Investopedia: “The greater fool theory states that it is possible to make money by buying securities, whether or not they are overvalued, by selling them for a profit at a later date. This is because there will always be someone (i.e. a bigger or greater fool) who is willing to pay a higher price.” We read about this in our finance classes, but to see a livestream of it last week in GME and some other stocks was beyond belief!

Short squeezes are nothing new on Wall Street, they occurred back in 1990s during the Tech bubble when many were making the calls that markets were overvalued and shorted the markets only to be squeezed out of their shorts in a matter of days or months. We are mostly worried about those investors who are now holding the GME stock with an average price well over $100, $200, or even $400. The Fed is also partly to blame for this as they have been providing fuel to this fire through excess liquidity. The pandemic has turned excess liquidity into a movement of individual investors, but those that are not able to get out in time will end being the biggest losers in this trade. Admittedly we do not have a solution for getting rid of the Wall Street greed, but at the same we also do not believe that a short-lived approach employed by retails investors will address the issue.

Also, let’s not forget Robinhood in all of this! In our previous newsletters we’ve compared Robinhood’s trading app to the Tinder dating app and though the ease of investing has led to wild swings, we never thought it would reach this level! Robinhood is facing tremendous backlash and a ton of lawsuits for limiting trades in a supposedly free market system and they may simply get away with this by getting their wrists slapped and paying a fine! And even more pronounced, Robinhood is the first source of unity in the Biden administration – a force so powerful that AOC and Ted Cruz (a scumbag of epic proportions) actually were on the same side of this argument! Just when you think you’ve seen it all, the market Gods remind you of their glory and show you something that you never thought was possible!

Happy investing!

Disclosure Statements:

- This letter is confidential and may not be redistributed without the express written consent of SARINA Capital, LP.

- The information presented does not involve the rendering of personalized investment, financial, legal or tax advice, but is limited to the dissemination of general information on products and services. Before implementing any of the options presented, a professional adviser should be consulted about the legal, tax and financial suitability of this type of investment. This presentation should not be viewed as an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein.

- Past performance is no guarantee of future results. No person should invest who is not, either alone or with their advisers, capable of evaluating the merits and risks of prospective investments. No representation is made that SARINA Capital, LP will or is likely to achieve its investment objectives or that any investor will or is likely to achieve results comparable to those shown or will make any profit at all or will be able to avoid incurring substantial losses.

- Specific companies or securities mentioned in this document are meant to demonstrate SARINA Capital’s investment style and the types of industries and instruments in which we invest and are not selected based on past performance. The analyses and conclusions of SARINA Capital contained in this document include certain statements, assumptions, estimates and projections that reflect various assumptions by SARINA Capital concerning anticipated results that are inherently subject to significant economic, competitive, and other uncertainties and contingencies and have been included solely for illustrative purposes. No representations express or implied, are made as to the accuracy or completeness of such statements, assumptions, estimates or projections or with respect to any other materials herein. SARINA Capital may buy, sell, cover or otherwise change the nature, form or amount of its investments, including any investments identified in this letter, without further notice and in SARINA Capital’s sole discretion and for any reason. SARINA Capital hereby disclaims any duty to update any information in this letter.

- Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of preparation and are subject to change.

- Certain information has been provided by third-party sources and, although believed to be reliable, it has not been independently verified and its accuracy or completeness cannot be guaranteed.

- © 2021 SARINA Associates, LLC, all rights reserved.