Elections came and went and investors seemed extremely optimistic about the results – a Biden victory was slated to mean bad news for the markets but the exact opposite has happened. Any possible negativity around election results has been overshadowed by positive news about the vaccine which has fueled markets to new highs, particularly the small caps and sectors that were left behind in recovery since March (energy, airlines, hotels, etc.). However, this rally comes with a backdrop of raging COVID-19 cases across the United States, new rounds of shutdowns in some European countries, and weakening employment recovery.

The onset of winter and continuous absurdity of the White House administration to politicize mask wearing has led to record shattering spread of the COVID-19 virus across the country. Many Governors (Dakotas are a prime example) who favored Trump’s approach of politicizing a health safety issue and did not require wearing of masks in their states are now suffering the consequences. Furthermore, this is putting a heavy toll on healthcare workers yet again as hospitals across the country are nearing full capacity. This has led to food services and bars cutting jobs in November for the first time since April.

Speaking of jobs, the U.S. added 245,000 jobs in November compared to 610,000 in October. The unemployment rate ticked slightly lower to 6.7% in November compared to 6.9% in previous month. This was partly due to fewer Americans looking for work – the labor force participation rate dropped slightly in November to 61.5% compared to 61.7% in the previous month. This pandemic has been particularly hard for women and baby boomers, as these two groups have seen the biggest rise in unemployment during the pandemic.

Full Bull / Euphoria

Despite the negative backdrops mentioned above, the shift from market optimism to euphoria has led to what to a full bull market. A full bull market, as defined by Bank of America, occurs when investors move out of cash and into more riskier asset classes such as stocks, bonds, etc. According to a Bank of America survey of fund managers, cash levels are currently at only 4.1%, just a whisker above the sub-4% number that Bank of America analysts see as a full bull. The fund manager optimism is jumped to its highest level since 2018, a time when markets were flying high following corporate tax cuts. The full bull market has added $30 trillion to the MSCI all-world index market capitalization since March and this index saw its biggest monthly jump ever in November of 12.2%. Investors are also citing lack of options as bond yields remain extremely low thanks to the Fed’s accommodative policies. Many analysts believe this has led to possibly overshooting the runway on equity markets.

Citigroup’s Panic/Euphoria Model, a contrarian indicator for market sentiment, is also flashing a red signal as it continues to rise in euphoria territory. According to Citigroup’s Tobias Levkovich, “Current euphoric readings signal a 100% probability of losing money in the coming 12 months if we study historical patterns – indeed, we saw such levels back in early September as well right before a selloff in stocks.” The euphoric investment sentiment has also been supported by rebounding corporate profits. Furthermore, the appointment of Janet Yellen as Treasury Secretary for the Biden administration has fostered hopes of the Fed and Treasury working in a more coordinated and aggressive effort to ensure the economy stay afloat. Recall, Yellen was the Fed Chairman from 2014-2018, a time that saw accommodative Fed policy and fostered solid growth in the U.S. The hope among investors is that the combination of Yellen and the current chair Jerome Powell will work closely to provide any necessary stimulus funding to support current or future economic downturns.

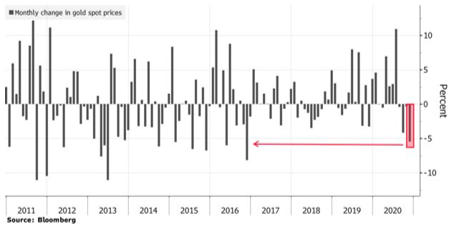

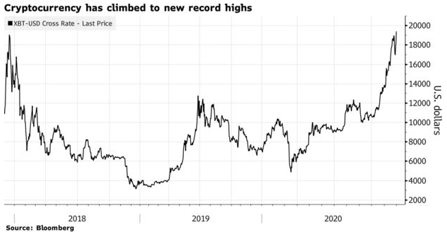

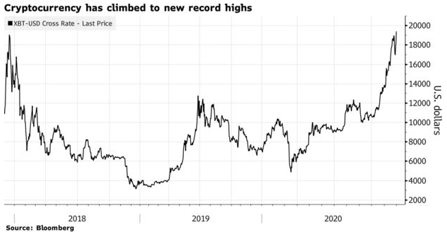

Investors have shifted away from growth and technology stocks and we are now seeing a heavy rotation into small caps. Bitcoin has regained strength and is now sitting at all-time highs with some investors predicting $100,000 price for Bitcoin over the next few years! Given the risk-on mood, safer assets like gold slipped below $1,800 while seeing the largest monthly decrease since 2016.

The record ascent for Bitcoin appears to be different than what we saw back in 2017/early 2018. It appears that more institutional investors are getting in on the action this time around while the sentiment around Bitcoin appears to be more positive among the more influential investors. A strong skeptic of Bitcoin in the past, Blackrock’s CEO Larry Fink said that Bitcoin appears to be gaining legitimacy as an asset class. Another investment giant on Wall Street, AllianceBernstein ($631 billion in assets under management), had a change of heart when it comes to Bitcoin. In a research note for clients, the firm said that it was opposed to the idea of investing in Bitcoin back in early 2018; however, in the post-pandemic world of high debt levels and diversification options, the firm said Bitcoin now has role in asset allocation. Many investors are investing in Bitcoin has a hedge against inflation, putting in squarely in competition with gold. Unfortunately, gold is getting destroyed in the “inflation hedge” category by Bitcoin with the meteoric rise over the past couple of months. However, Bitcoin’s tremendous rise and its potential use in criminal activity has caught the eye of many regulatory bodies around the world and if there are regulations put around Bitcoin and its usage is discouraged by these bodies, it could potentially lead to weakness in the price. Crypto currencies are here to stay; however, their path forward has yet to be determined.

Financial markets tend to be forward-looking so despite a 4.4% projected contraction in world economy in 2020, markets are pricing in a brighter outlook for 2021 where the International Monetary Fund is projecting a 5.2% expansion for the global economy. That said, because a strong rebound is already priced into the market, any weakness from economic data that would suggest otherwise could lead to high volatility in the markets. As we ride the current full bull / euphoric market, it is impossible to predict where the markets are headed in the future. That said, as an investor it is paramount to position the portfolio and have a plan ready in case a selloff ensues.

Happy investing!

Disclosure Statements:

- This letter is confidential and may not be redistributed without the express written consent of SARINA Capital, LP.

- The information presented does not involve the rendering of personalized investment, financial, legal or tax advice, but is limited to the dissemination of general information on products and services. Before implementing any of the options presented, a professional adviser should be consulted about the legal, tax and financial suitability of this type of investment. This presentation should not be viewed as an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein.

- Past performance is no guarantee of future results. No person should invest who is not, either alone or with their advisers, capable of evaluating the merits and risks of prospective investments. No representation is made that SARINA Capital, LP will or is likely to achieve its investment objectives or that any investor will or is likely to achieve results comparable to those shown or will make any profit at all or will be able to avoid incurring substantial losses.

- Specific companies or securities mentioned in this document are meant to demonstrate SARINA Capital’s investment style and the types of industries and instruments in which we invest and are not selected based on past performance. The analyses and conclusions of SARINA Capital contained in this document include certain statements, assumptions, estimates and projections that reflect various assumptions by SARINA Capital concerning anticipated results that are inherently subject to significant economic, competitive, and other uncertainties and contingencies and have been included solely for illustrative purposes. No representations express or implied, are made as to the accuracy or completeness of such statements, assumptions, estimates or projections or with respect to any other materials herein. SARINA Capital may buy, sell, cover or otherwise change the nature, form or amount of its investments, including any investments identified in this letter, without further notice and in SARINA Capital’s sole discretion and for any reason. SARINA Capital hereby disclaims any duty to update any information in this letter.

- Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of preparation and are subject to change.

- Certain information has been provided by third-party sources and, although believed to be reliable, it has not been independently verified and its accuracy or completeness cannot be guaranteed.

- © 2020 SARINA Associates, LLC, all rights reserved.